Defintion:

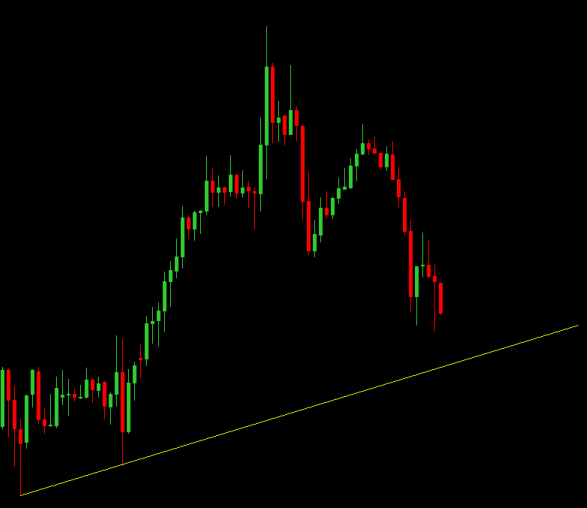

I have encountered the concept of "touch trading", which is a method of entering a position simply when price reach a level, expecting the price with reverse at the level without piercing through the level.

Some criteria:

Touch trading is used when the trader has very good confidence at the level. One reason for such a confidence may be that a lot of key moving averages, support-resistence, pivots, Fibo level, Round number, etc. are overlapping at the level.

Questions:

May I ask what else constitute a good touch trade setup? Why this entering method seems to work well some time? Under what situation this entering method would not work well? How many pips would you prepare as the stop loss?

Please share your view if you have relevant experience!

I have encountered the concept of "touch trading", which is a method of entering a position simply when price reach a level, expecting the price with reverse at the level without piercing through the level.

Some criteria:

Touch trading is used when the trader has very good confidence at the level. One reason for such a confidence may be that a lot of key moving averages, support-resistence, pivots, Fibo level, Round number, etc. are overlapping at the level.

Questions:

May I ask what else constitute a good touch trade setup? Why this entering method seems to work well some time? Under what situation this entering method would not work well? How many pips would you prepare as the stop loss?

Please share your view if you have relevant experience!