Shakesfx GBP/ JPY Parabolic SAR. Nothing more, nothing less.

EDIT: This system is for all pairs, not just GBP/JPY. (Unfortunately I cannot change the Thread title)

Having been burnt in the past by overtrading I sought a system that would offer a longer term profitable strategy. I settled on Parabolic SAR because it is simple and consistent. I have only back tested since ’04, but the results so far look promising. I know that all indictors lag, but SAR seems to be on the ball with not many negative trades. I have realised that most profitable traders in the 5% club mostly trade daily charts. Lets see how we get on with it, I am open to advice and will keep a journal of my trades here. I work in Iraq at present, so have limited access to internet, but will post as often as I can.

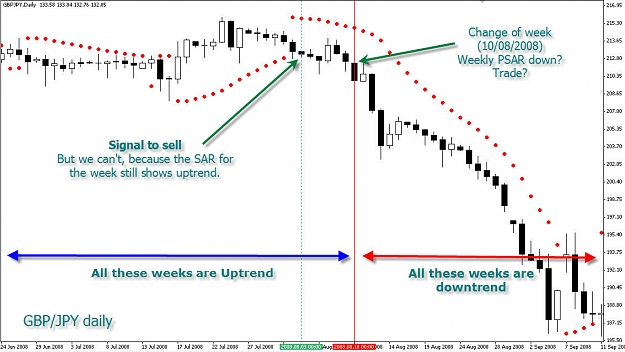

I stick to the DAILY charts and only trade in the direction of the WEEKLY SAR. I do not use any other indictors. This seems to take away all of the emotions during trading, and hopefully will allow me to carry on with normal life without being glued to screens everyday. I only need to check once a day, at the change of the daily candle to see if an opposite SAR signal has appeared. 5 mins a day for consistant profit suits me fine. Obviously, the profits shown here may not be to everyones taste, but I would rather have steady profit with less pips than fast profit (or loss). This trading style suits me and is what I am aiming for.

For the last 12 Months Dec 07- Dec 08, the following trades would have been placed using this daily system on GBY/JPY:

20/12/07 Sell at 226.16

24/01/08 Close Trade at 208.84 = +1732

06/02/08 Sell at 209.28

14/02/08 Close Trade at 212.42 = -314

29/02/08 Sell at 208.73

28/03/08 Close Trade at 199.73 = +900

18/04/08 Buy at 203.78

08/05/08 Close Trade at 204.60= +82

23/05/08 Buy at 205.97

01/07/08 Close Trade at 211.31= +540

18/07/08 Buy at 212.16

03/08/08 Close Trade at 212.64 = - 48

03/08/08 Sell at 212.64

22/09/08 Close Trade at 195.38 = +1726

30/09/08 Sell at 187.64

27/11/08 Close Trade at 146.59 = +4105

02/12/08 Sell at 138.55 Running g at 133.16 = +539 Pips on 25/12/08

Dec 07-Dec 08 total = + 9358 Pips (9 trades)

Out of those 9 trades, only 2 trades would have resulted in a negative return.

Back testing manually since Dec 2004 we have the following trades and results:

Dec 06 – Dec 07 = +3888 (14 trades)

28/11/06 Buy at 224.97

05/01/07 Close Trade at 230.81 = +584

12/01/07 Buy at 233.91

01/02/07 Close Trade at 236.98 = +307

28/02/07 Sell at 231.73

19/03/07 Close Trade at 225.97 = +576

19/03/07 Buy at 225.97

20/04/07 Close Trade at 237.36 = +1139

29/04/07 Buy at 238.18

13/05/07 Close Trade at 238.44 = +26

18/05/07 Buy at 239.43

08/06/07 Close Trade at 239.60 = +17

14/06/07 Buy at 241.74

27/06/08 Close Trade at 244.46 = +272

01/07/07 Buy at 247.28

26/07/07 Close Trade at 247.64 = +36

26/07/07 Sell at 247.64

08/08/07 Close Trade at 243.75 = +389

12/08/07 Sell at 238.93

23/08/07 Close Trade at 232.66 =+627

19/09/07 Sell at 232.85

28/09/07 Close Trade at 232.64 = -21

30/09/07 Buy at 234.77

17/10/07 Close Trade at 237.74 =+297

30/10/07 Buy at 236.38

11/11/07 Close Trade at 230.65 = -573

11/11/07 Sell at 230.65

29/11/07 Close Trade at 228.53 =+212

Dec 05 – Dec 06 = +238 (11 trades)

15/12/05 Sell at 208.36

13/01/06 Close Trade at 202.83 =+553

22/02/06 Buy at 207.22

27/02/06 Close Trade at 202.16 = -506

29/03/06 Buy at 205.57

21/04/06 Close Trade at 207.76 =+219

03/05/06 Buy at 208.63

10/05/06 Close Trade at 206.18 = -245

23/05/06 Buy at 210.04

21/06/06 Close Trade at 211.86 =+184

06/07/06 Buy at 212.18

10/07/06 Close Trade at 210.40 = -178

14/07/06 Buy at 212.71

28/07/06 Close Trade at 213.63 = +92

04/08/06 Buy at 217.00

18/08.06 Close Trade at 217.82 =+82

24/08/06 Buy at 220.27

05/09/06 Close Trade at 221.30 =+103

15/09/06 Buy at 221.70

16/10/06 Close Trade at 221.63 = -7

23/10/06 Buy at 223.53

14/11/06 Close Trade at 222.94 = -59

Dec 04 – Dec 05 = +2155 (7 trades)

01/12/04 Buy at 196.72

21/12/04 Close Trade at 201.28 = +456

30/03/05 Buy at 201.61

21/04/05 Close Trade at 205.23 =+362

17/05/05 Sell at 196.54

13/06/05 Close Trade at 196.82 =+ 28

01/07/05 Sell at 197.59

27/07/05 Close Trade at 195.46 =+ 213

30/08/05 Buy at 198.68

12/09/05 Close Trade at 200.71 =+ 203

05/10/05 Buy at 201.04

07/11/05 Close Trade at 206.57 =+553

28/11/05 Buy at 204.93

14/12/05 Close Trade at 208.33 =+340

Back testing shows mostly positive trades. In fact out of a total of 41 trades since Dec ’04, only 9 trades were closed at a loss. Largest drawdown was 573 pips during Nov ’07. Large drawdown’s such as this would obviously be protected by a SL. I am back testing manually using new parameters to see which TP and SL levels work best for locking in profits. I will post the results using SL’s and TP levels as soon as I can.

RULES:

Parabolic SAR settings: (0.02,0.20)

Check the daily chart at the close/open of a new daily candle.

If an opposite SAR is shown, check against the weekly chart for overall trend.

If the weekly and daily SAR’s are in agreement, enter the trade immediately at new candle.

Check once a day at the open/close of the new daily candle and wait for a reversal SAR to appear.

If reversal SAR appears, DO NOT exit trade until completion of THAT daily candle, this is to ensure that this is a definite reversal signal as sometimes the SAR dot can repaint itself in the opposite direction. When this candle is complete and the next daily candle appears EXIT THE TRADE.

Await the next DAILY entry signal.

EDIT: This system has been refined, check pages 3, 4 and 5 for latest version using 4hr SAR entry with DAILY and WEEKLY SAR's.

Examples for Long and Short entries:

EDIT: This system is for all pairs, not just GBP/JPY. (Unfortunately I cannot change the Thread title)

Having been burnt in the past by overtrading I sought a system that would offer a longer term profitable strategy. I settled on Parabolic SAR because it is simple and consistent. I have only back tested since ’04, but the results so far look promising. I know that all indictors lag, but SAR seems to be on the ball with not many negative trades. I have realised that most profitable traders in the 5% club mostly trade daily charts. Lets see how we get on with it, I am open to advice and will keep a journal of my trades here. I work in Iraq at present, so have limited access to internet, but will post as often as I can.

I stick to the DAILY charts and only trade in the direction of the WEEKLY SAR. I do not use any other indictors. This seems to take away all of the emotions during trading, and hopefully will allow me to carry on with normal life without being glued to screens everyday. I only need to check once a day, at the change of the daily candle to see if an opposite SAR signal has appeared. 5 mins a day for consistant profit suits me fine. Obviously, the profits shown here may not be to everyones taste, but I would rather have steady profit with less pips than fast profit (or loss). This trading style suits me and is what I am aiming for.

For the last 12 Months Dec 07- Dec 08, the following trades would have been placed using this daily system on GBY/JPY:

20/12/07 Sell at 226.16

24/01/08 Close Trade at 208.84 = +1732

06/02/08 Sell at 209.28

14/02/08 Close Trade at 212.42 = -314

29/02/08 Sell at 208.73

28/03/08 Close Trade at 199.73 = +900

18/04/08 Buy at 203.78

08/05/08 Close Trade at 204.60= +82

23/05/08 Buy at 205.97

01/07/08 Close Trade at 211.31= +540

18/07/08 Buy at 212.16

03/08/08 Close Trade at 212.64 = - 48

03/08/08 Sell at 212.64

22/09/08 Close Trade at 195.38 = +1726

30/09/08 Sell at 187.64

27/11/08 Close Trade at 146.59 = +4105

02/12/08 Sell at 138.55 Running g at 133.16 = +539 Pips on 25/12/08

Dec 07-Dec 08 total = + 9358 Pips (9 trades)

Out of those 9 trades, only 2 trades would have resulted in a negative return.

Back testing manually since Dec 2004 we have the following trades and results:

Dec 06 – Dec 07 = +3888 (14 trades)

28/11/06 Buy at 224.97

05/01/07 Close Trade at 230.81 = +584

12/01/07 Buy at 233.91

01/02/07 Close Trade at 236.98 = +307

28/02/07 Sell at 231.73

19/03/07 Close Trade at 225.97 = +576

19/03/07 Buy at 225.97

20/04/07 Close Trade at 237.36 = +1139

29/04/07 Buy at 238.18

13/05/07 Close Trade at 238.44 = +26

18/05/07 Buy at 239.43

08/06/07 Close Trade at 239.60 = +17

14/06/07 Buy at 241.74

27/06/08 Close Trade at 244.46 = +272

01/07/07 Buy at 247.28

26/07/07 Close Trade at 247.64 = +36

26/07/07 Sell at 247.64

08/08/07 Close Trade at 243.75 = +389

12/08/07 Sell at 238.93

23/08/07 Close Trade at 232.66 =+627

19/09/07 Sell at 232.85

28/09/07 Close Trade at 232.64 = -21

30/09/07 Buy at 234.77

17/10/07 Close Trade at 237.74 =+297

30/10/07 Buy at 236.38

11/11/07 Close Trade at 230.65 = -573

11/11/07 Sell at 230.65

29/11/07 Close Trade at 228.53 =+212

Dec 05 – Dec 06 = +238 (11 trades)

15/12/05 Sell at 208.36

13/01/06 Close Trade at 202.83 =+553

22/02/06 Buy at 207.22

27/02/06 Close Trade at 202.16 = -506

29/03/06 Buy at 205.57

21/04/06 Close Trade at 207.76 =+219

03/05/06 Buy at 208.63

10/05/06 Close Trade at 206.18 = -245

23/05/06 Buy at 210.04

21/06/06 Close Trade at 211.86 =+184

06/07/06 Buy at 212.18

10/07/06 Close Trade at 210.40 = -178

14/07/06 Buy at 212.71

28/07/06 Close Trade at 213.63 = +92

04/08/06 Buy at 217.00

18/08.06 Close Trade at 217.82 =+82

24/08/06 Buy at 220.27

05/09/06 Close Trade at 221.30 =+103

15/09/06 Buy at 221.70

16/10/06 Close Trade at 221.63 = -7

23/10/06 Buy at 223.53

14/11/06 Close Trade at 222.94 = -59

Dec 04 – Dec 05 = +2155 (7 trades)

01/12/04 Buy at 196.72

21/12/04 Close Trade at 201.28 = +456

30/03/05 Buy at 201.61

21/04/05 Close Trade at 205.23 =+362

17/05/05 Sell at 196.54

13/06/05 Close Trade at 196.82 =+ 28

01/07/05 Sell at 197.59

27/07/05 Close Trade at 195.46 =+ 213

30/08/05 Buy at 198.68

12/09/05 Close Trade at 200.71 =+ 203

05/10/05 Buy at 201.04

07/11/05 Close Trade at 206.57 =+553

28/11/05 Buy at 204.93

14/12/05 Close Trade at 208.33 =+340

Back testing shows mostly positive trades. In fact out of a total of 41 trades since Dec ’04, only 9 trades were closed at a loss. Largest drawdown was 573 pips during Nov ’07. Large drawdown’s such as this would obviously be protected by a SL. I am back testing manually using new parameters to see which TP and SL levels work best for locking in profits. I will post the results using SL’s and TP levels as soon as I can.

RULES:

Parabolic SAR settings: (0.02,0.20)

Check the daily chart at the close/open of a new daily candle.

If an opposite SAR is shown, check against the weekly chart for overall trend.

If the weekly and daily SAR’s are in agreement, enter the trade immediately at new candle.

Check once a day at the open/close of the new daily candle and wait for a reversal SAR to appear.

If reversal SAR appears, DO NOT exit trade until completion of THAT daily candle, this is to ensure that this is a definite reversal signal as sometimes the SAR dot can repaint itself in the opposite direction. When this candle is complete and the next daily candle appears EXIT THE TRADE.

Await the next DAILY entry signal.

EDIT: This system has been refined, check pages 3, 4 and 5 for latest version using 4hr SAR entry with DAILY and WEEKLY SAR's.

Examples for Long and Short entries: