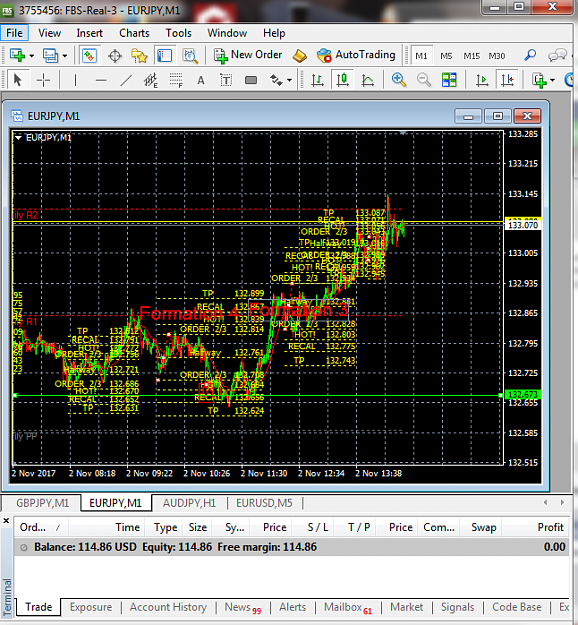

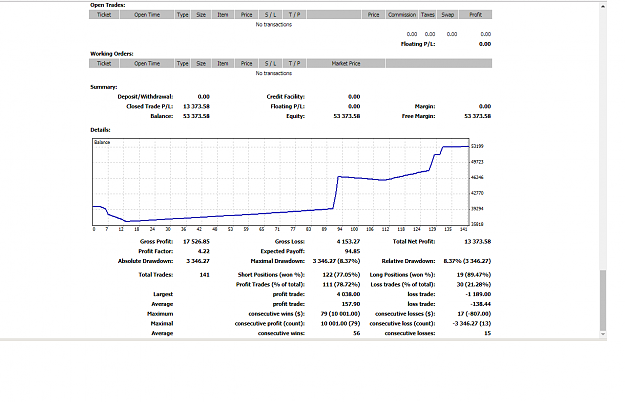

As with any system or strategy, it is not 100%

- Joined Jul 2011 | Status: Member | 7,724 Posts | Online Now

If you trade like me, you'll be homeless and broke within a week.

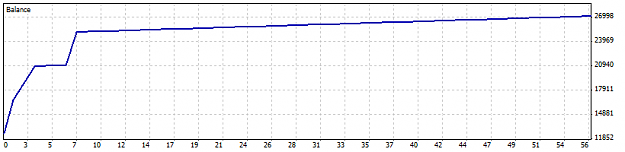

Goldilocks All Time Return:

91.0%

- Joined Jul 2011 | Status: Member | 7,724 Posts | Online Now

If you trade like me, you'll be homeless and broke within a week.

Goldilocks All Time Return:

91.0%

- Joined Nov 2015 | Status: Member | 2,964 Posts

Success is a Journey Not a Destination....... kind regards ramzam