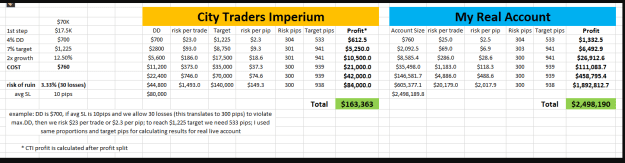

Yes, I always analyze this way when looking at the props..... If I have $10,000 personal account of which I can lose 100%, what is the equivalent at the prop firm, what are they charging me for that and how many times do I have to flip it?

Use MFF as an example.....the equivalent to a $12K personal account would be their 100K eval....

they charge $475 if you use the 5% discount. I must earn 67% (8% with 12% DD) in phase 1 and 41%(5% with 12%DD) in phase 2.....

so trading my $475 investment on my own would result in growth to $1,118 after the 2 stages (11% of the 10K) ......

I now get my $475 refunded plus I've made $160 in phase 1 bonus, $200 in phase 2 bonus, so I am already up $360 and I now have the equivalent of a $12,000 personal account.

I hate to sound like a broken record, but this is why the eval is THE ONLY MODEL one should be using.......FTMO, TFTP, TFF all offer the same bang for your buck, not quite as good as MFF but everyone should understand the concept.

If you prefer the express route as opposed to reinvesting profits, for under $5K, one can take the largest challenge offered at MFF, FTMO, TFTP and TFF, have $1 million AUM and with MAX LOSS have the equivalent of $106K personal account.

Reinvest the refunded challenge fees and repeat.........$2 million AUM or equivalent of $212K personal account.

Challenge fees are refunded again, you now have a $212K personal account at NO COST TO YOU!!!!!!!!

None of the new companies that have no history of payout or the unlimited time or the 1 step eval or the instant funding, etc, etc, etc are going to magically get you funded. The firm isn't the holy grail, you are, so find the best value, clear and concise rules, proven payout history and just f*****in' trade.

Saturday morning training over.......

Use MFF as an example.....the equivalent to a $12K personal account would be their 100K eval....

they charge $475 if you use the 5% discount. I must earn 67% (8% with 12% DD) in phase 1 and 41%(5% with 12%DD) in phase 2.....

so trading my $475 investment on my own would result in growth to $1,118 after the 2 stages (11% of the 10K) ......

I now get my $475 refunded plus I've made $160 in phase 1 bonus, $200 in phase 2 bonus, so I am already up $360 and I now have the equivalent of a $12,000 personal account.

I hate to sound like a broken record, but this is why the eval is THE ONLY MODEL one should be using.......FTMO, TFTP, TFF all offer the same bang for your buck, not quite as good as MFF but everyone should understand the concept.

If you prefer the express route as opposed to reinvesting profits, for under $5K, one can take the largest challenge offered at MFF, FTMO, TFTP and TFF, have $1 million AUM and with MAX LOSS have the equivalent of $106K personal account.

Reinvest the refunded challenge fees and repeat.........$2 million AUM or equivalent of $212K personal account.

Challenge fees are refunded again, you now have a $212K personal account at NO COST TO YOU!!!!!!!!

None of the new companies that have no history of payout or the unlimited time or the 1 step eval or the instant funding, etc, etc, etc are going to magically get you funded. The firm isn't the holy grail, you are, so find the best value, clear and concise rules, proven payout history and just f*****in' trade.

Saturday morning training over.......

3