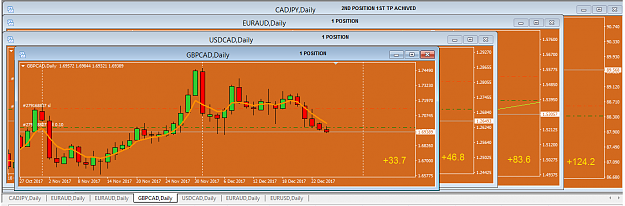

Disliked{quote} Well, I've adapted this strategy to my way of trading. - as rules say I take 2 positions and I put sl like BK8 saysn - as soon as the price touch a resistance, a 50 sma or 200 sma in lower timeframe or a weekly pivot point or I gained 30 pips I close a position and set a tighter stop loss (generally at same pip of the first gain. In this way I protect the capital) - for the second position I leave it run move the stop loss like BK8 said as soon as possible.; - I take profit when:sl touch, 200 pip gained, price touch 3rd resistance or support...Ignored

While like others whom have incorporated their beliefs into the basic formula, I too use additional modified indicators to assist me in choosing entry points but am not at liberty to discuss them until I can complete a minimum of 6 months of consistent profits first. Lets face it: its not worth the trouble to offer something if its clearly not been tested both in past performance and real time. Once again, thank you to all that have provided ongoing input.

Doppiomalto: on your statement regarding taking the first profits/moving your stop losses surrounding the 50/200 SMA in lower time frames, I am curious to know just what time frame you are viewing? I wish that you all will be surrounded by friends and family during the Christmas Season and next year is a very profitable year for all of us in both monetary value and gaining ongoing trading relationships. Bobby Boudain