Business as usual: GKFX is NOT leaving UK

Following the temporary placement of a notice on GKFX UK’s site that sparked controversy, FinanceFeeds spoke to GKFX to clarify the firm’s direction

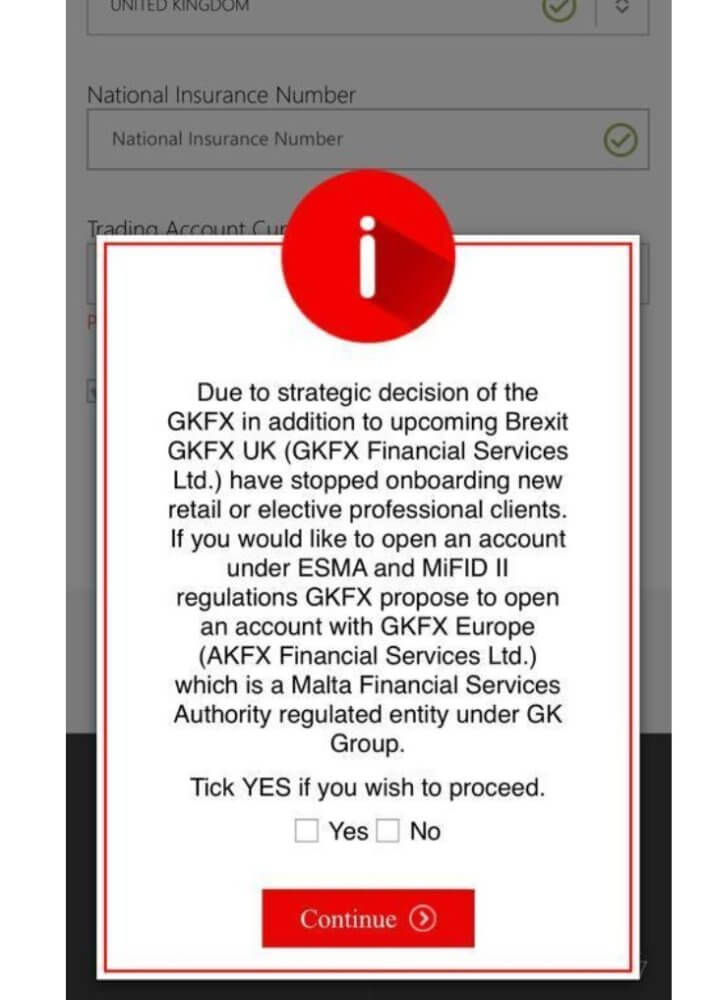

As last week drew to a close, speculation among industry participants in the UK began to mount that GKFX was preparing to onboard European clients via its Malta-based operations and cease to onboard new clients via its long-established British GKFX entity.

Yesterday, I made it clear that GKFX is a force to be reckoned with. It is a very large retail CFD and FX firm, which may well have its origins in strictly regulated Turkey, but has expanded across the United Kingdom, and perhaps more importantly, China.

GKFX is a massive market participant in China, and has been for several years. Many of my trips to the offices of medium sized introducing brokers (IBs) in second tier development cities across China has revealed longstanding and unshakable relationships with GKFX which was (until China began asking some of the bigger firms like FXCM to leave) the fourth largest international FX representative in China.

This notice was temporarily displayed on GKFX UK’s website

Chinese IBs and commercial partners trust GKFX very highly indeed, and an FCA license and London address goes a very long way in the esteem of Chinese commercial partners.

Thus, bearing this in mind, plus the company’s strong domestic market CFD trading client base which goes cheek by jowl with some of the world’s most renowned and evergreen names such as GAIN Capital and IG Group, there would be little reason for GKFX to leave the UK for any purpose.

The speculative candor came about due to a message that was displayed on GKFX UK’s website and was displayed to all British clients on Thursday last week, stating that GKFX was no longer accepting new clients opening new accounts at the British entity of the firm.

Within a very short time, this message was no longer displayed, and FinanceFeeds contacted GKFX UK CEO Rob Woolfe for clarification.

Mr Woolfe this morning spoke to FinanceFeeds, explaining “” As part of GKFX’s Brexit strategy, we are considering a number of options and this message that prematurely appeared on our website is one of several under consideration. The message was immediately removed from our websites and no clients were or are affected.”

Therefore, it is clear that the firm is indeed accepting new clients to its British entity and that it is operating absolutely as normal, thus no British clients need to open their accounts via the firm’s Malta entity.

When attempting to open a demo account from a UK IP address without a VPN (I am in the UK – ed) the site does not allow a demo or live account to be established, instead going in a loop which was not addressed by the firm during our conversation this morning. FinanceFeeds will provide further clarity when that point has been covered.

Mr Woolfe further explained that the UK entity was absolutely operating as normal, showing that most certainly companies in the electronic trading business are indeed looking at their options with regard to rationalizing their operations post-Brexit, however there is nothing to be too concerned about.