Disliked{quote} It depends on what your trading methodology is. The NOKSEK trade is just an idea to have a go at reverse martingale. I dont usually trade using envelopes and bounces away from MAs. If I have another go with this Rev. Mart. Idea I will probably look for something more traditional like try to find the beginning of potentially strong trend (easier said than done). More along the lines of Post 36. Look for a pair at a good potential reversal point on a high time frame. Preferably with the trend on a higher time frame still. That is a good place...Ignored

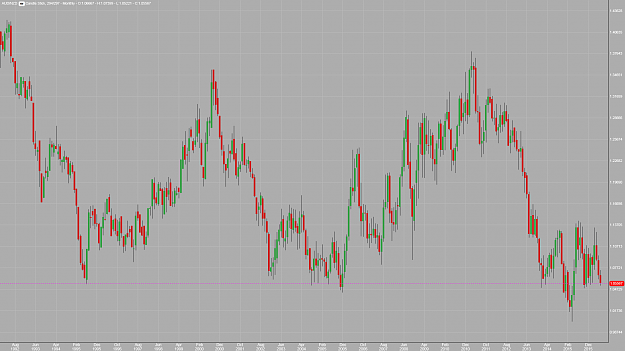

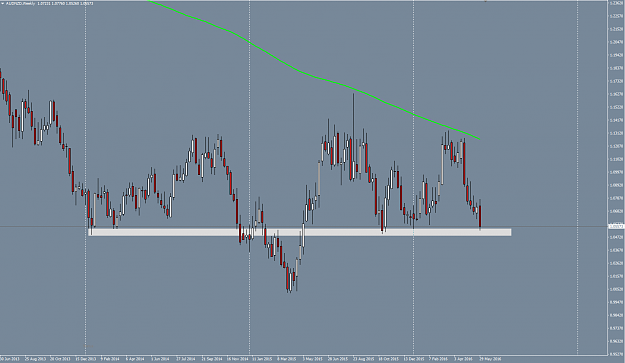

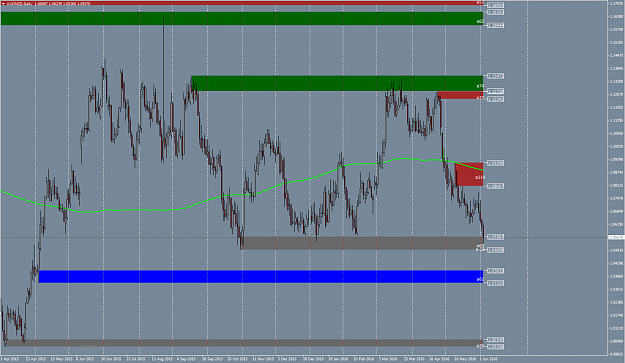

Daily chart shows the pair has reached a pretty decent demand zone. In the past 9 months there have been 3 significant 700+ pip moves.

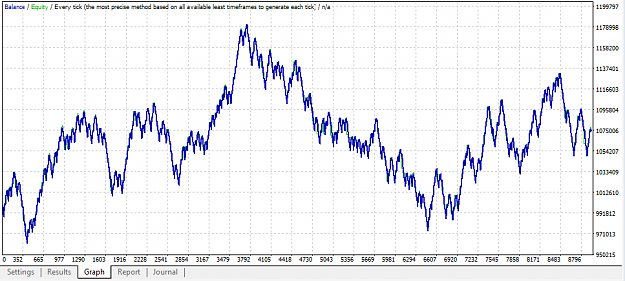

If a good reversal signal occurs say on D1 chart, I would be tempted to trade a similar method to that in post 36. Incidently trading that method short from 28/04/16 (the break of the swing low on 13/04/2016) the method would just not have worked because the 2nd trade would have been stopped out by about 10 pips. Otherwise it would have worked so if I do get a good reversal signal and enter the 1st trade I will add a bit extra to the ATR 5 readings to make sure the retracements are a bit bigger before trade 2 & 3 entry.

Everything will be okay in the end. If it's not okay, it's not the end.