I'd like to know how people view the common and conflicting ideas of setting pre-defined TP levels (and SL's) vs the idea of cutting losses short and letting profits run.

Taking a profit at a set level (1, 1.5,2,3,etc) seems to be a very arbitrary way to close a trade where you have no idea where the market level is going to move (or at least seems to infer an ability to predict both a SL level that wont be hit vs a TP level that will be). Additionally, letting a trade 'run' still requires some sort of decision of where to get out of the trade, other than BE (or worse, a loss).

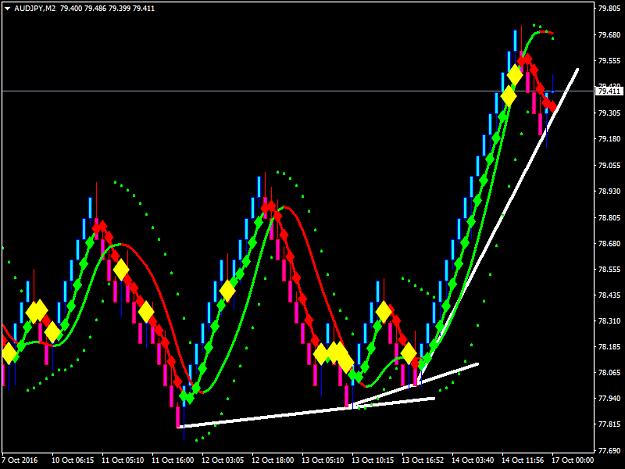

Do people tend to just put themselves in one camp: A) - set ranges for TP/SL and ignore the idea of letting it run, or another camp: B) let it run until a strong turn/indicator signal says close and try to let it run?

Taking a profit at a set level (1, 1.5,2,3,etc) seems to be a very arbitrary way to close a trade where you have no idea where the market level is going to move (or at least seems to infer an ability to predict both a SL level that wont be hit vs a TP level that will be). Additionally, letting a trade 'run' still requires some sort of decision of where to get out of the trade, other than BE (or worse, a loss).

Do people tend to just put themselves in one camp: A) - set ranges for TP/SL and ignore the idea of letting it run, or another camp: B) let it run until a strong turn/indicator signal says close and try to let it run?