Regardless of what the Federal Reserve does or does not do Wednesday, financial markets could face some turbulence afterwards.

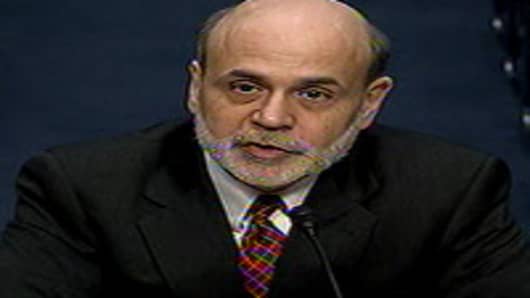

The Fed’s two-day meeting ends with a statement just before 12:30 p.m. ET. The economic and interest rate forecasts of Fed officials are then released at 2 p.m., and Fed Chairman Ben Bernanke briefs the media at 2:15 p.m.

The Fed is widely expected to take no action, make no moves towards new easing or significantly change its statement. However, it may tweak the language slightly, change its forecast for GDP and employment, and adjust where individual members see interest rates changing.

But there is an undercurrent in the investment community for something more than what the consensus expects, and that’s what analysts say could be a wild card for Wednesday’s markets.

It is also part of the same debate that is playing out with the new volatility in stocks: whether the U.S. economy is just temporarily sputtering or getting ready to slow down.

Bond market traders, for instance, are watching closely to see if the Fed comments on “Operation Twist,” a program expected to end in June.

While most expect no change in “Twist” and a winddown of the program in June, there are some who expect the Fed to actually say it could extend the program. In that program, the Fed purchases longer-dated Treasurys, and sells the same amount of shorter dated securities, in an effort to drive down rates.

“By the way I look at it, the low back end rates are not just because of Europe. There’s some probability being priced in that the market thinks ’twist’ gets extended. We think they’re going to be disappointed at the April meeting,” said Nomura Americas Treasury strategist George Goncalves, adding it’s more likely the program would be extended at the June meeting.

CRT Capital did a survey of dozens of professionals in the Treasury market last week, and it’s findings also found a split in market thinking.

“Interestingly, the vast majority expected that the Fed would not offer a new round of QE or a materially more dovish statement. In fact, only 3.5 percent expected the FOMC to be more dovish, and no one expected them to be more hawkish,” said Ian Lyngen, senior CRT strategist.

“On the other hand, 45 percent said the market was pricing in some additional type of accommodation or more dovish statement, suggesting to us there was a more dovish bias in the market than there actually might be.”

Lyngen said that could create a flurry in markets, therefore, if the Fed does what the consensus believes it will do.

“A largely unchanged statement will be negative to risk assets to the benefit of the Treasury market,” he said.

The markets had been primed earlier in the year to expect a third quantitative easing program, or QE3, should the economy deteriorate, but more positive numbers in recent months and comments by Fed officials have since discouraged that view.

Will Fed do more?

Yet, analysts and traders say there are some investors who are still looking for the Fed to signal it will do more.

QE is a different type of program than “twist.” A third round could involve the purchase of mortgage securities, and unlike “twist” the Fed, in past QE programs, has added the securities to its balance sheet.

“I think the market is positioning for some chaos because I think it’s pretty clear the Fed’s not going to change the key policy variables. They’re not going to change the rate guidance. They’re not going to change the balance sheet guidance. They’ll probably tweak a few things in their description of the economy, maybe on financial stress and inflation,” said Ward McCarthy, chief financial economist at Jefferies. “The more important things will be the changes in the economic forecasts sand the press conference.”

In the stock market, there is also some expectation of a more dovish Fed.

“Either they don’t comment one way or the other which would disappoint, or they say they’re not going to do it (QE), then I the market acts negatively,” said John Canally, economist and investment strategist at LPL Financial. “The market has been a little reactive. They just shoot first and ask questions later.”

“There’s a segment of the market that’s 'buy' if there’s QE3, 'sell' if no QE3. They’ll be some sell button pushed somewhere if there’s no QE3,” said Canally.

Canally does not expect any more clarity on QE3.

“Bernanke is going to be back and forth. I’m sure a reporter well ask the question: ‘Will you do QE3?’ and he’s not going to say yes or no. He’s going to say ‘data depending,” said Canally.

Art Cashin, director of NYSE floor operations at UBS, said a lot of the reaction will depend on Bernanke.

“It depends on how effective his performance is. There’s a high risk for them to be disappointing. He’s got to be pretty convincing in that ‘we think things are moving along somewhat better but we stand ready to move at a moment’s notice,’ and maybe even mention QE3,” said Cashin.

Cashin does not expect the Fed to do anything.

“I think he’s going to find a way to hold out a promise – should things deteriorate, we’ll be there for you,” he said.

McCarthy said the individual forecasts of Fed members could be a factor for markets.

They are displayed on a chart, with the timing of the first rate hike from the current zero rate, but the Fed officials are not individually named with their forecasts. In its last forecast, the tendency was for rates to stay low into late 2014.

“You could have a situation where some raise their inflation forecast and some lower it. The mass confusion will come from the scattered diagram of Fed funds forecasts. The core will probably not change,” he said.

But if there are significant moves forward in rate hike forecasts to 2013, or even 2012, that would be market moving.

“On the economic forecast side, they probably will have to lower the unemployment rate,” he said.

The current 8.2 percent unemployment rate is at the low end of the Fed’s forecast.

“And on the inflation front, I think you could get mixed results there," he added. "Oil and gas rose, but inflation continued to decelerate.”

McCarthy also noted that the Fed changed the language on the economy to moderate growth from modest growth in its last statement. He does not expect to see that change back to modest even though the economy is showing signs of weakening.

“Maybe they change it to moderate with some qualifier,” he said.

Deutsche Bank chief U.S. economist Joseph LaVorgna said he expects the Fed to raise its GDP number slightly.

“I just think the Fed may sound a little bit more confident in the outlook. I think their numbers will be showing that, and they’re not talking about more QE,” he said. “But I think they’re going to leave the door open to it because that’s how the Fed behaves.”

Follow Patti Domm on Twitter: @pattidommQuestions? Comments? Email us at marketinsider@cnbc.com