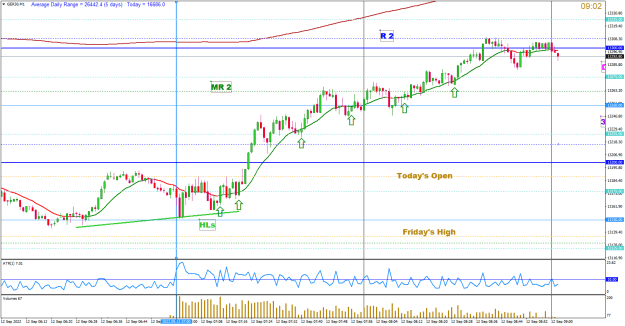

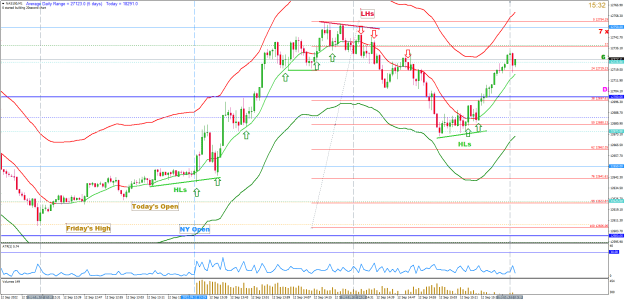

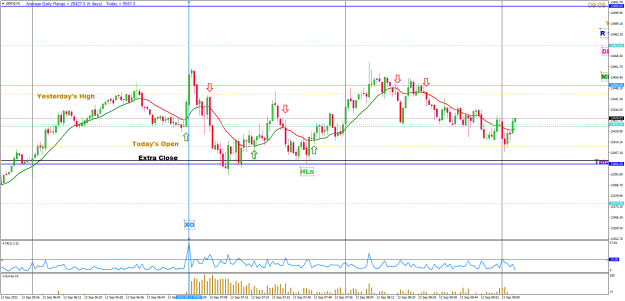

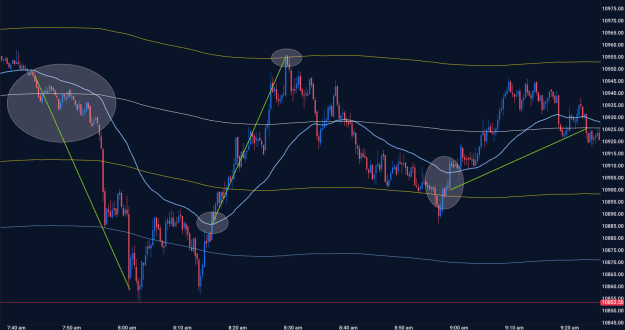

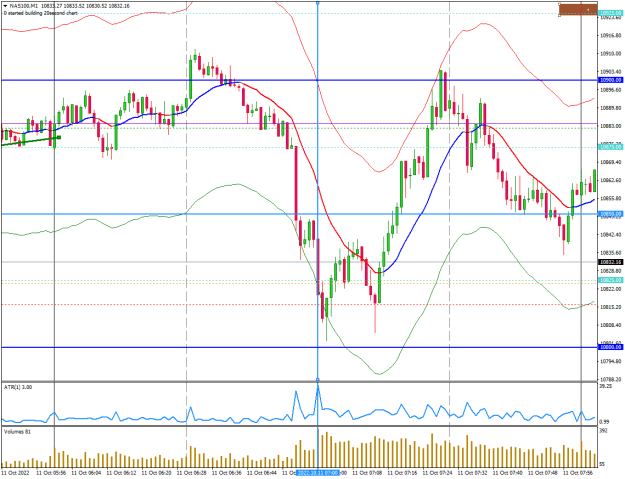

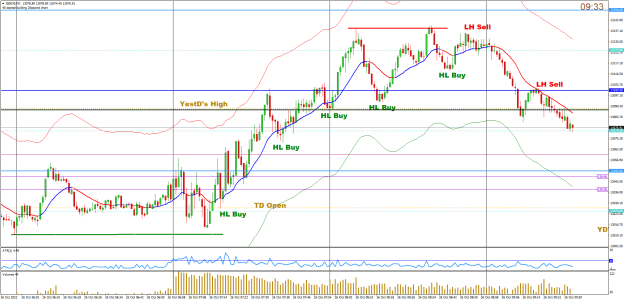

DislikedGM - lethargic start with only 45 pts range in last hour - a Grey Zone in our terms I sold the opening spike up for 24 pts and will now "sit on my hands" till I see a clear entry ECB stuff later so anything might happen. I never bother to think about things like that.....just trade what's on my screen!Ignored

And, yes, a morning to stay away from the screens.