By ecnforexbrokers

ECN Forex broker vs Market Maker - What is the main difference between the ECN Forex Brokers & Market Maker?

Market Maker basically "make" the Forex market. That is, if you are with the trading currency pairs with a market maker, you do not get direct access to the Forex market. Instead, the broker is sitting on the other side of the terminal, and pretty much trades against you.

With a Market-Maker:

1st You see frequent stop requotes & Hunting

2nd They lose money on trades that seem otherwise profitably

3rd Your currency feeds are manipulated and

4th When (and if) you earn money, you have a hard time withdrawing it to your bank.

The biggest reason why the market maker away with this because they are not regulated.

All these problems) can be solved by Broker Moving into an electronic communications network (ECN. Like a Straight Through Processing (STP) brokers, Forex brokers are regulated by both ECN and known.

We all know Forex Brokers manipulate prices, and spreads. How they do it? Why does not someone stop them?

It may surprise you, as one that come Forex market is not as transparent as their counterparts such as equities and options markets. In contrast to these markets, it is not centrally controlled or vary in the same way, so the exchange rate can be between brokers. The main providers of liquidity are the big banks and hedge funds, as they are known to inter-bank market. In this sense, we see how ECN broker and market maker fit into the picture.

Market Maker Broker As the name suggests, they "make" the price, such as changing bid and ask values. Say for example, 1 pip spread they get from the interbank market on EURUSD, but for us 3 pips spread display (spread is the difference between bid and ask). Agents can vary from time to time and sometimes show even tighter spreads on demo accounts, but when you open a live account, it is a completely different story.

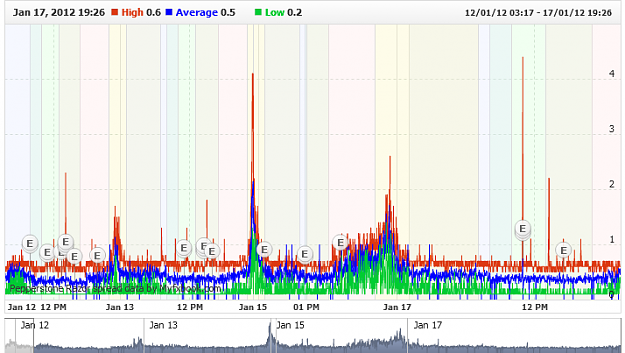

Every time you open and close a trade you will lose the spread. This adds up to a considerable value when you trade frequently. Not only is this, but Market Maker Broker notorious for the production of spikes, they do this to stop it is to customers. Some brokers and market makers freeze its platform in the news announcements, or increase by 20-30 pips spreads, which is quite common. Since Forex is not fixed, regulated than other markets, there is not much you can do NFA and similar organizations.

The only advantage of using a Broker Market Maker is that it means less open to account, and usually offer platforms that are easy to use required. They also provide greater leverage to benefit s are questionable. Read more leverage in Forex trading help?

ECN BrokersECN Brokers simply offers the best possible price that is the dissemination of the best current market participants. The price on the platform is straight out of the interbank market and there is no manipulation of spreads. Spreads, as you know are the bread and butter Broker Market Maker. Since there is no impact on spreads for ECN broker, the only way they can raise money on commissions and fees. This fee is not different from what you pay when buying or selling stocks. From my personal experience of the Commission are negotiable and you can quote a broker for another bid the lowest commission. Also works from an economic commission payments as higher spreads on market-making platform. I have done several times when there was no spread at all (BID = ASK)

If there are drawbacks, the most common is the lack of user-friendly platform. Most ECN broker platforms are difficult to navigate, and it takes time to get used to it. But once you are familiar, you can take advantage of the pre-order types that are typically not available to comment on other platforms.

ECN Forex broker vs Market Maker - What is the main difference between the ECN Forex Brokers & Market Maker?

Market Maker basically "make" the Forex market. That is, if you are with the trading currency pairs with a market maker, you do not get direct access to the Forex market. Instead, the broker is sitting on the other side of the terminal, and pretty much trades against you.

With a Market-Maker:

1st You see frequent stop requotes & Hunting

2nd They lose money on trades that seem otherwise profitably

3rd Your currency feeds are manipulated and

4th When (and if) you earn money, you have a hard time withdrawing it to your bank.

The biggest reason why the market maker away with this because they are not regulated.

All these problems) can be solved by Broker Moving into an electronic communications network (ECN. Like a Straight Through Processing (STP) brokers, Forex brokers are regulated by both ECN and known.

We all know Forex Brokers manipulate prices, and spreads. How they do it? Why does not someone stop them?

It may surprise you, as one that come Forex market is not as transparent as their counterparts such as equities and options markets. In contrast to these markets, it is not centrally controlled or vary in the same way, so the exchange rate can be between brokers. The main providers of liquidity are the big banks and hedge funds, as they are known to inter-bank market. In this sense, we see how ECN broker and market maker fit into the picture.

Market Maker Broker As the name suggests, they "make" the price, such as changing bid and ask values. Say for example, 1 pip spread they get from the interbank market on EURUSD, but for us 3 pips spread display (spread is the difference between bid and ask). Agents can vary from time to time and sometimes show even tighter spreads on demo accounts, but when you open a live account, it is a completely different story.

Every time you open and close a trade you will lose the spread. This adds up to a considerable value when you trade frequently. Not only is this, but Market Maker Broker notorious for the production of spikes, they do this to stop it is to customers. Some brokers and market makers freeze its platform in the news announcements, or increase by 20-30 pips spreads, which is quite common. Since Forex is not fixed, regulated than other markets, there is not much you can do NFA and similar organizations.

The only advantage of using a Broker Market Maker is that it means less open to account, and usually offer platforms that are easy to use required. They also provide greater leverage to benefit s are questionable. Read more leverage in Forex trading help?

ECN BrokersECN Brokers simply offers the best possible price that is the dissemination of the best current market participants. The price on the platform is straight out of the interbank market and there is no manipulation of spreads. Spreads, as you know are the bread and butter Broker Market Maker. Since there is no impact on spreads for ECN broker, the only way they can raise money on commissions and fees. This fee is not different from what you pay when buying or selling stocks. From my personal experience of the Commission are negotiable and you can quote a broker for another bid the lowest commission. Also works from an economic commission payments as higher spreads on market-making platform. I have done several times when there was no spread at all (BID = ASK)

If there are drawbacks, the most common is the lack of user-friendly platform. Most ECN broker platforms are difficult to navigate, and it takes time to get used to it. But once you are familiar, you can take advantage of the pre-order types that are typically not available to comment on other platforms.