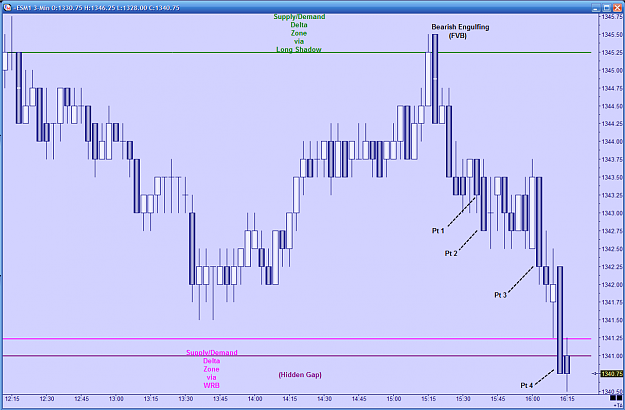

I know this is breaking the 50 sma rule, but like i said, sometimes i will take a countertrend trade.... but i will be more cautious with my stops..

http://i1222.photobucket.com/albums/.../guengulf2.png

http://i1222.photobucket.com/albums/.../guengulf2.png