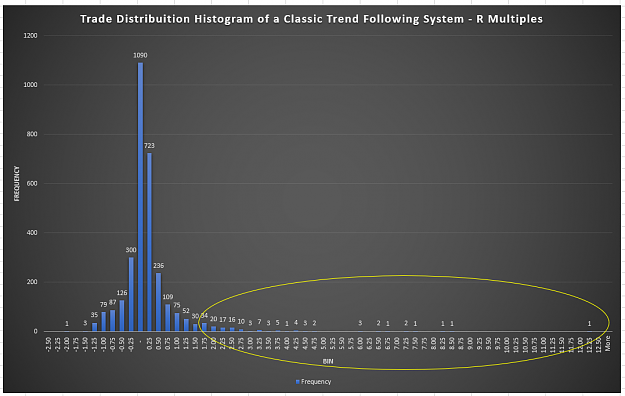

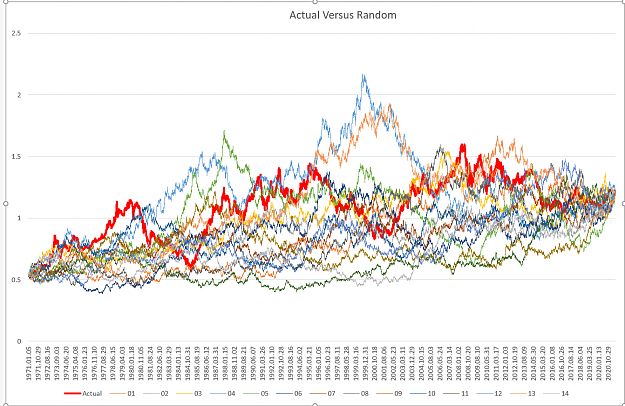

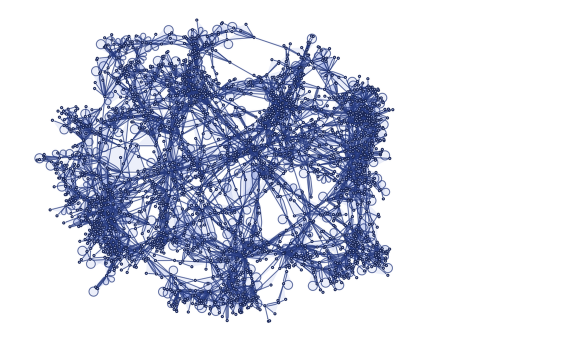

DislikedGlenhaven Capital....ouch {image} Probably no need to go on...but it at least demonstrates how the long term fortunes are dictated by Outliers. The rest is just noise...in the scheme of things :-)Ignored

- Post #4,503

- Quote

- Jun 23, 2021 9:27pm Jun 23, 2021 9:27pm

- | Commercial Member | Joined Apr 2013 | 4,366 Posts

- Post #4,504

- Quote

- Jun 23, 2021 9:34pm Jun 23, 2021 9:34pm

- | Commercial Member | Joined Apr 2013 | 4,366 Posts

- Post #4,505

- Quote

- Jun 23, 2021 9:37pm Jun 23, 2021 9:37pm

- | Commercial Member | Joined Apr 2013 | 4,366 Posts

- Post #4,506

- Quote

- Jun 23, 2021 9:40pm Jun 23, 2021 9:40pm

- | Commercial Member | Joined Apr 2013 | 4,366 Posts

- Post #4,508

- Quote

- Jun 23, 2021 10:09pm Jun 23, 2021 10:09pm

- | Commercial Member | Joined Apr 2013 | 4,366 Posts

- Post #4,509

- Quote

- Jun 23, 2021 10:11pm Jun 23, 2021 10:11pm

- | Commercial Member | Joined Apr 2013 | 4,366 Posts

- Post #4,511

- Quote

- Jun 24, 2021 12:34am Jun 24, 2021 12:34am

- | Commercial Member | Joined Apr 2013 | 4,366 Posts

- Post #4,513

- Quote

- Jun 24, 2021 3:22am Jun 24, 2021 3:22am

- | Commercial Member | Joined Apr 2013 | 4,366 Posts

- Post #4,514

- Quote

- Jun 27, 2021 11:17pm Jun 27, 2021 11:17pm

- | Commercial Member | Joined Apr 2013 | 4,366 Posts

- Post #4,515

- Quote

- Jun 30, 2021 11:52pm Jun 30, 2021 11:52pm

- | Commercial Member | Joined Apr 2013 | 4,366 Posts

- Post #4,516

- Quote

- Jul 8, 2021 9:29pm Jul 8, 2021 9:29pm

- | Commercial Member | Joined Apr 2013 | 4,366 Posts

- Post #4,517

- Quote

- Jul 9, 2021 3:49am Jul 9, 2021 3:49am

- | Commercial Member | Joined Apr 2013 | 4,366 Posts

- Post #4,518

- Quote

- Jul 12, 2021 12:53am Jul 12, 2021 12:53am

- | Commercial Member | Joined Apr 2013 | 4,366 Posts

- Post #4,519

- Quote

- Jul 16, 2021 12:41am Jul 16, 2021 12:41am

- | Commercial Member | Joined Apr 2013 | 4,366 Posts

- Post #4,520

- Quote

- Jul 25, 2021 11:09pm Jul 25, 2021 11:09pm

- | Commercial Member | Joined Apr 2013 | 4,366 Posts