DislikedLet me talk about this last week. Taking hindsight from the previous week, my hindsight was down.

1. Had a limit order on Bar 2 and a stop order at 7700 level. This was overexposure. Lost 160 pips when price rocked back. Only one trade would have been good.

2. Entered a limit order at 50% of Bar 5. Lost 65 pips there. Good trade in my book.

3. Bar 7 was a pin bar back into the range. Took a short there and cut it quickly when price reversed. Again good trade.

4. Bar 8 closed the day as a bullish engulfing bar. Taking hindsight from daily now...Ignored

Few comments on this chart, hopefully you'll not be offended by tone:

3. - Bad trade. Used to entry like this until realized simple truth - in order for pin bar to be a valid signal there must be a preceeding trend with price losing steam (bars with small bodies) - here you have long, very strong bullish bar.

Moreover - look at spacing and direction of emas - when preceeding trend is fading you'll find them almost flat (directionless)

4. Bad trade. If your weekly hindsight is down - no point to invent new hindsight at one level lower. Stick to your plan.

5. Bad trade. - against your weekly hindsight.

6. Bad trade, again against weekly hindsight.

My opinion is one needs to have enough patience to stick to initial plan - weekly hindsight.

Moreover, the more trend progresses, the more spaced should be your stacks. In you example trades on bars 27 and 28 were overtrading and trying to catch the train which is gone few days ago.

In you chart I would enter short after bar 12, no trade on bar 13, one- two stacks on bar 14, all my shorts would be closed by BE on bar 15,

on bar 17 I would have 1 trade closed in small loss or BE, then bar 18 is a payday bar - I would enter at every good possibility as bar 17 made a new low and "almost" engulfed bar 15 + we have preceeding up trend.

Then on bar 19 I would add few more stacks, on bars 20-21 all my shorts except of 1-2 positions enerred early on candle 18 would be closed at BE and on bar 23 I would try to enter on its wick and definetely would enter on its body. On bar 24 I would add more shorts.

Bar 25 - no trade for me as price not moving any lower, bar 26 - same story, no trade within bar 24.

On bar 27 I would add one stack.

On bars 28-29 some of my shorts would be closed by BE or small loss and on bar 30 I would not enter new shorts until price would not be lower than minimum of bar 29 - as my shorts were closed recently - no point in overtrading - better wait and watch what price doing.

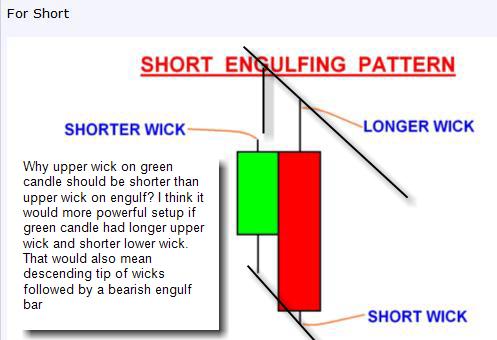

As bar 30 closed as engulging bar I would enter short on break of minimum of bar 29.

Doing so I would not overexpose myself and would still end up with 3-5 positions enterred EARLY in the trend, not in the bottom. Hopefully was helpful. If not you can simply ignore and forget.