Introduction

After many PM's, Emails, & any other possible ways of contact by what seems like the entire FF family; I've decided to share my simple trading system/strategy with you. For those who don't know me, my name is Josef (pronounced: Joseph) and I have been trading fx for over two years. I frequent the Eur/Usd thread as I only trade Eur/Usd. I chose to trade E/U because of the viable; business nature of the pair.

The Problem

Different strokes for different folks. While we all hold various skills and tools, we all are tackling the same problem. Unfortunately, one person's method may not help another. Oscillator Indications. For the most part I have a huge problem with putting them to practice on a live account. The reasons are of course, obvious. Though, I would never tell a person their system and/or indicator doesn't work. It's just that, Oscillator Indicators has never worked for me.

The Solution

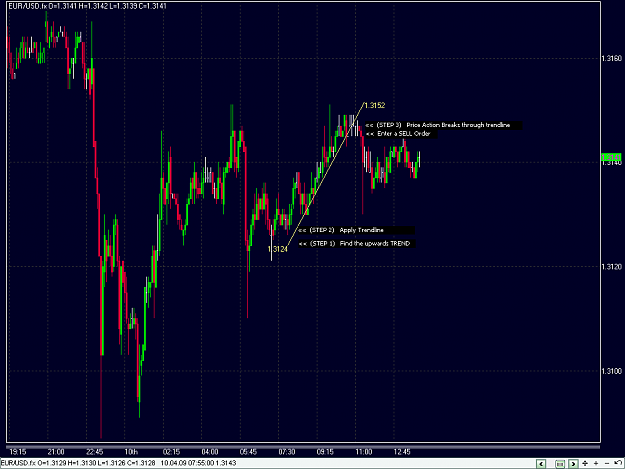

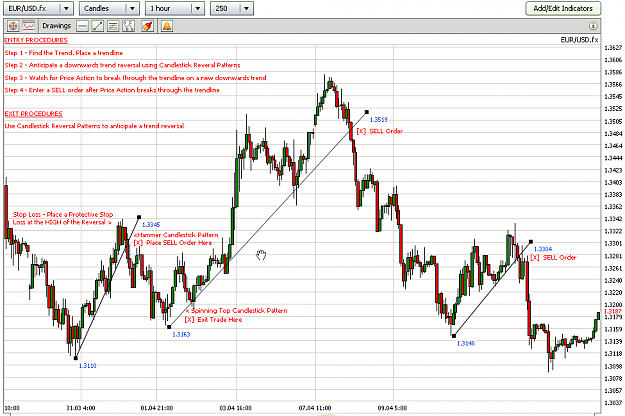

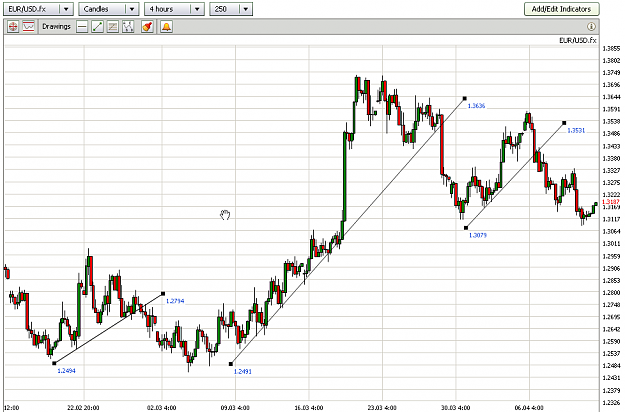

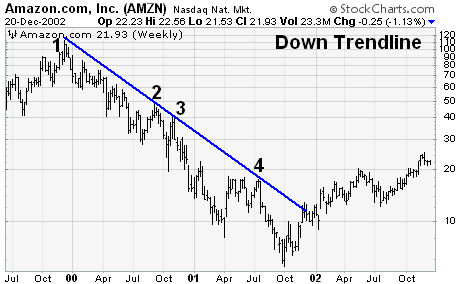

Price Action. As some of us cringe at those two, little words, I totallty understand. I too, was one that didn't believe in Pure Price Action trading. After putting Price Action up to test, I found I understood the market better. I understood the why, how, and when of Price Action. What I've found is that a trader only needs Candlestick Patterns, Trendlines, and maybe Pivot Points.

*

*

*

**** Revised **** Trendline Break System version 2.0

Visit POST #63 to view the revised strategy

http://www.forexfactory.com/showpost...7&postcount=63

Get a compiled version of Heikin Ashi

Visit POST #65 to download

http://www.forexfactory.com/showpost...5&postcount=65