Forex sentiment analysis can be a useful tool to help traders understand and act on price behavior. While applying sound technical and fundamental analyses is key, having an additional feel for the market consensus can add depth to a trader’s view of forex and other markets. In this article, we outline what market sentiment is, how it relates to forex trading, and what the top sentiment indicators are.

What is Market Sentiment?

Market sentiment defines how investors feel about a particular market or financial instrument. As traders, sentiment becomes more positive as general market consensus becomes more positive. Likewise, if market participants begin to have a negative attitude, sentiment can become negative.

As such, traders use sentiment analysis to define a market as bullish or bearish , with a bear market characterized by assets going down, and a bull market by prices going up. Traders can gauge market sentiment by using a range of tools such as sentiment indicators (see below), and by simply watching the movement of the markets, using the resulting information to make their decisions.

What is Sentiment Analysis in forex trading?

Sentiment analysis can be directly translated to currency pairs, even though it is not unique to the forex market. Contrarian investors will look for crowds to either buy or sell a specific currency pair, while waiting to take a position in the opposite direction of sentiment.

How Forex Sentiment Analysis Works

An example of how sentiment analysis can be applied in forex trading is a large single movement in GBP/USD in 2016, with negative sentiment sending GBP slumping to a 31-year low following Britain’s vote to leave the European Union. After broadly positive sentiment in the year that followed, negative sentiment then took over much of 2018 again before prices started to trend higher in 2019.

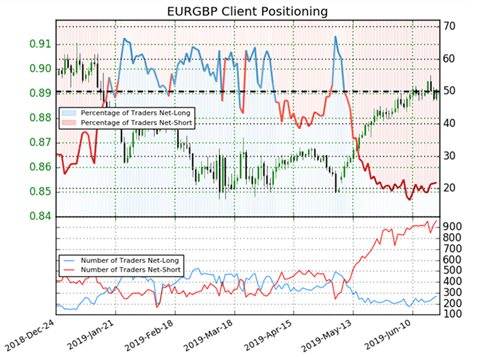

Another example of net short sentiment can be seen in the EUR/GBP chart below, with 21.9% of traders net-long with a ratio of traders short to long at 3.58 to 1. The chart shows in blue the percentage of IG traders taking a net long position, and in red the percentage taking a net short position.

Chart to show net negative sentiment alongside price action

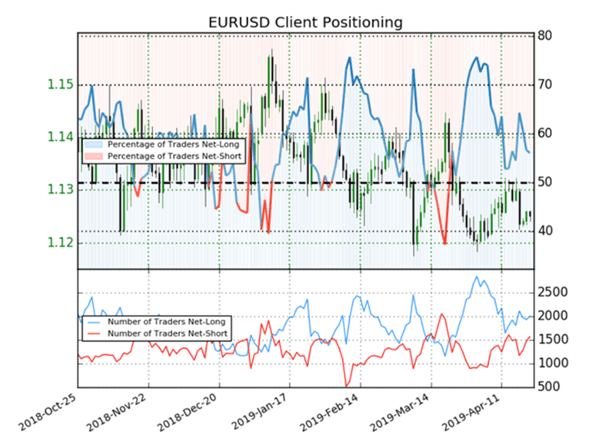

Rising sentiment may mean there are few traders left to keep pushing the trend up. In this case, traders may want to watch for a price reversal. On the other hand, a price moving lower, showing signals that it has topped may prompt a sentiment trader to enter short. The below chart shows an example of the EUR/USD pair experiencing net positive sentiment.

Chart to show net positive sentiment alongside price action

Using Sentiment Indicators

Sentiment indicators are numeric or graphic representations of how optimistic or pessimistic traders are about market conditions. This can refer to the percentage of trades that have taken a given position in a currency pair. For example, 70% of traders going long and 30% going short will simply mean 70% of traders are long on the currency pair.

The best sentiment indicators for forex traders include IG Client Sentiment (as seen in the charts above) and the Commitment of Traders (COT) Report.

IG Client Sentiment

IG Client Sentiment can be a useful tool to incorporate into your trading strategy. It can give a helpful picture of the number of long and short trades occurring in a particular market, giving an impression of the turning points in sentiment. For more on this indicator and how it can assist your trading, be sure to click the link above.

Commitments of Traders Report

The Commitment of Traders (COC) Report, published weekly by the Commodity Futures Trading Commission (CFTC), is compiled from submissions from traders in the commodities markets, giving a picture of the commitment of classified trading groups. The CFTC’s report is released every Friday at 15:30 Eastern Time and can be a useful market signal.

Read more on market sentiment

For more information on market sentiment, check out our piece How to Read Risk ‘OFF’ or Risk ‘ON’ Sentiment, understand the predictions of 2019 being a ‘Risk Off’ year, and don’t forget to refer to the aforementioned IG Client Sentiment for a full, up-to-date picture of who’s long and who’s short.

https://www.dailyfx.com/forex/education/trading_tips/daily_trading_lesson/2019/03/12/how-to-combine-fundamental-technical-analysis.htmlhttps://www.dailyfx.com/forex/education/trading_tips/daily_trading_lesson/2019/05/20/cot-report-forex-trading.html