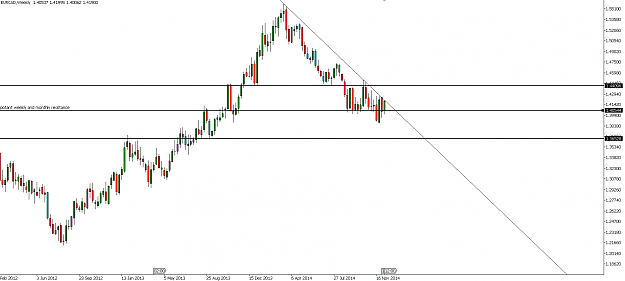

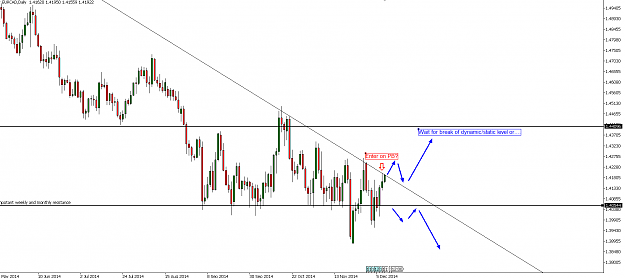

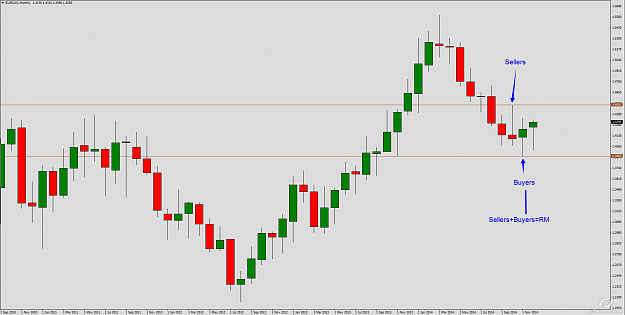

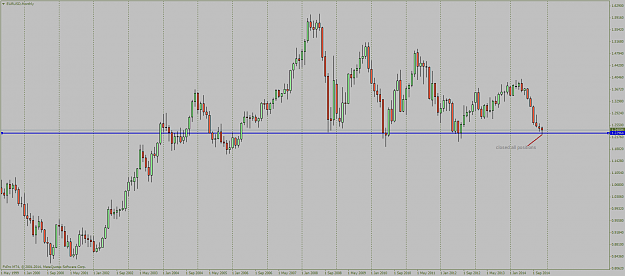

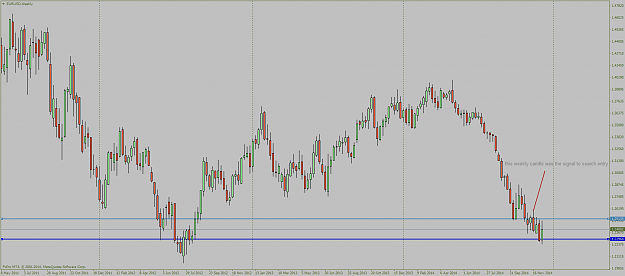

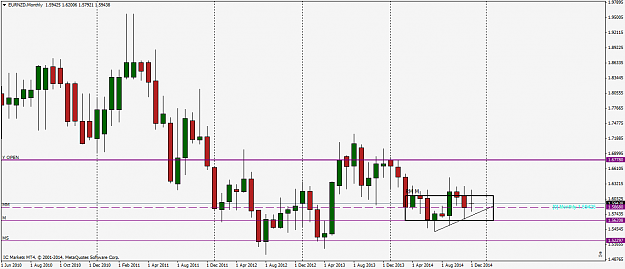

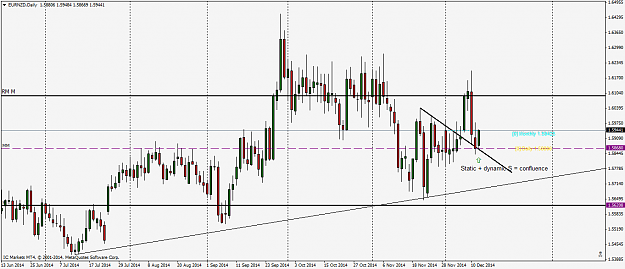

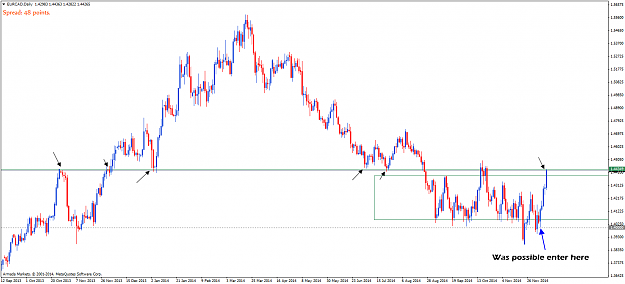

DislikedHey, I have a question about the PB on EURAUD weekly (see chart). How do I know if it is bullish information (rejection of new support) or bearish information (inverted PB showing selling pressure) which might indicate price turning back into the range? Thanks in advance {image}Ignored

Hi Tft...

Fxgroup talked about this pair in the webinar, so if you were long already from previous support at 1,4590ish

i think the best approach is to protect your capital, taking some action, i always do that when i see price acting

in a way that i dont like, either pulling some profits, moving stops to be or simply taking full profits there, this is

a personnal matter everyone, should find is way to manage is own book.

I guess screen time will be our best teacher for this i suppose.

My view about the pair is that it should reach at least 1,4906 resistance, the weekly bar you refered showed some profit taking

already but it managed to stay above 1,4745 s/r, so this can lead us to have positive expectation about future price movement...

thatīs my 2 cents