Interactive Brokers bolsters capabilities of Futures Term Structure tool

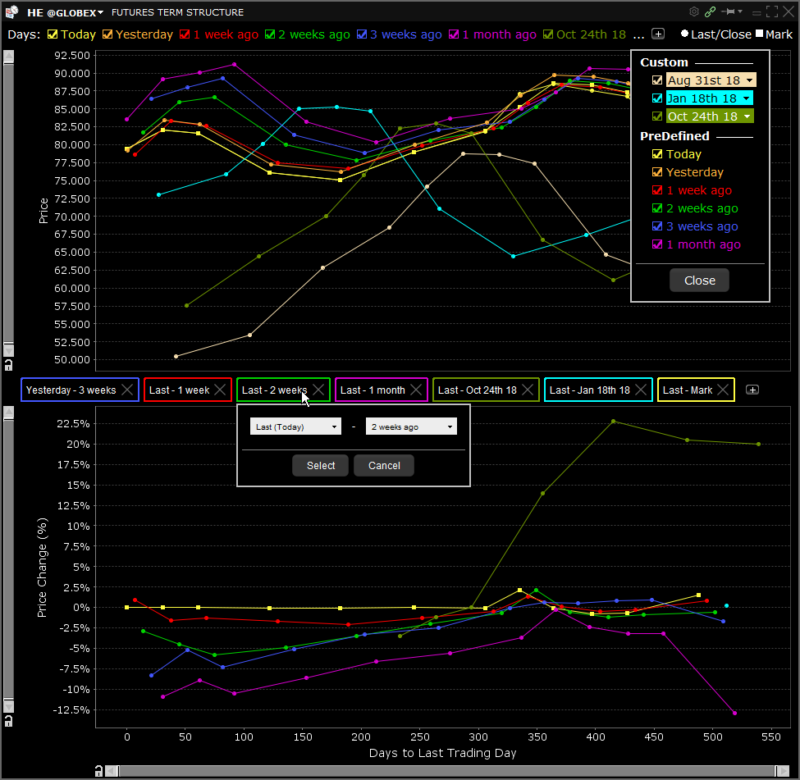

A new flexible series selector lets traders easily add, remove or modify what series are shown on the difference plot.

Online trading major Interactive Brokers Group, Inc. (IEX:IBKR) continues to enhance its TWS platform. The latest (beta) version of the platform further boosts the Futures Term Structure tool.

A new flexible series selector lets traders easily add, remove or modify what series are shown on the difference plot and how each is calculated with a single click in the displayed configuration panel. Between the Price and the Difference Plot traders can see labels for the currently selected difference definitions. Their border colors are the same as their difference series color. TWS updates the default series for the difference plot based on traders’ configuration as the traders add or remove dates to the price plot or change their configuration.

- Traders can change the difference series definition by clicking on the label. It will show a small popup where one can select the days (all the series that are selected for the Price Plot). Once a trader select the days pair it will change the currently selected definition to the new one (unless a trader selected a pair which is already selected, in this case it will just remove the edited definition).

- Traders can remove a definition and its series by clicking the X inside the color border.

- Traders can add a new definition by clicking on the + button and using the same popup as for the editing/changing.

- When a trader removes a date form the top check boxes it will remove all definitions that contained this date.

- When a trader selects a new date the window will generate the appropriate new definition depending on the configuration.

The definitions a trader specifies here will be kept for a newly opened Futures Term Structure window or when the trader selects a new future, even after the trader logs out and restarts TWS.

To access the Futures Term Structure tool, one has to select a futures contract and use the right-click menu to select Charts and then Term Structure.

The preceding version of TWS also enhanced the Futures Term Structure tool. For instance, the “Today Last Price” series have been added in the term structure plot. Further, the underlying/index price (when available) has been added as the first node in the series. Optionally, traders can also add values markers at the underlying/index price (when available) by selecting “Underlying” in the right-click context menu.