Hello everyone, and a happy new year to all.

Please go through the first couple of pages to get trade examples of this strategy.

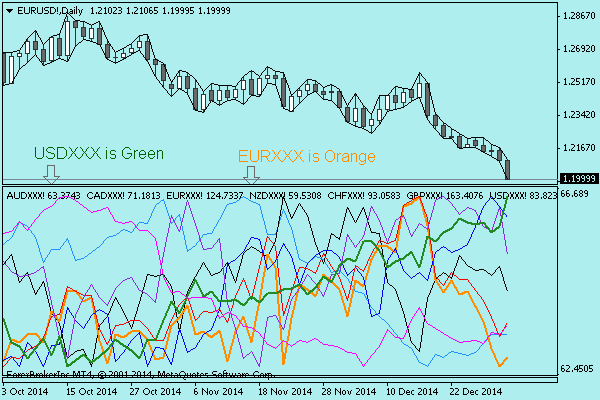

Currency Strength

I'm sure we'll all agree that a pair moves based on the strength of the currency. Obviously it involves order flow and S+R levels which is why a pair doesn't just move in one direction, but we know that investors will move their money to stronger economies, one of the reasons causing the forex markets to move. The strength of currencies can be seen from looking at economies. For example, on a larger scale, when the central banks are looking to raise interest rates, the currency will strengthen, and when that interest rate hike happens, we'll see a more substantial rise on a small time period, but the currency will still rise in value long term too.

Fundamental Data

Right here on the front page of FF, we have economic data for upcoming releases on the market. Looking at these, they seem to provide invaluable data on the way in which a currency pair will move during the day. Going to shoot off some examples.

Maybe it is wrong of me, but with this style of trading I have only ever focused on GBP news and USD news, and looking at the GBP/USD, USD/JPY and GBP/JPY pairs. I understand that many fundamental traders look to pair a strong currency with a weak currency, which obviously makes sense, which is why I'm here looking for more insight onto this.

Also for this, we'll be looking at using London open as that is when there is a large influx of money into the forex market daily.

(1) I'll use the most recent data release on 31 Dec 2014, which is USD Unemployment Claims. We know from the Fed's monetary policy that they are focused on employment for the recovery of the economy so this should be a hot topic for the markets. Obviously, it's the holiday period so I personally wouldn't trade it anyway, but the concept is still in tact. Also, I'm sure most will know but for those that may get a little confused, a larger value on unemployment claims is worse, for obvious reasons. The previous figure reported on FF was 281k, while the forecast figure is 287k. Now this isn't much larger, but take not which side it is on. When I say which side, whether it is on the positive or negative side of the previous figure. Since this is on the negative side for this release, as it is higher, we are looking at a short-term weak Dollar.

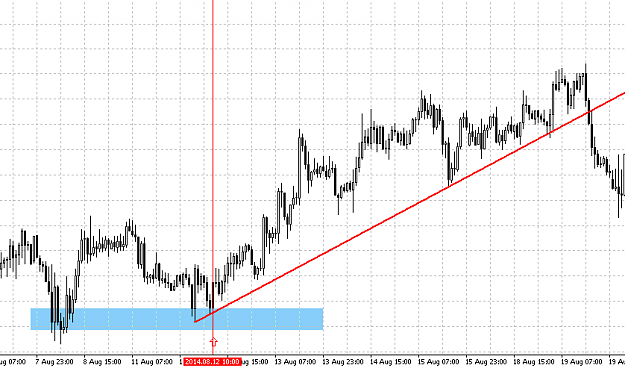

I have marked on London open with the thick horizontal line, and the arrow which shows which bar we enter, which is 08:00AM GMT. Now from the above statement, we know that it is forecast to be a weak dollar, so a short-term bullish GBP/USD makes sense. As I have mentioned on the chart, price reverses at 12:00AM GMT, this is common in forex as what many state is larger traders are leaving their desk so maybe taking their profit for the morning.

(2) Now I'll pick a random event... 19 Nov 2014, a considerably more substantial event, but still an important event none the less. It is the GBP MPC Official Bank Rate Votes which is, in my opinion, quite simple to trade. Previous was 2-0-7 and the forecast was the same, as well as actual coming in like this. We know that obviously this is something the Central Bank is interested in as they always are, so it's going to move the markets, and we know that the Central Bank of England have already said they're going to look at a rate hike, but that it wouldn't be this year. So this value is expected, which is still positive for investors. It would have been very unlikely to come out as worse data because of statements from the Central Bank. If we look to the GBP/USD chart, we can see the following:

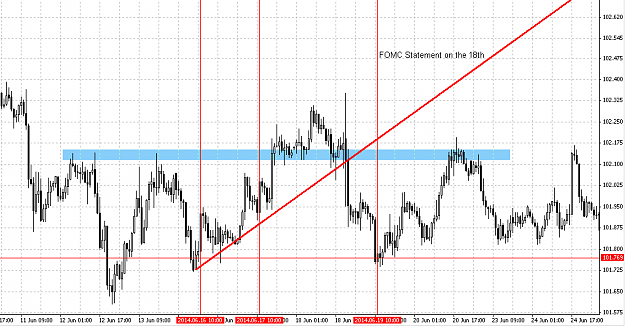

Again, I have shown London open, and with this we can see that there is a slight drop of around 25-30 pips before the huge move upwards occurs. Also note that we had some RED data out for the USD on this same day, which is Building Permits, but we know that the Fed isn't interested in Home Sales or anything to do with housing, so this piece of data is pretty irrelevant. We also have FOMC Meeting Minutes out on the same day, which may have been the cause of this spike, but I highly doubt it as minutes are just a re-iteration of what has already been said.

Final Thoughts

Although this may be perceived as bad, I see forex in a similar way to poker. Definitely not gambling, but there needs to be a strong strategy. With poker, we are going to have small losses along the way, but people will bet when they see they have a good chance at winning, with the cards in their hand. The cards in our hands are the free economic forecasts given to us, which can be found elsewhere on the web not just here on FF. We take our chances, as with poker, based on what forecasts are telling us. Generally, we can capitalise on these, otherwise, we may not be able to, similar again to playing poker. For anyone that plays poker, they will know...

And please bear in mind that this isn't a strategy I'm telling people to use or even telling you that it works. Maybe it does, but this whole thing may just be a coincidence. That is why I am here, to get some more insight onto what people think of this type of strategy.

Thanks.

Please go through the first couple of pages to get trade examples of this strategy.

Currency Strength

I'm sure we'll all agree that a pair moves based on the strength of the currency. Obviously it involves order flow and S+R levels which is why a pair doesn't just move in one direction, but we know that investors will move their money to stronger economies, one of the reasons causing the forex markets to move. The strength of currencies can be seen from looking at economies. For example, on a larger scale, when the central banks are looking to raise interest rates, the currency will strengthen, and when that interest rate hike happens, we'll see a more substantial rise on a small time period, but the currency will still rise in value long term too.

Fundamental Data

Right here on the front page of FF, we have economic data for upcoming releases on the market. Looking at these, they seem to provide invaluable data on the way in which a currency pair will move during the day. Going to shoot off some examples.

Maybe it is wrong of me, but with this style of trading I have only ever focused on GBP news and USD news, and looking at the GBP/USD, USD/JPY and GBP/JPY pairs. I understand that many fundamental traders look to pair a strong currency with a weak currency, which obviously makes sense, which is why I'm here looking for more insight onto this.

Also for this, we'll be looking at using London open as that is when there is a large influx of money into the forex market daily.

(1) I'll use the most recent data release on 31 Dec 2014, which is USD Unemployment Claims. We know from the Fed's monetary policy that they are focused on employment for the recovery of the economy so this should be a hot topic for the markets. Obviously, it's the holiday period so I personally wouldn't trade it anyway, but the concept is still in tact. Also, I'm sure most will know but for those that may get a little confused, a larger value on unemployment claims is worse, for obvious reasons. The previous figure reported on FF was 281k, while the forecast figure is 287k. Now this isn't much larger, but take not which side it is on. When I say which side, whether it is on the positive or negative side of the previous figure. Since this is on the negative side for this release, as it is higher, we are looking at a short-term weak Dollar.

I have marked on London open with the thick horizontal line, and the arrow which shows which bar we enter, which is 08:00AM GMT. Now from the above statement, we know that it is forecast to be a weak dollar, so a short-term bullish GBP/USD makes sense. As I have mentioned on the chart, price reverses at 12:00AM GMT, this is common in forex as what many state is larger traders are leaving their desk so maybe taking their profit for the morning.

(2) Now I'll pick a random event... 19 Nov 2014, a considerably more substantial event, but still an important event none the less. It is the GBP MPC Official Bank Rate Votes which is, in my opinion, quite simple to trade. Previous was 2-0-7 and the forecast was the same, as well as actual coming in like this. We know that obviously this is something the Central Bank is interested in as they always are, so it's going to move the markets, and we know that the Central Bank of England have already said they're going to look at a rate hike, but that it wouldn't be this year. So this value is expected, which is still positive for investors. It would have been very unlikely to come out as worse data because of statements from the Central Bank. If we look to the GBP/USD chart, we can see the following:

Again, I have shown London open, and with this we can see that there is a slight drop of around 25-30 pips before the huge move upwards occurs. Also note that we had some RED data out for the USD on this same day, which is Building Permits, but we know that the Fed isn't interested in Home Sales or anything to do with housing, so this piece of data is pretty irrelevant. We also have FOMC Meeting Minutes out on the same day, which may have been the cause of this spike, but I highly doubt it as minutes are just a re-iteration of what has already been said.

Final Thoughts

Although this may be perceived as bad, I see forex in a similar way to poker. Definitely not gambling, but there needs to be a strong strategy. With poker, we are going to have small losses along the way, but people will bet when they see they have a good chance at winning, with the cards in their hand. The cards in our hands are the free economic forecasts given to us, which can be found elsewhere on the web not just here on FF. We take our chances, as with poker, based on what forecasts are telling us. Generally, we can capitalise on these, otherwise, we may not be able to, similar again to playing poker. For anyone that plays poker, they will know...

And please bear in mind that this isn't a strategy I'm telling people to use or even telling you that it works. Maybe it does, but this whole thing may just be a coincidence. That is why I am here, to get some more insight onto what people think of this type of strategy.

Thanks.