Hi,

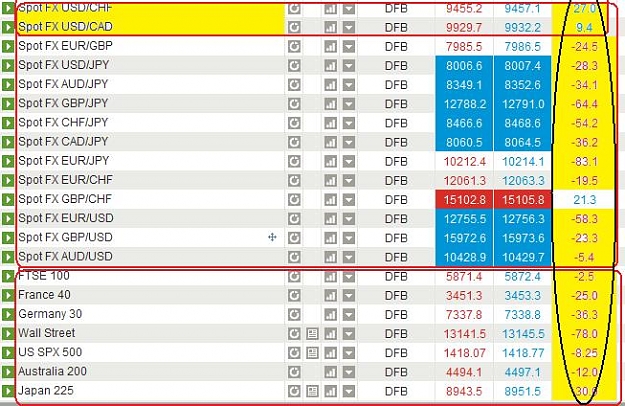

Anyone been trading positive/negative correlated pairs ?

How do you trade them ?

Can share your experience and findings ?

Thanks.

Anyone been trading positive/negative correlated pairs ?

How do you trade them ?

Can share your experience and findings ?

Thanks.

Forex is my business