System Parts (In Order of Importance):

1. Money Management Strategy

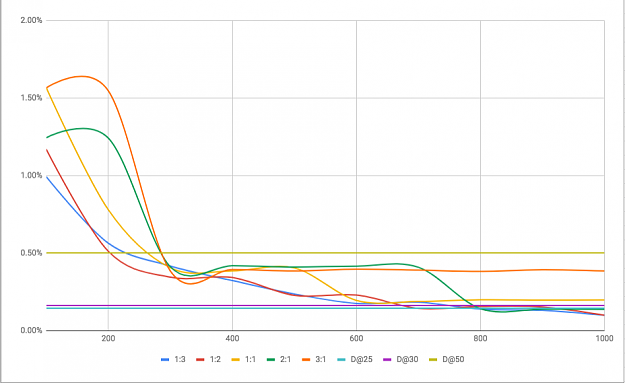

2. Risk:Reward Optimization

3. Entry/Exit Strategy

Benchmark:

- Average S&P500 Annual Returns (9.8%)

1. Money Management Strategy

2. Risk:Reward Optimization

3. Entry/Exit Strategy

Benchmark:

- Average S&P500 Annual Returns (9.8%)