- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

CFD trading

Trade CFDs on forex, commodities, indices, and more.

Open accountTo open a CFD trading account as a Company, Trust, or SMSF, apply here.

Share trading

Invest in shares and ETFs on the Australian share market.

Open accountOpen a Personal or Company/Trust/SMSF share trading account.

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- FX Analysis – GBP, EUR JPY, USD

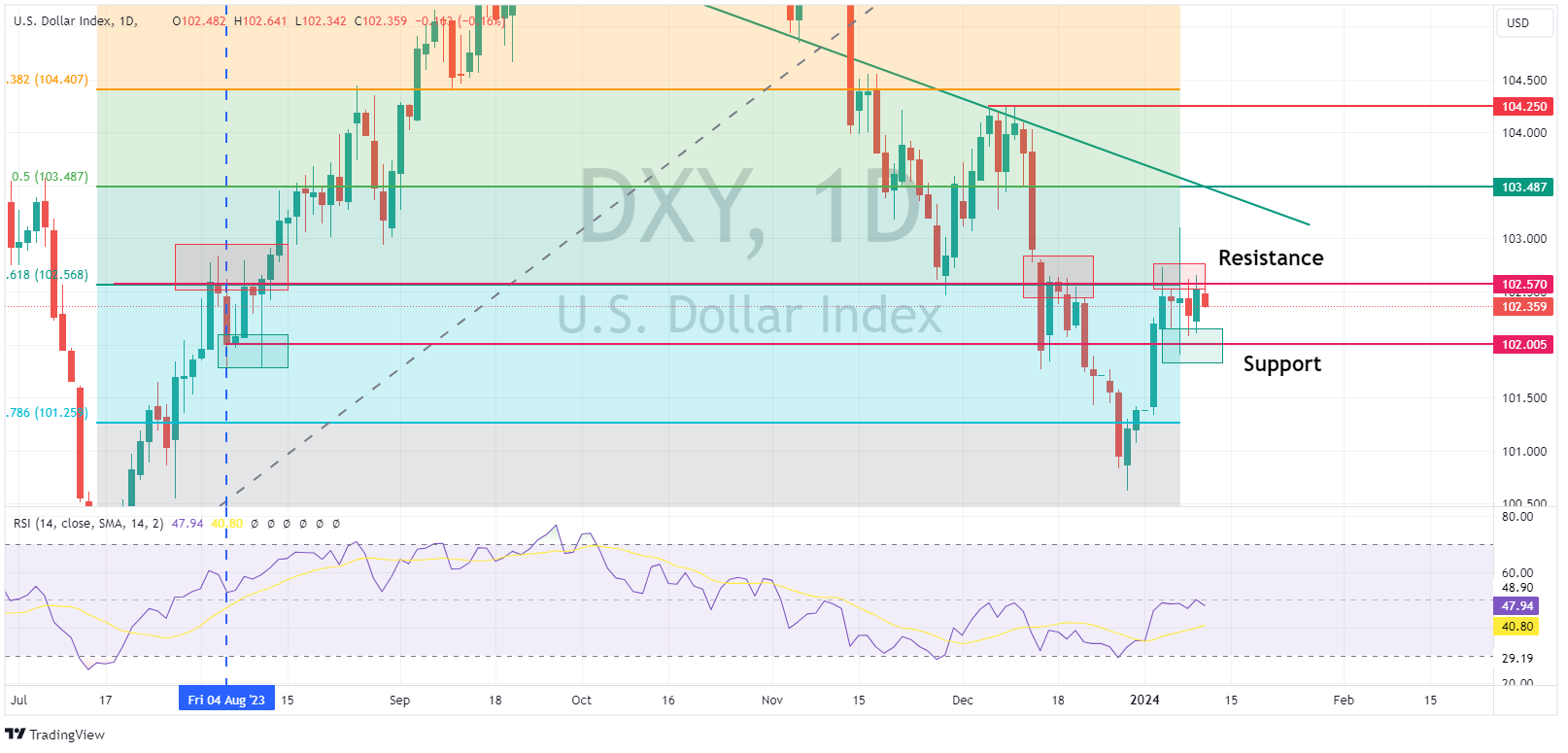

News & analysisUSD saw weakness in Wednesday’s session with a risk on equity market and only a marginal move higher in yields weighing on the Greenback ahead of today’s key US CPI report. There was little in the way of major US data releases but some hawkish leaning comments late in the session from the Fed’s Williams stemmed losses. The US Dollar Index (DXY) did make another attempt to breach the 102.57 resistance, but for the 5th time this year was again rejected, this will be a key level to watch over todays CPI report.

EUR moved higher with EURUSD heading into the APAC session at highs of around 1.0970. EUR was supported by comments from the ECB’s De Guindos who warned the rapid pace of disinflation seen in 2023 is likely to slow down in 2024 and Schnabel who said it is too early to discuss rate cuts.

JPY was the G10 underperformer after Japanese wage data came in much softer than expected, throwing cold water on expectations of the BOJ normalizing rates. USDJPY following the US10Y-JP10Y rate differential higher and breaching the psychological 145 level.

GBP also saw gains vs USD, taking advantage of a weaker USD and a risk-on session in equities. BoE Governor Bailey spoke in the UK session, pushing back on rate cut expectations while stressing the importance of returning inflation to target.

Ahead today the much-awaited US CPI report which will shape market expectations of the Feds next move and should get FX markets moving.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Market Analysis – Hot CPI whipsaws markets – USD, Gold, JPY, AUD

USD was ultimately flat in a choppy session on Thursday after hotter-than-expected US CPI data. The US Dollar Index (DXY) hitting briefly breeching the resistance at 102.63 to hit a high of 102.76. This proved to be another false breakout of this level with DXY gradually retracing for the rest of the session to unchanged levels. JPY outperfo...

January 12, 2024Read More >Previous Article

Shares by GO Markets launches in Australia

Award-winning online broker, GO Markets Pty Ltd (GO Markets), is making it easier to trade the ASX with a new and improved platform launched this week...

January 10, 2024Read More >Please share your location to continue.

Check our help guide for more info.