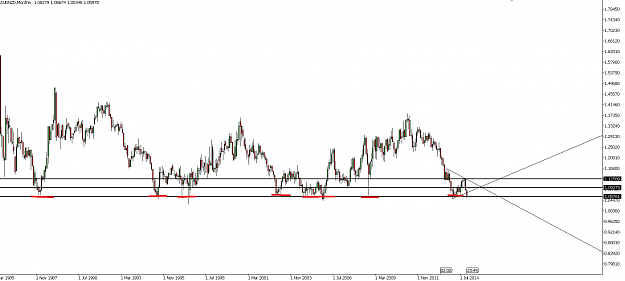

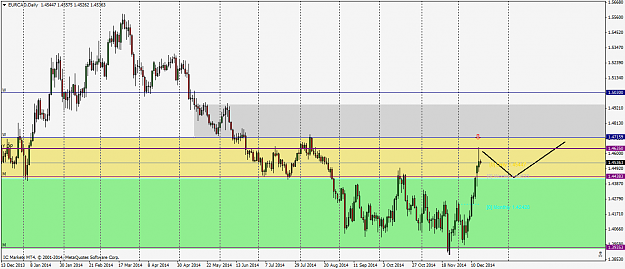

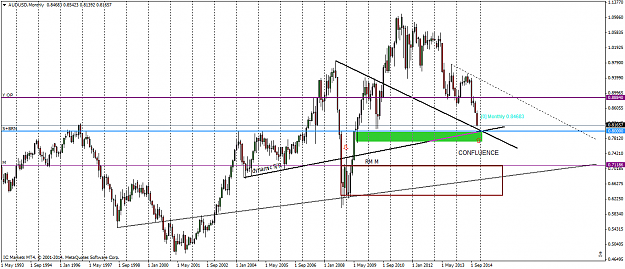

AUDNZD in interesting situation right now:

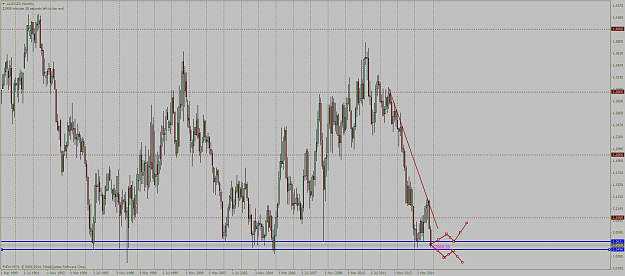

Monthly: Price is at extremly important resistance.

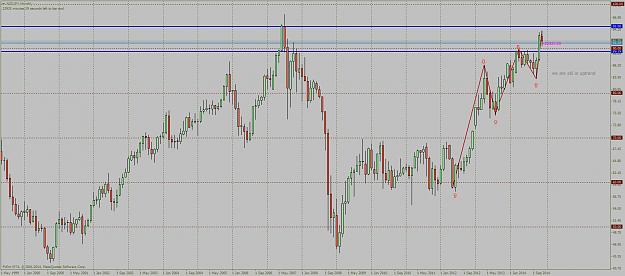

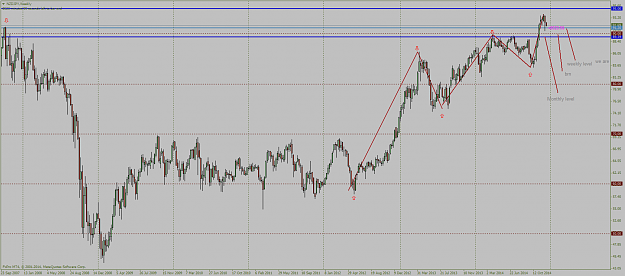

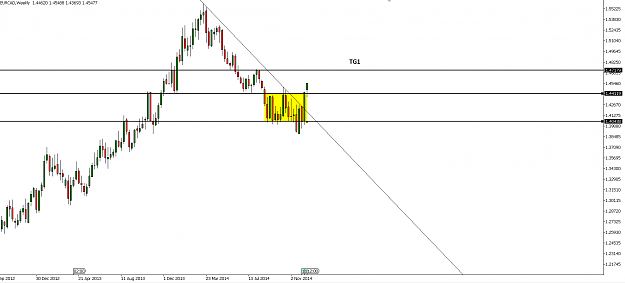

Weekly: Price closed outside of bullish TL and above important resistance -> I will wait for bullish PA as confirmation on daily

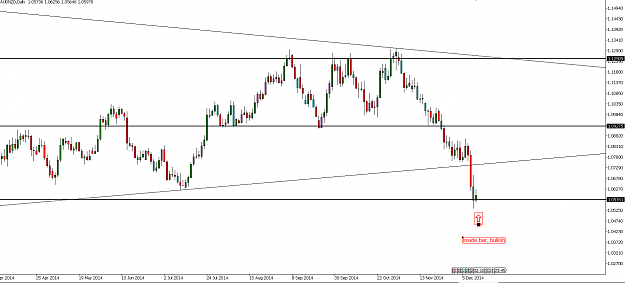

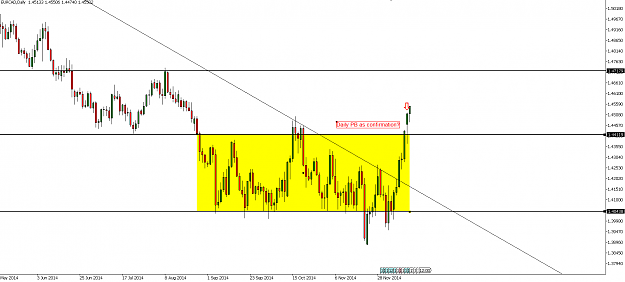

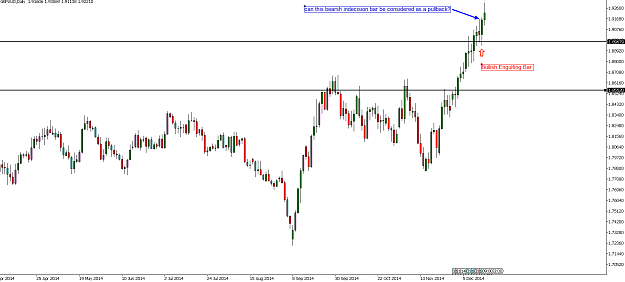

Daily: A bullish inside bar has been formed, but can not be taken as an entry, as the candles belong to this weeks close and we need a daily confirmation of this weeks close next week

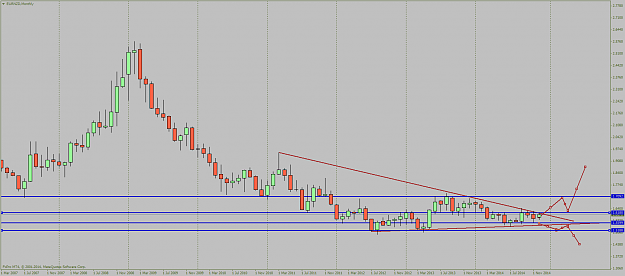

Monthly: Price is at extremly important resistance.

Weekly: Price closed outside of bullish TL and above important resistance -> I will wait for bullish PA as confirmation on daily

Daily: A bullish inside bar has been formed, but can not be taken as an entry, as the candles belong to this weeks close and we need a daily confirmation of this weeks close next week