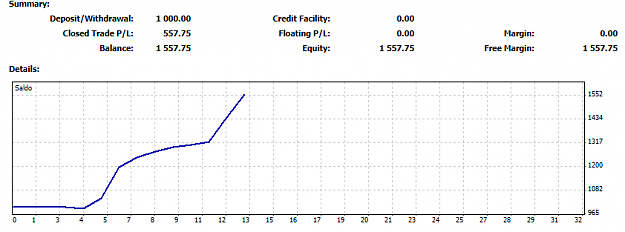

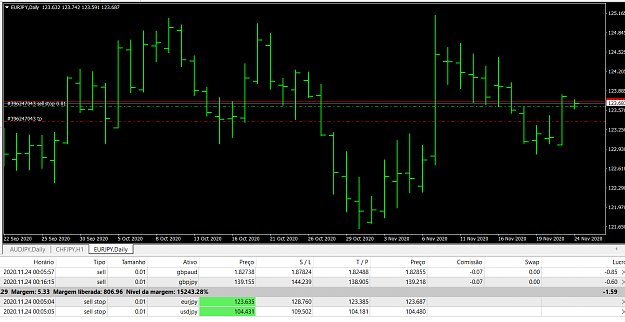

Disliked{quote} MM is very important with this strategy. This is the signal today. I'm used yesterday range = 80 {image}Ignored

Sp= Spread

PFO= todays Range

ADR= Average Daily Range

CS=?

HeatM= todays change?

D1=?

OD1=?

TLS=?

W1=?

Thank you for your interesting strategy

Best hundsbua