Technical Analysis – Could EURGBP bulls keep the rebound alive?

EURGBP edges higher after weaker UK CPI

Path higher filled with strong resistance points

Momentum indicators are mostly bullish

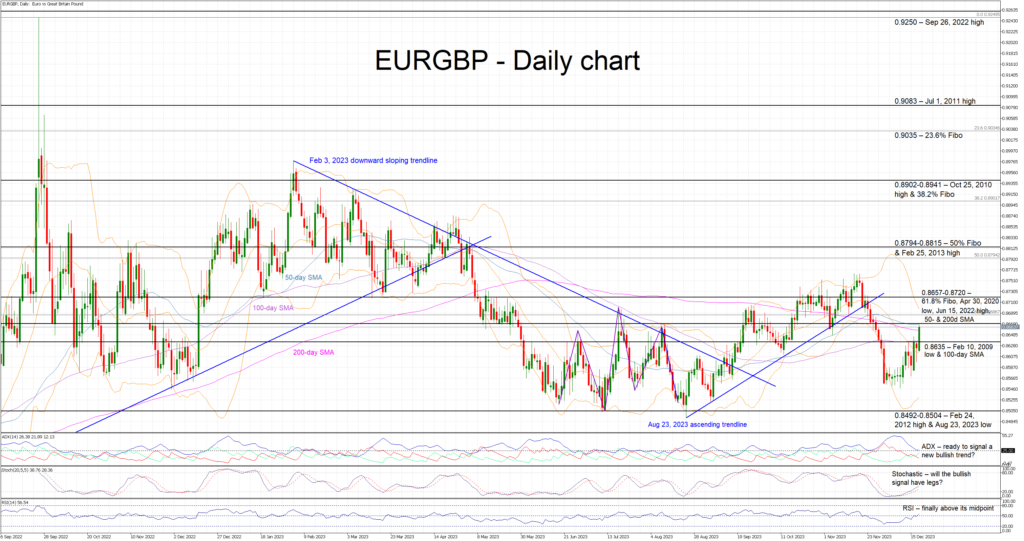

EURGBP is trading higher today after the downside surprise registered by the UK inflation report. The 0.8635 level was easily surpassed with the EURGBP bulls now preparing to test the resistance set by the 0.8657-0.8720 area. They are just halfway to recovering the losses incurred during the November 20-December 1 correction.

In the meantime, the momentum indicators appear supportive of the current upleg. The Average Directional Movement Index (ADX) remains a tad above its 25-threshold, confirming the increasing bullish pressure in the market. Similarly, the RSI has finally managed to return back above its 50-midpoint. More importantly, the stochastic oscillator is edging higher, above its oversold territory, and building a good gap from its moving average.

Should the bulls feel confident, they could first try to push EURGBP above the very busy 0.8657-0.8720 area. This is populated by the 61.8% Fibonacci retracement of the August 4, 2022 – September 26, 2022 uptrend, the June 15, 2022 high and the 50- and 200-day simple moving averages (SMAs). If successful in overcoming this key region, the bulls could have the chance to stage a move above the recent peak of 0.8765 and record a new 7-month high.

On the flip side, the bears appear determined to defend the busy 0.8657-0.8720 area and protect their recent hard-earned gains. They could then try to push EURGBP back below the 0.8635 level defined by the February 10, 2009 low and the 100-day SMA. Even lower, the path appears to be unhindered until the 0.8492-0.8504 area.

To sum up, with some support from the momentum indicators, EURGBP bulls are trying to keep the current upleg intact. However, their true drive could be tested at the busy 0.8657-0.8720 area.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.