If You Don’t Have Any Time This Morning

Powell & Co. will follow through on their expectation to hold rates steady this month; the outlook has not changed in any material way to induce them to cut rates and a rate hike remains a long way off.

Key Data

The impressive November employment report dominated the news last Friday. Employment grew by a whopping 266k, well above expectations. Returning autoworkers accounted for some of the gain (41k), but that simply offset a loss the previous month. After accounting for upward revisions to previous months, job growth has averaged 205k over the past three months. Not bad for an economy that analysts well over a year ago were saying was about to tip into recession.

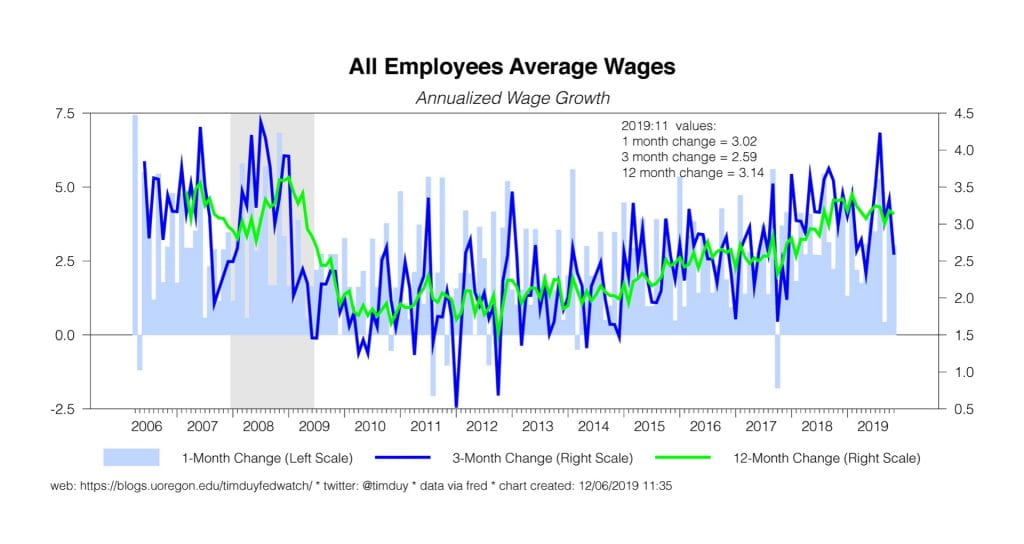

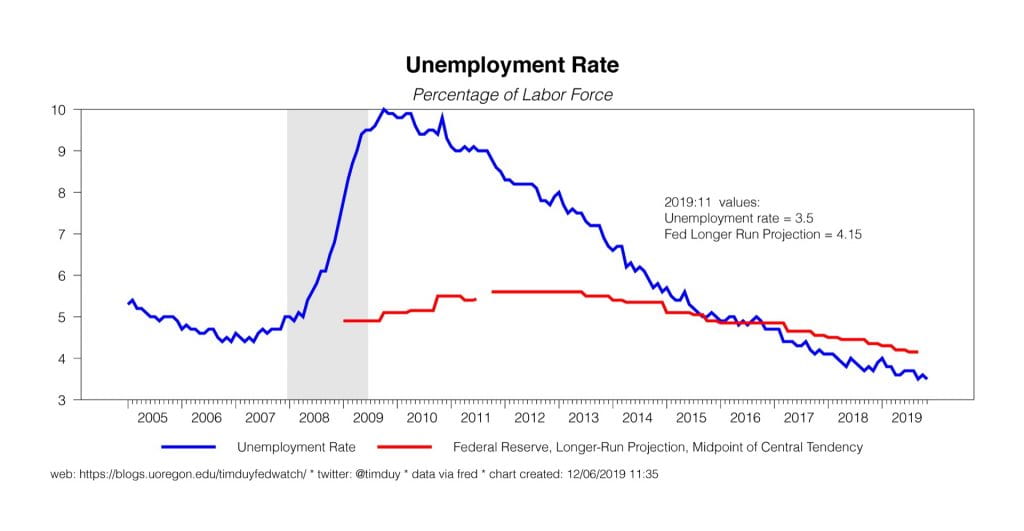

Underlying details were solid as well. Hours-worked edged higher while wages continue to grow in the 3.0-3.5% year-over-year range of the past year. The unemployment rate edged back down to 3.5%, well-below a level the Fed believes (believed?) consistent with stable inflation. A slight 0.1 percentage point decline in labor force participation left that series trending near its recent range.

Temporary employment rose; the overall pattern has mirrored the 2015-16 period. Some of the temp help weakness in recent years might (hopefully) be attributable to some supply-side constraints as this is the potential pool of labor I would expect to dry up first with sufficient permanent jobs available. Underemployment measures, however, have yet to uniformly return to pre-recession lows. This suggests the labor market still has room to run.

Manufacturing data earlier in the weak revealed the sector as still weak (ISM) or in the process of bottoming out (PMI); see my thoughts here. The ISM service measure edged down but the internals were generally good with rising new orders and employment components. The service side of the economy continues to hold up despite the softness in manufacturing.

Fedspeak

No Fedspeak due to blackout period ahead of this week’s FOMC meeting. Late last week I wrote about Federal Reserve Governor Lael Brainard’s endorsement of yield curve control:

Given the proximity to the effective lower bound for interest rates, the Federal Reserve is looking to bolster its policy arsenal ahead of the next recession. Watch for the “bond traders’ nightmare” of adding yield curve control to the Fed’s toolkit to rise to the top of the list as the policy review draws closer to an end.

For more, please visit Bloomberg Opinion.

Upcoming Data

Per usual, the data flow decelerates a bit in the second week of the month. Highlights for the week include the Consumer Price Index (Wednesday), the Producer Price Index (Thursday), and Retail Sales (Friday), all for November. The late-Thanksgiving holiday may weigh on the Retail Sales numbers – so don’t panic if the number is on the soft side of expectations. The usual initial unemployment claims report comes Thursday. The big event for the week is the Fed meeting, which concludes Wednesday and is followed by Federal Reserve Chair Jerome Powell’s press conference.

Discussion

Market participants widely expect the Fed to hold rates steady this week, which is exactly what will happen. I think the statement will be little change other than updating the economic review section.More important will be the message delivered via the Summary of Economic Projections and Powell’s press conference. I anticipate a general sense of optimism with some residual concerns about risks to the outlook in the context of an overall dovish policy path.

The base outlook for the economy will likely hold fairly constant with the Fed anticipating the economy will grow near trend through the forecast horizon while inflation gradual returns to 2%. The unemployment forecast should edge down considering solid job growth; unemployment is currently 3.5% while the year-end estimate for the fourth quarter was 3.7% as of last September. More important will be the direction of the longer-run estimates of unemployment. Considering the persistent undershooting of the inflation target, policy makers will likely bring down their estimates of the natural rate of unemployment.

The projected path of interest rates as depicted in the “dot-plot” will edge lower; the dots for 2020 will collapse to a combination of the current level and, I suspect, the 175-200 basis point range. There will be a contingent that anticipates the Fed can begin reversing this year’s rate cuts by the end of next year while of course some participants didn’t approve of recent cuts at all. Watch for downward revisions to the longer-run rate estimate; the events of the past year should make the Fed even more cautious of what I think remains their optimistic estimates of neutral rates.

Powell’s goal will be to deliver an optimistic message while avoiding any hints that policy makers are looking to soon reverse recent rate cuts. The Fed arguably has pulled off a soft-landing for the economy this year and they absolutely do not want to risk that with some premature hawkish talk. Look for Powell to highlight existing risks to the outlook and persistent undershooting of the inflation target as reasons to expect rates will be steady for the foreseeable future. Also expect Powell to express optimism regarding the supply-side response of the labor market; he may also point toward still somewhat-elevated underemployment measures as a reason to think the economy has yet to reach full employment.

Bottom Line: The Fed will gift market participants with a “dovish-hold.”