Hi Guys,

I had a very simple idea two weeks ago.

What would happen if I just follow strength of the 8 majors for one week?

Let me explain the idea a bit further:

Monday morning 8.00 am (Central European Time)

I look at the currency strength calculator on this site: Currency strength calculator

I don't exactly know how they calculate the relative strength of each currency but at the moment I don't care.

For the time period used to calculate strength I choose a period of the last 10 weeks.

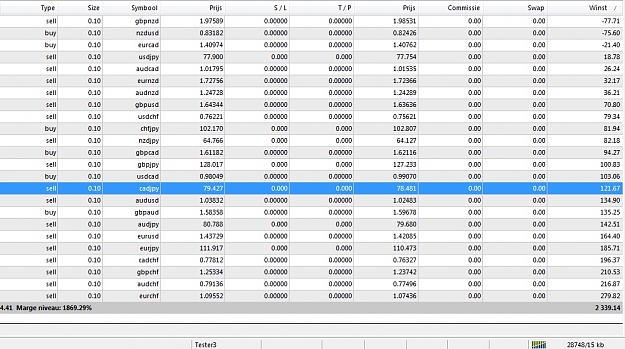

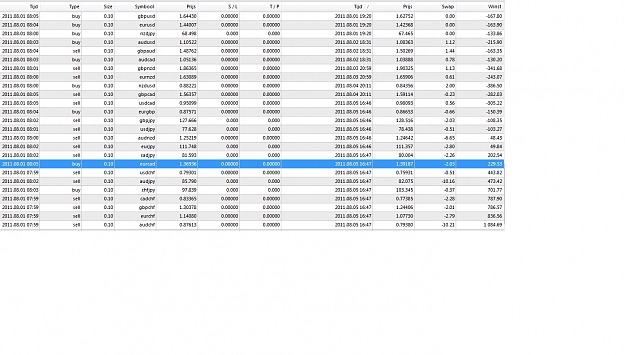

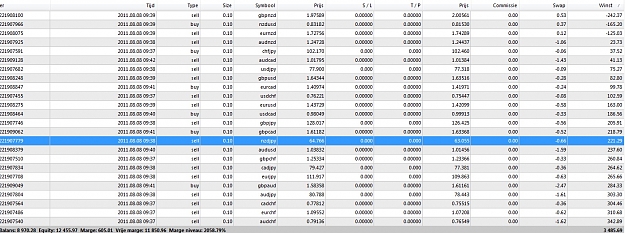

Then I open trades for every possible combination of the 8 currencies in the direction of strength, i.e. If CHF is rated stronger then GBP I open a Sell GBP/CHF trade.

During the London and US session the open trades will develop into losers and (hopefully) winners.

At 20.00 pm (Central European Time) when the markets have settled a bit I look at my list of trades and close half the size of the losers. (If total amount on the negative side is 800,- I close the largest trades until the negative side is lower then 400,-).

I repeat the last procedure at 20.00 pm of every following day until friday when I will close all open positions.

Last week went very well and ended with a nice profit (Demo offcourse).

I thought I would share this idea with you to see what you think of this simple approach.

Best Wishes and Happy Trading,

FBForex

I had a very simple idea two weeks ago.

What would happen if I just follow strength of the 8 majors for one week?

Let me explain the idea a bit further:

Monday morning 8.00 am (Central European Time)

I look at the currency strength calculator on this site: Currency strength calculator

I don't exactly know how they calculate the relative strength of each currency but at the moment I don't care.

For the time period used to calculate strength I choose a period of the last 10 weeks.

Then I open trades for every possible combination of the 8 currencies in the direction of strength, i.e. If CHF is rated stronger then GBP I open a Sell GBP/CHF trade.

During the London and US session the open trades will develop into losers and (hopefully) winners.

At 20.00 pm (Central European Time) when the markets have settled a bit I look at my list of trades and close half the size of the losers. (If total amount on the negative side is 800,- I close the largest trades until the negative side is lower then 400,-).

I repeat the last procedure at 20.00 pm of every following day until friday when I will close all open positions.

Last week went very well and ended with a nice profit (Demo offcourse).

I thought I would share this idea with you to see what you think of this simple approach.

Best Wishes and Happy Trading,

FBForex