A British exit from the European Union could cost the UK as much as €300bn (£215bn), or 14% of GDP, according to a German study.

The report from two respected German institutes warns of far-reaching consequences for the whole region should next week’s UK general election pave the way for a referendum on EU membership, as promised by the Conservatives, and ultimately a British departure from the bloc.

Even under the best-case scenario, where an independent UK has a trade agreement with the EU, the costs would outweigh the benefits, claims the study by the Bertelsmann Stiftung (foundation) and ifo Institute.

The economic losses for Germany and the remaining EU member states would be significantly smaller but everyone involved would miss out, the report says.

“A Brexit is a losing game for everyone in Europe from an economic perspective alone – particularly for the UK,” said Aart De Geus, chairman and chief executive of the Bertelsmann Stiftung.

“But aside from the economic consequences, it would be an especially bitter setback for European integration as well as Europe’s role in the world. Setting the course for a Brexit in the House of Commons elections would weaken the EU.”

Studies into a UK exit from the EU, or Brexit, have varied wildly in their conclusions as to how much would be gained or lost. Economists agree that much would depend on what sort of trade agreements an independent UK could negotiate with the EU and other big trading partners.

The German study assesses three scenarios and what their likely effect would be in the year 2030, when it believes the negative effects will have shown their full effect.

Brexit ‘could knock 14% off GDP’...

In the most favourable case, the UK receives a status similar to Switzerland and still has a trade agreement with the EU. In the least favourable, Britain loses all trade privileges arising from EU membership and its free trade agreements.

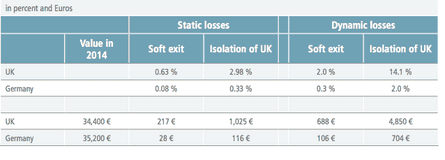

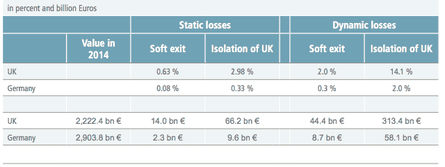

Under the most favourable scenario, GDP per head would be €220 (£157) lower than if the UK remained in the EU.

But losses could run as high as €4,850 (£3,471) per head under the least favourable scenario of trade isolation and when taking into account the dent to innovation in Britain and London’s status as a financial centre.

That is a loss of €313bn for the entire national economy, the study says, or means 14% is knocked off GDP, using the size of the economy in 2014 as a base.

... ‘costing the UK economy more than €300bn’

The report adds: “Possible savings, such as the cancelling of EU budget payments that currently total around 0.5% of the British GDP, could not compensate for economic losses, even in the best-case scenario.”

By contrast, the losses to Germany from the UK leaving the EU would be more modest. GDP per capita would be €30-€115 smaller in 2030, the study says. But taking all factors into account, again such as the London’s diminishing status as a financial centre, losses could be as high as €700 per capita in Germany.

European countries that would have to absorb above-average losses due to a Brexit are led by Ireland, followed by Luxembourg, Belgium, Sweden, Malta and Cyprus, the researchers said.

Comments (…)

Sign in or create your Guardian account to join the discussion