Banks have been accused of "corporate slut-shaming" for refusing financial services to sex workers, with NAB singled out as "absolute worst hypocrites".

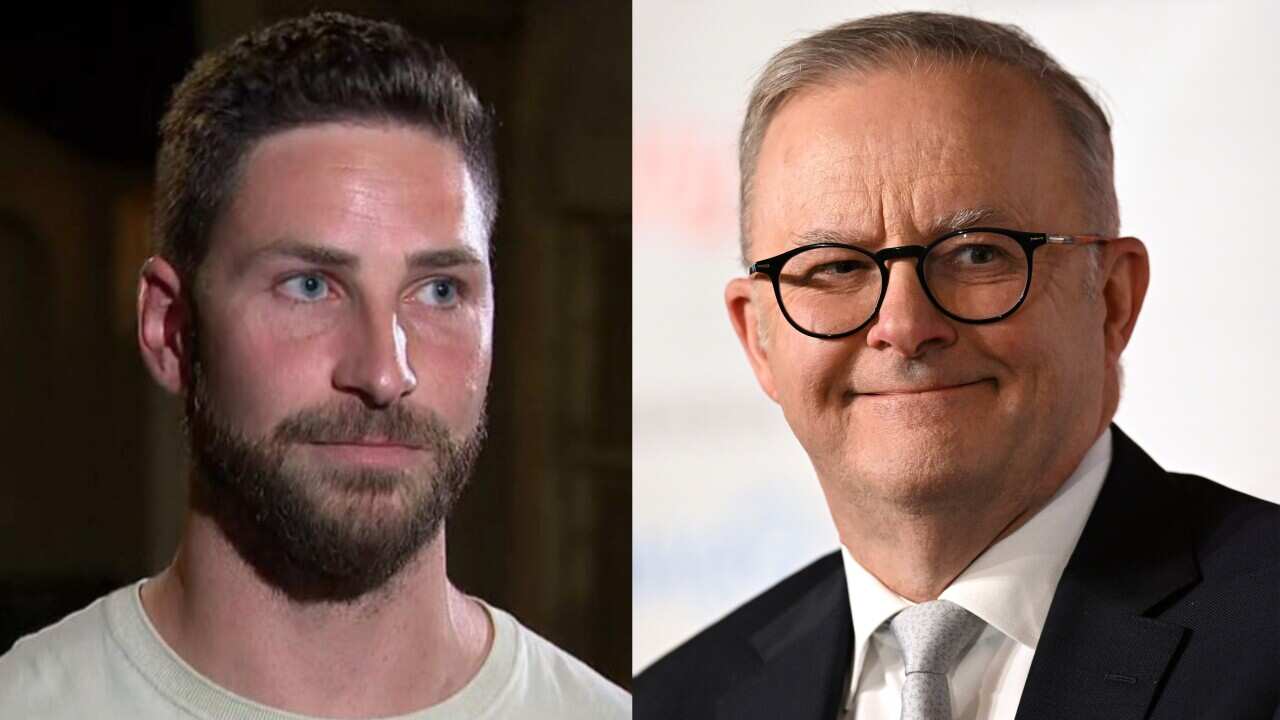

Victorian MP David Limbrick says a number of banks have contacted sex workers in recent weeks to tell them their accounts have been cancelled and to take their business elsewhere.

The Liberal Democrat said sex shop workers were also being discriminated. "I condemn these policies which effectively amount to corporate slut-shaming," Mr Limbrick told the upper house on Tuesday.

"I condemn these policies which effectively amount to corporate slut-shaming," Mr Limbrick told the upper house on Tuesday.

File photo Source: AAP

"The absolute worst hypocrites are NAB, who simultaneously claim all sorts of virtues in their human rights, diversity and inclusion policies while treating sex workers like lesser human beings.

"I'll continue to publicly shame NAB until they change."

NAB stopped servicing brothels and escort agencies earlier this year to comply with anti-money laundering laws, bringing it into line with all other major banks, a spokeswoman for NAB told AAP.

"However, we do provide banking services to sex workers who operate independently and legally and have no plans to change this policy," she said.

"We encourage customers who work in the sex industry to contact us for more information."

Rachel Payne from adult industry body Eros Association said the majority of complaints they receive relate to banks.

"NAB has been particularly bad when it comes not only to denying services to sex workers but also adult retailers," she told AAP.

Complaints have included refusal of service, higher-than-usual fees for business and workers have also been denied personal loans and refused mortgage applications.

"How can the banks have moral high-ground on what is an essential service?" Ms Payne said.

"We have to remember these are legal, tax-paying businesses. Without proper access to banking services, it is almost impossible to operate".