-

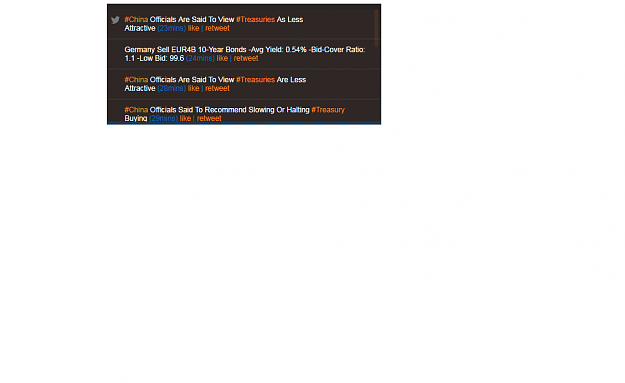

China Officials Said To Recommend Slowing Or Halting Treasury Buying

#China Officials Said To Recommend Slowing Or Halting #Treasury Buying

— LiveSquawk (@LiveSquawk) January 10, 2018

- Comments

- Comment

- Subscribe

- Comment #1

- Quote

- Jan 10, 2018 5:40am Jan 10, 2018 5:40am

- Guest

- | IP XXX.XXX.4.66

- Comment #2

- Quote

- Jan 10, 2018 5:45am Jan 10, 2018 5:45am

- XuMar

- | Joined Feb 2015 | Status: Member | 510 Comments

- Comment #3

- Quote

- Jan 10, 2018 5:45am Jan 10, 2018 5:45am

- Spec_And

- | Joined Oct 2013 | Status: Member | 186 Comments

"Where you want to be is always in control, never wishing, always trading.

- Comment #4

- Quote

- Jan 10, 2018 5:48am Jan 10, 2018 5:48am

- greendiesel

- | Joined Apr 2010 | Status: Member | 292 Comments

- Comment #5

- Quote

- Jan 10, 2018 5:48am Jan 10, 2018 5:48am

-

kingleeny

kingleeny - Joined Jul 2014 | Status: Member | 1479 Comments

- Comment #6

- Quote

- Jan 10, 2018 5:49am Jan 10, 2018 5:49am

-

kingleeny

kingleeny - Joined Jul 2014 | Status: Member | 1479 Comments

- Comment #7

- Quote

- Jan 10, 2018 5:51am Jan 10, 2018 5:51am

- greendiesel

- | Joined Apr 2010 | Status: Member | 292 Comments

- Comment #8

- Quote

- Jan 10, 2018 5:51am Jan 10, 2018 5:51am

-

mario.gharib

mario.gharib - | Joined May 2017 | Status: Junior Member | 2 Comments

- Comment #9

- Quote

- Jan 10, 2018 5:52am Jan 10, 2018 5:52am

- barkie

- | Joined Mar 2014 | Status: Member | 1647 Comments

- Comment #10

- Quote

- Jan 10, 2018 5:52am Jan 10, 2018 5:52am

-

JakubSzalaFX

JakubSzalaFX - Joined Jan 2016 | Status: Member | 633 Comments | Online Now

- Comment #11

- Quote

- Jan 10, 2018 5:53am Jan 10, 2018 5:53am

- XuMar

- | Joined Feb 2015 | Status: Member | 510 Comments

- Comment #12

- Quote

- Jan 10, 2018 6:00am Jan 10, 2018 6:00am

- Guest

- | IP XX.XXX.193.79

- Comment #13

- Quote

- Jan 10, 2018 6:06am Jan 10, 2018 6:06am

-

JakubSzalaFX

JakubSzalaFX - Joined Jan 2016 | Status: Member | 633 Comments | Online Now

- Comment #14

- Quote

- Jan 10, 2018 6:06am Jan 10, 2018 6:06am

-

Dingoman-two

Dingoman-two - Joined Aug 2017 | Status: Just a little Aussi Battler | 326 Comments

- Comment #15

- Quote

- Jan 10, 2018 6:07am Jan 10, 2018 6:07am

- greendiesel

- | Joined Apr 2010 | Status: Member | 292 Comments

- Comment #16

- Quote

- Jan 10, 2018 6:09am Jan 10, 2018 6:09am

-

Trainman

Trainman - | Joined Mar 2012 | Status: Member | 263 Comments

Sure I have a trading plan. Buy low. Sell high. What's yours?

- Comment #17

- Quote

- Jan 10, 2018 6:09am Jan 10, 2018 6:09am

-

jegas

jegas - Joined Oct 2011 | Status: Forex is an Unpredicatable Game.... | 1208 Comments

- Comment #18

- Quote

- Jan 10, 2018 6:10am Jan 10, 2018 6:10am

- thelws

- | Joined Nov 2008 | Status: Member | 128 Comments

- Comment #19

- Quote

- Jan 10, 2018 6:10am Jan 10, 2018 6:10am

-

copi88

copi88 - Joined Mar 2008 | Status: Lord of the Dance | 32 Comments | Online Now

Boxing clever since 76.

- Comment #20

- Quote

- Jan 10, 2018 6:11am Jan 10, 2018 6:11am

-

Dingoman-two

Dingoman-two - Joined Aug 2017 | Status: Just a little Aussi Battler | 326 Comments

- Comment #21

- Quote

- Jan 10, 2018 6:14am Jan 10, 2018 6:14am

- Spec_And

- | Joined Oct 2013 | Status: Member | 186 Comments

"Where you want to be is always in control, never wishing, always trading.

- Comment #22

- Quote

- Jan 10, 2018 6:16am Jan 10, 2018 6:16am

-

Tfh

Tfh - | Membership Revoked | Joined Jan 2018 | 1 Comment

The Earth is flat!

- Comment #23

- Quote

- Jan 10, 2018 6:17am Jan 10, 2018 6:17am

- Spec_And

- | Joined Oct 2013 | Status: Member | 186 Comments

"Where you want to be is always in control, never wishing, always trading.

- Comment #24

- Quote

- Jan 10, 2018 6:20am Jan 10, 2018 6:20am

-

Dingoman-two

Dingoman-two - Joined Aug 2017 | Status: Just a little Aussi Battler | 326 Comments

- Comment #25

- Quote

- Jan 10, 2018 6:20am Jan 10, 2018 6:20am

- slouw

- | Joined Apr 2013 | Status: Member | 3 Comments

- Comment #26

- Quote

- Edited 7:15am Jan 10, 2018 6:21am | Edited 7:15am

-

Ssggss

Ssggss - | Joined Dec 2017 | Status: Member | 9 Comments

- Comment #27

- Quote

- Jan 10, 2018 6:22am Jan 10, 2018 6:22am

- Spec_And

- | Joined Oct 2013 | Status: Member | 186 Comments

"Where you want to be is always in control, never wishing, always trading.

- Comment #28

- Quote

- Jan 10, 2018 6:26am Jan 10, 2018 6:26am

- slouw

- | Joined Apr 2013 | Status: Member | 3 Comments

- Comment #29

- Quote

- Jan 10, 2018 6:37am Jan 10, 2018 6:37am

- slouw

- | Joined Apr 2013 | Status: Member | 3 Comments

- Comment #30

- Quote

- Jan 10, 2018 6:38am Jan 10, 2018 6:38am

-

Tony112

Tony112 - Joined Apr 2008 | Status: sometimes... news come unexpected | 2514 Comments

Invest in alarm clocks

- Comment #31

- Quote

- Jan 10, 2018 6:45am Jan 10, 2018 6:45am

- wukatrades

- | Joined Jan 2017 | Status: Thinker | 50 Comments

- Comment #32

- Quote

- Jan 10, 2018 6:49am Jan 10, 2018 6:49am

-

maximinus

maximinus - | Joined May 2010 | Status: Non Member | 4 Comments

Don't be smart. Be rich.

- Comment #33

- Quote

- Jan 10, 2018 6:49am Jan 10, 2018 6:49am

-

jrdFX

jrdFX - | Joined Mar 2012 | Status: Member | 53 Comments

- Comment #34

- Quote

- Jan 10, 2018 6:53am Jan 10, 2018 6:53am

- XuMar

- | Joined Feb 2015 | Status: Member | 510 Comments

- Comment #35

- Quote

- Jan 10, 2018 6:55am Jan 10, 2018 6:55am

- Spec_And

- | Joined Oct 2013 | Status: Member | 186 Comments

"Where you want to be is always in control, never wishing, always trading.

- Comment #36

- Quote

- Edited 7:14am Jan 10, 2018 6:58am | Edited 7:14am

- bloodpoodle

- Joined Dec 2010 | Status: Member | 112 Comments

The only system that will work is one designed by and for yourself.

- Comment #37

- Quote

- Jan 10, 2018 7:11am Jan 10, 2018 7:11am

-

TarryFaster

TarryFaster - | Joined Jan 2013 | Status: Member | 17 Comments

- Comment #38

- Quote

- Jan 10, 2018 7:21am Jan 10, 2018 7:21am

- bloodpoodle

- Joined Dec 2010 | Status: Member | 112 Comments

The only system that will work is one designed by and for yourself.

- Comment #39

- Quote

- Jan 10, 2018 7:21am Jan 10, 2018 7:21am

- abelfxtrader

- | Joined Sep 2010 | Status: Member | 137 Comments

- Comment #40

- Quote

- Jan 10, 2018 7:33am Jan 10, 2018 7:33am

- JsouzaBR2015

- | Joined Jan 2018 | Status: Junior Member | 1 Comment

- Comment #41

- Quote

- Jan 10, 2018 8:13am Jan 10, 2018 8:13am

-

althar

althar - | Joined Apr 2011 | Status: Member | 478 Comments

- Comment #42

- Quote

- Jan 10, 2018 9:42am Jan 10, 2018 9:42am

-

Sansonit

Sansonit - | Joined Jan 2018 | Status: Member | 15 Comments

- Comment #43

- Quote

- Jan 10, 2018 9:46am Jan 10, 2018 9:46am

- Guest

- | IP XX.XXX.25.82

- Comment #44

- Quote

- Jan 10, 2018 9:47am Jan 10, 2018 9:47am

-

kenleander

kenleander - | Joined Aug 2010 | Status: Member | 707 Comments

- Comment #45

- Quote

- Jan 10, 2018 10:55am Jan 10, 2018 10:55am

- Guest

- | IP XXX.XXX.206.49

- Comment #46

- Quote

- Jan 10, 2018 2:58pm Jan 10, 2018 2:58pm

-

Quantum3

Quantum3 - | Joined Mar 2017 | Status: Member | 69 Comments

They wanna push you off the path with their frequency wires