Hi again all,

ok, here we go again.

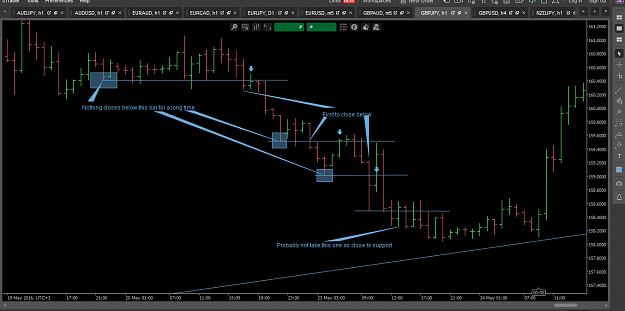

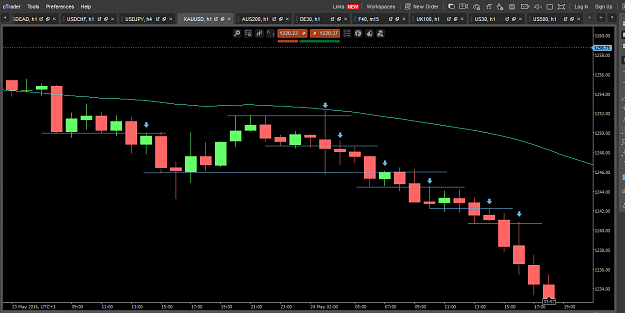

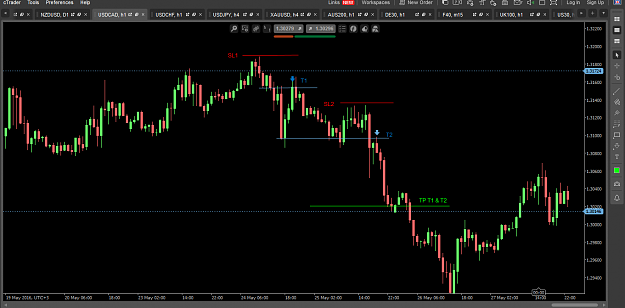

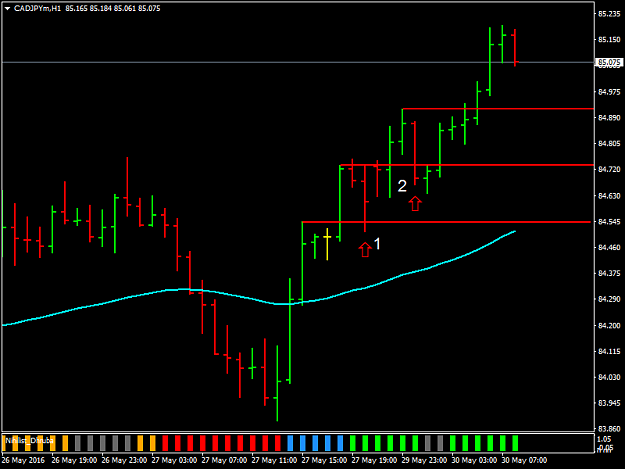

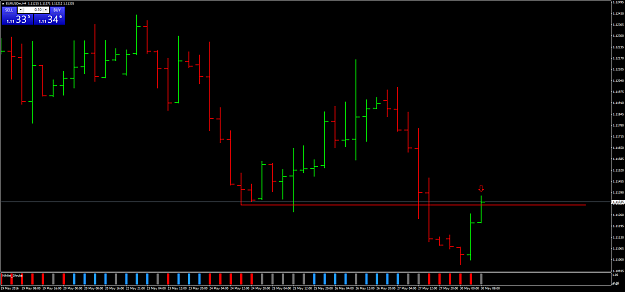

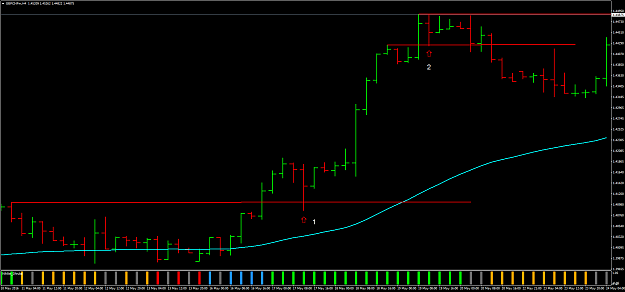

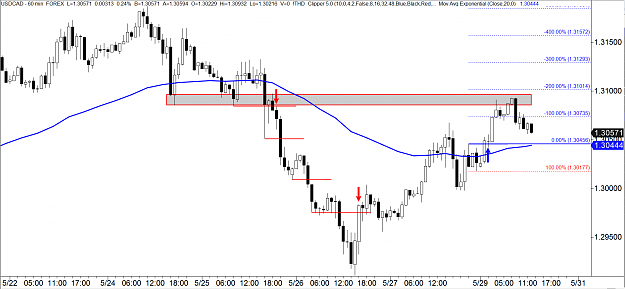

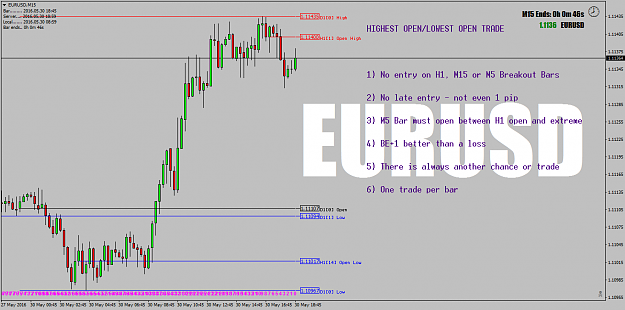

Based on major S/R, market structure and trend (higher highs, lower lows etc) to get direction of price. Draw in minor S/R and wait for price to break that point and retrace back to the level before entering.

Could wait until price actually closes below the line after going above it (for a short) as it's confirmation as per Russ Horn's Rejection Spike (thanks to that poster!)

Cheers

Pharley

ok, here we go again.

Based on major S/R, market structure and trend (higher highs, lower lows etc) to get direction of price. Draw in minor S/R and wait for price to break that point and retrace back to the level before entering.

Could wait until price actually closes below the line after going above it (for a short) as it's confirmation as per Russ Horn's Rejection Spike (thanks to that poster!)

Cheers

Pharley