Fair enough Proximus. Let's see if I can address your comments. Of course, every tick on the chart represents a valid trade. Each is just as valid as the other. Indeed, I often do look at the tick chart, but it doesn't give me much perspective, like how does this price compare to where it was a week ago, or a month ago. Of course you could get that information with a huge screen and a very compressed tick chart, but charts are designed to be informative to the eye, and it's much easier and cleaner for me to look at a daily chart to see where prices were a month ago than a highly compressed 1 minute chart. In the end, it's just compression of data. The 1 minute timeframe is merely a compression of all the ticks that occurred over that 1 minute time span, just as the 5M is the compression of the 5 previous 1Minute charts, and so on up through the daily and monthly charts. It is true that a 60 minute chart is very much like the summation of 60 1-minute charts, and a 60 minute moving average over a long period would look very similar. You can run many moving averages and pick out the data as you suggest, but it's a bit messy, as your chart above portrays. If it pleases my eye and makes it easier for me to see the data I am looking for, it has served it's purpose. If you prefer to look at a highly compressed 1 minute chart rather than an expanded 60 minute chart, that's fine with me. I sometimes do that myself to see more detail in price movement over the same time period.

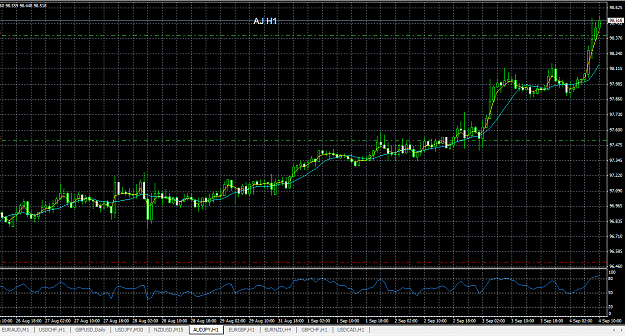

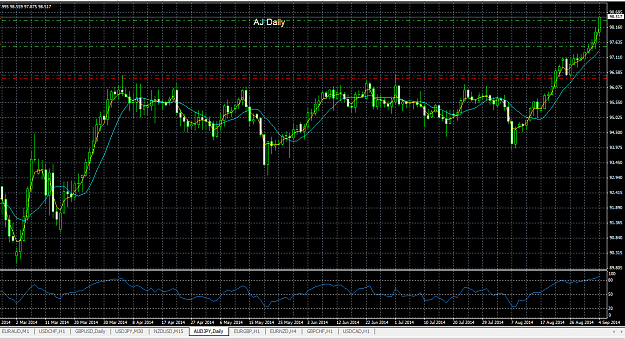

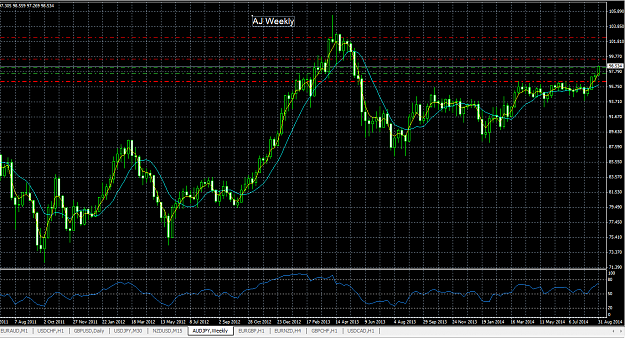

The logic of checking trends at different sampling periods is that they will give different results for the trend in different time periods. If you sample at only one time period, say the 1H chart, and trend is up, does that mean the trade is valid for a period of two weeks? But if the trend is up on the weekly chart, do you really want to enter long right now when price is going down on the 1 minute, 5 minute, 15M, 30M, H1, H4 and daily? You might be right as far as the weekly chart, but you might be entering in the middle of a big reversal and the only way to see it is to look at the lower timeframes. If all those charts are trending up though, I believe it would be safe to say that price is trending up. As far as the spacing of the timeframes, they are rather arbitrary, like they are all a factor of 4 to 6 apart, except the 30 minute chart that doesn't fit the 4 to 6 factor rule. Ignore it if you like. If you are a stickler for order, you can make them all a factor of 5 apart, though you will have some odd periods and I doubt it would improve your results any.

I have a chart with my favorite widgets on it, and another on another screen which is usually naked price, or almost so. I use 3 objective methods to determine trend on my widget chart. I suspect each trader will find her or his own favorites. Mine are a 100 period quadratic regression, a 5ema cross over the 10sma, and the 10RSI(H+L)/2 cross over the 50% mark. If a trend is strong and clear, these will usually all agree. Occasionally I will refer to moving averages or 5,3,3 stoch as well, but those aren't deciding factors for me. Usually, I can tell at a glance of a naked chart if trend is up or down, but as you noted, I need something objective to be consistent. If a trend isn't very clear to me, I consider it undecided and I don't count it in my analysis. If I have to blow the chart way up or squint to see the trend, I skip it and move on. I'm sure I've thrown out some very good trades because trend wasn't clear to me at that moment, but that's the price of consistency. Happy trading!

The logic of checking trends at different sampling periods is that they will give different results for the trend in different time periods. If you sample at only one time period, say the 1H chart, and trend is up, does that mean the trade is valid for a period of two weeks? But if the trend is up on the weekly chart, do you really want to enter long right now when price is going down on the 1 minute, 5 minute, 15M, 30M, H1, H4 and daily? You might be right as far as the weekly chart, but you might be entering in the middle of a big reversal and the only way to see it is to look at the lower timeframes. If all those charts are trending up though, I believe it would be safe to say that price is trending up. As far as the spacing of the timeframes, they are rather arbitrary, like they are all a factor of 4 to 6 apart, except the 30 minute chart that doesn't fit the 4 to 6 factor rule. Ignore it if you like. If you are a stickler for order, you can make them all a factor of 5 apart, though you will have some odd periods and I doubt it would improve your results any.

I have a chart with my favorite widgets on it, and another on another screen which is usually naked price, or almost so. I use 3 objective methods to determine trend on my widget chart. I suspect each trader will find her or his own favorites. Mine are a 100 period quadratic regression, a 5ema cross over the 10sma, and the 10RSI(H+L)/2 cross over the 50% mark. If a trend is strong and clear, these will usually all agree. Occasionally I will refer to moving averages or 5,3,3 stoch as well, but those aren't deciding factors for me. Usually, I can tell at a glance of a naked chart if trend is up or down, but as you noted, I need something objective to be consistent. If a trend isn't very clear to me, I consider it undecided and I don't count it in my analysis. If I have to blow the chart way up or squint to see the trend, I skip it and move on. I'm sure I've thrown out some very good trades because trend wasn't clear to me at that moment, but that's the price of consistency. Happy trading!