Spot on BW, spot on Pumi, spot on RickM imo.

By using an indi, or TA, or FA to predict WHICH way price is headed is for, what …

To getting in PRIOR to a definite directional confirmation.

Maybe for the thrill of having a crystal ball?

But for the trader, why not just WAIT. Until price shows its direction. It HAS to at some point.

(While price might spike, fake, flip, tight range itself or consolidate etc and any other tricks it can, until it delivers direction)

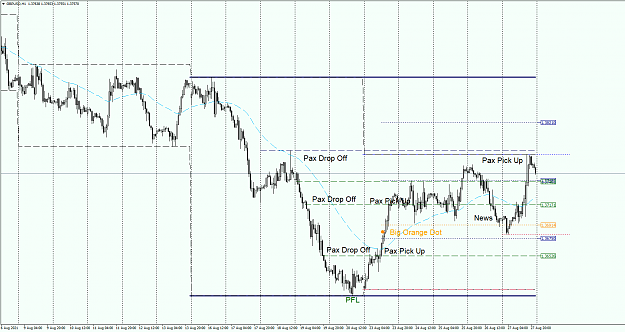

And when price delivers its direction (confirmation), the beauty is that price IS then going SOMEWHERE.

(Well at least it has for pretty much the past 13 years that I could see).

Once price IS going to its ‘somewhere’, pick up your extra pips then, rather than by some pseudo “prediction” before the actual event.

Past data has shown often (well, to me that is) that price can easily go UP against a ‘down’ news or political statement’.

OR vice versa (and sometimes both up & down, in the same period lol).

Easier (for me) to just wait till price tips its hand.

And for price to move to its ‘somewhere’ it has to ultimately tip its hand. It HAS to.

(For me that can often be during the later NY session when I am already in the cot for the night)

Traders who get caught in the wrong direction have often just entered ‘direction’ too early.

imho that is

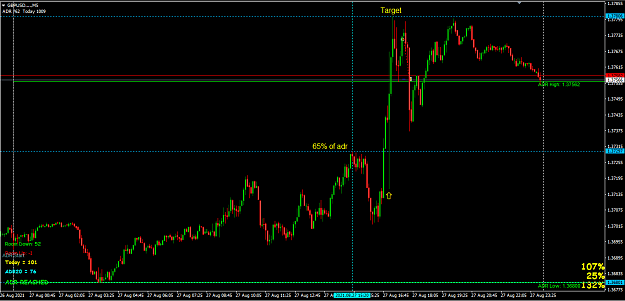

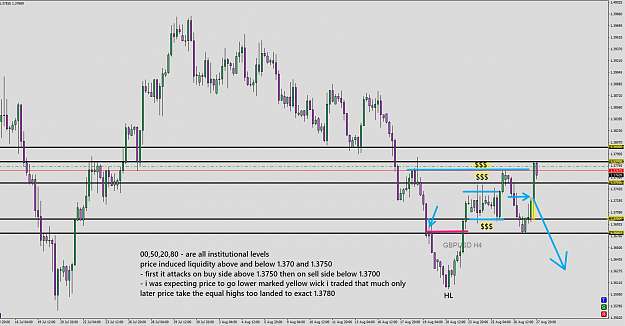

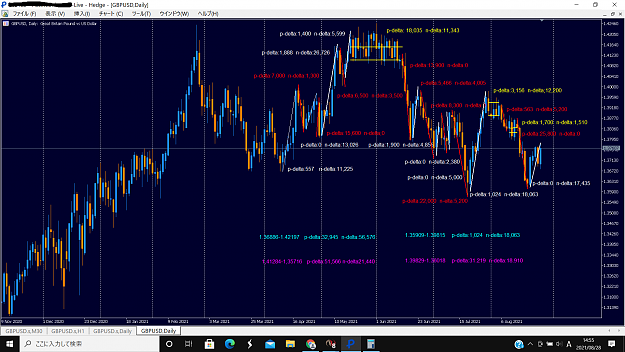

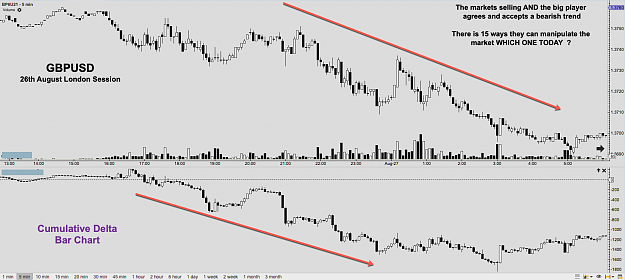

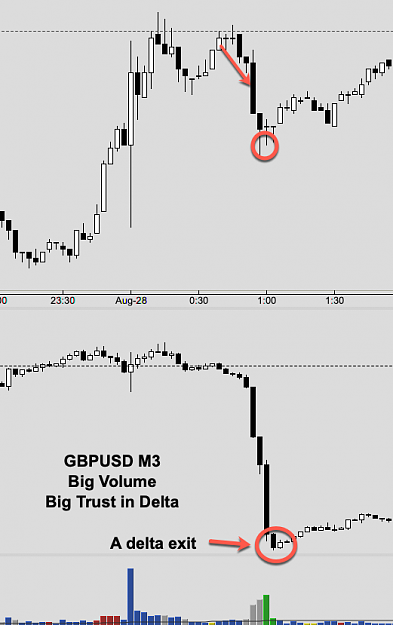

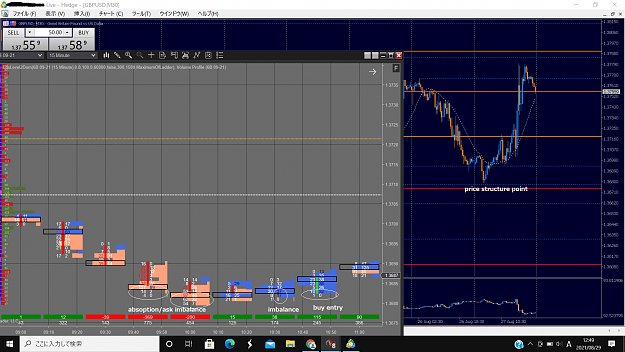

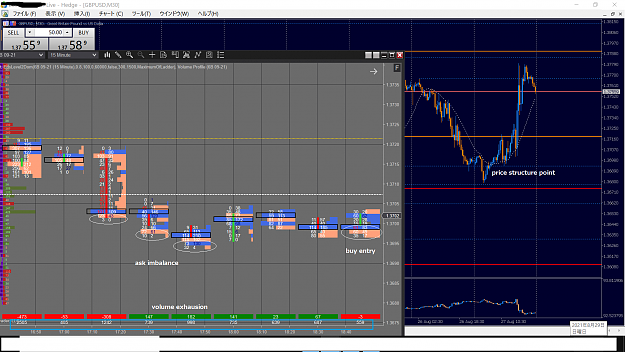

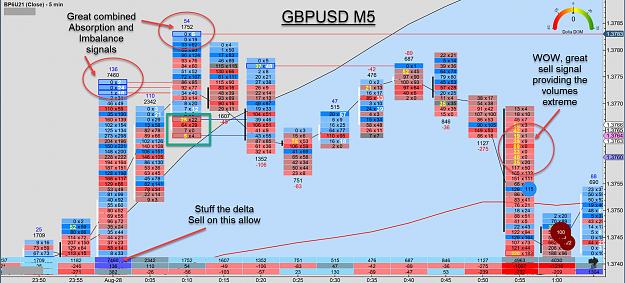

GU a classic move last night, as BW said, 100 pips. Algo repeating level to next directional algo repeating level.

.

By using an indi, or TA, or FA to predict WHICH way price is headed is for, what …

To getting in PRIOR to a definite directional confirmation.

Maybe for the thrill of having a crystal ball?

But for the trader, why not just WAIT. Until price shows its direction. It HAS to at some point.

(While price might spike, fake, flip, tight range itself or consolidate etc and any other tricks it can, until it delivers direction)

And when price delivers its direction (confirmation), the beauty is that price IS then going SOMEWHERE.

(Well at least it has for pretty much the past 13 years that I could see).

Once price IS going to its ‘somewhere’, pick up your extra pips then, rather than by some pseudo “prediction” before the actual event.

Past data has shown often (well, to me that is) that price can easily go UP against a ‘down’ news or political statement’.

OR vice versa (and sometimes both up & down, in the same period lol).

Easier (for me) to just wait till price tips its hand.

And for price to move to its ‘somewhere’ it has to ultimately tip its hand. It HAS to.

(For me that can often be during the later NY session when I am already in the cot for the night)

Traders who get caught in the wrong direction have often just entered ‘direction’ too early.

imho that is

GU a classic move last night, as BW said, 100 pips. Algo repeating level to next directional algo repeating level.

.

6