Markets

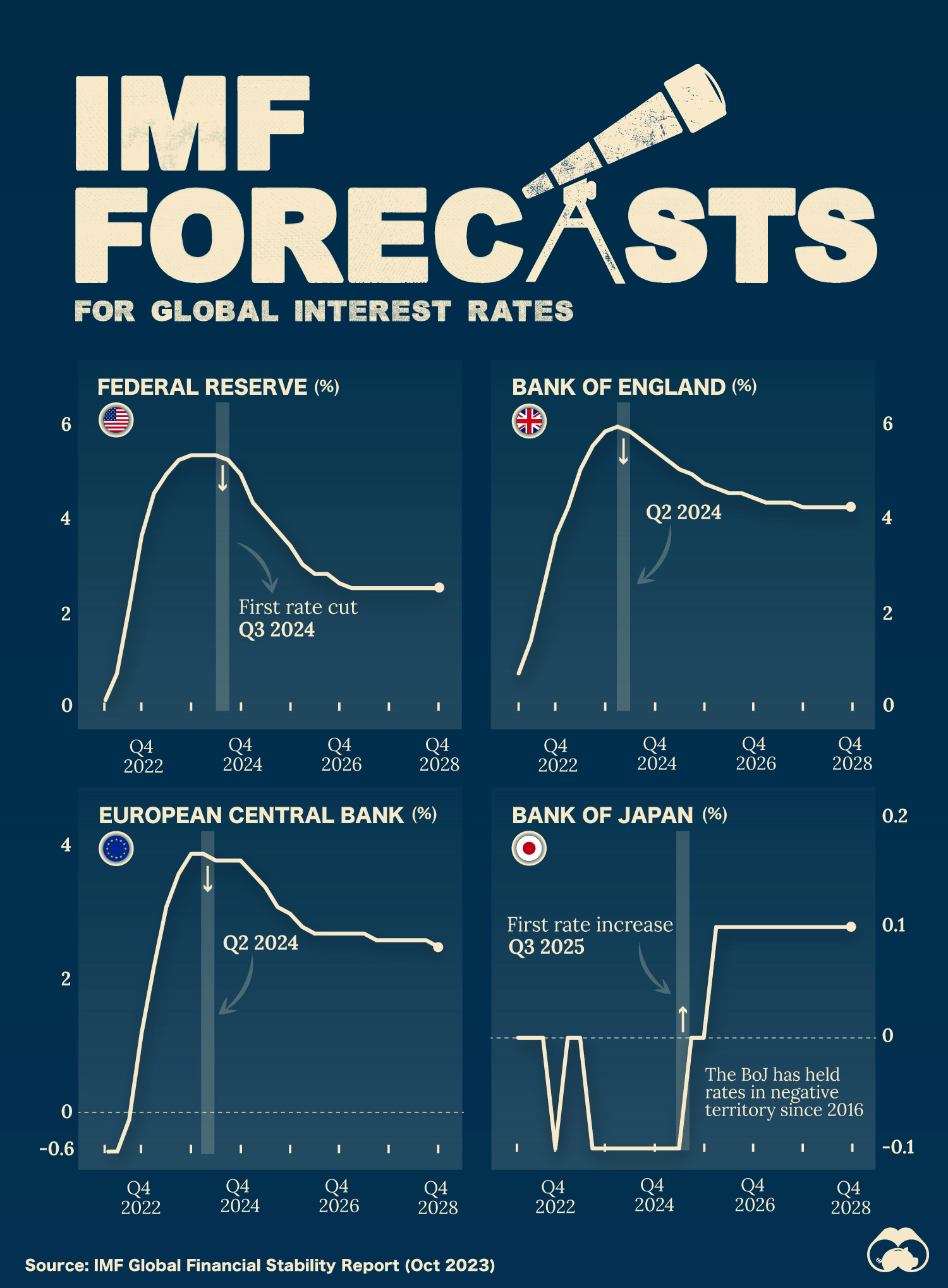

Charted: IMF Forecasts for International Interest Rates

Charted: IMF Forecasts for International Interest Rates

With inflation impacting markets and international interest rates for more than a year, how are different central banks expected to act in the future?

Although the outlook on inflation remains uncertain, the International Monetary Fund (IMF) expects most advanced economies to begin gradually easing interest rates by mid-2024.

These charts show the IMF’s projected central bank policy rates for four major economies through 2028, using the World Economic Outlook forecast data as of October 2023.

Interest Rates Forecasts for 4 Major Economies (2024‒2028)

Since 2022, interest rates have climbed in the EU, the UK, and the U.S. by at least 4 percentage points.

In 2023, rates have continued to climb at a slower pace and are expected to peak at the start of 2024. The U.S. Federal Reserve, for example, is expected to see interest rates peak around 5.4% before beginning to implement rate cuts in Q3 2024.

| Fiscal Quarter | 🇺🇸 U.S. | 🇪🇺 EU | 🇯🇵 Japan | 🇬🇧 UK |

|---|---|---|---|---|

| 2022Q1 | 0.2% | -0.6% | 0.0% | 0.8% |

| 2022Q2 | 0.8% | -0.6% | 0.0% | 1.5% |

| 2022Q3 | 2.2% | -0.1% | 0.0% | 2.6% |

| 2022Q4 | 3.7% | 1.2% | -0.1% | 3.7% |

| 2023Q1 | 4.6% | 2.2% | 0.0% | 4.3% |

| 2023Q2 | 5.0% | 3.1% | 0.0% | 5.1% |

| 2023Q3 | 5.3% | 3.6% | -0.1% | 5.6% |

| 2023Q4 | 5.4% | 3.9% | -0.1% | 5.9% |

| 2024Q1 | 5.4% | 3.9% | -0.1% | 6.0% |

| 2024Q2 | 5.4% | 3.8% | -0.1% | 5.9% |

| 2024Q3 | 5.3% | 3.8% | -0.1% | 5.7% |

| 2024Q4 | 5.0% | 3.8% | -0.1% | 5.5% |

| 2025Q1 | 4.4% | 3.6% | -0.1% | 5.3% |

| 2025Q2 | 4.1% | 3.4% | -0.1% | 5.1% |

| 2025Q3 | 3.8% | 3.1% | 0.0% | 5.0% |

| 2025Q4 | 3.5% | 3.0% | 0.0% | 4.8% |

| 2026Q1 | 3.1% | 2.8% | 0.1% | 4.7% |

| 2026Q2 | 2.9% | 2.7% | 0.1% | 4.6% |

| 2026Q3 | 2.9% | 2.7% | 0.1% | 4.6% |

| 2026Q4 | 2.7% | 2.7% | 0.1% | 4.5% |

| 2027Q1 | 2.6% | 2.7% | 0.1% | 4.4% |

| 2027Q2 | 2.6% | 2.7% | 0.1% | 4.4% |

| 2027Q3 | 2.6% | 2.6% | 0.1% | 4.4% |

| 2027Q4 | 2.6% | 2.6% | 0.1% | 4.3% |

| 2028Q1 | 2.6% | 2.6% | 0.1% | 4.3% |

| 2028Q2 | 2.6% | 2.6% | 0.1% | 4.3% |

| 2028Q3 | 2.6% | 2.6% | 0.1% | 4.3% |

| 2028Q4 | 2.6% | 2.5% | 0.1% | 4.3% |

On the other hand, Japan has held interest rates at 0% or slightly lower since 2016.

Despite the Japanese yen falling and inflation (and prices) in the country continuing to climb, the Japanese economy as a whole has struggled over the past few decades with weak consumer demand. There are worries that raising interest rates will make economic recovery tougher in the long run.

And as other central banks plan to start cutting rates, Japan is poised to do the opposite. In 2025, the country is forecasted by the IMF to see its first positive interest rates in nine years.

It’s important to remember that future rate cuts will largely depend on whether inflation in countries continues to decelerate. Major developments, such as the Israel-Hamas war, can also disrupt global markets and force central banks to change course.

Markets

Which Retailers Operate in the Most Countries?

From fast-fashion giant H&M to Apple, we show the top retailers globally with the largest international presence.

The Top Retailers Operating in the Most Countries

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Today, international expansion is a key growth strategy for the world’s top retailers as companies target untapped markets with the highest potential to drive revenue and profit streams.

While traditional retailers have sought out digital strategies as the industry evolves and consumer behaviors change, physical storefronts continue to be a dominant driver of retail sales. In 2023, brick-and-mortar sales comprised 81% of retail sales globally.

This graphic shows the top retailers operating in the most markets worldwide, based on data from the National Retail Federation.

Global Retailers With the Largest International Footprint

Here are the global retailers with the widest-reaching presence around the world in 2023:

| Ranking | Retailer | Number of Countries of First-Party Operation | Headquarters |

|---|---|---|---|

| 1 | H&M | 68 | 🇸🇪 Sweden |

| 2 | IKEA | 51 | 🇳🇱 Netherlands |

| 3 | Inditex | 45 | 🇪🇸 Spain |

| 4 | Decathlon | 34 | 🇫🇷 France |

| 5 | Carrefour | 32 | 🇫🇷 France |

| 6 | Sephora (LVMH) | 31 | 🇫🇷 France |

| 7 | Schwarz Group | 30 | 🇩🇪 Germany |

| 8 | Fast Retailing | 27 | 🇯🇵 Japan |

| 9 | Euronics International | 25 | 🇳🇱 Netherlands |

| 10 | Apple | 25 | 🇺🇸 U.S. |

Notably, eight of the top 10 companies with the widest market reach hail from Europe.

Fast-fashion giant H&M ranks first overall, with 4,454 stores across 68 countries last year. In 2023, the Swedish company earned $21.6 billion in revenues, with its largest markets by number of store locations being the U.S., Germany, and the UK. This year, it plans to open 100 new stores in growth markets, along with shutting down 160 stores in established locations, ultimately decreasing its global store count.

In second is IKEA, with a presence in 51 countries. Last year, the company expanded its footprint in India, launching its first store in the tech hub, Hyderabad. While the company has a broad international reach, its number of storefronts is a fraction of H&M, at 477 total stores worldwide.

Looking beyond the continent, Japan’s Fast Retailing is the top retailer in Asia, operating in 27 countries globally. As the parent company to fashion brand Uniqlo, it also stands as the seventh most valuable listed firm by market capitalization in the country.

Additionally, Apple is the sole American company to make this list, with storefronts in 25 countries. Overall, the company operates four types of retail stores: regular, AppleStore+, flagships, and flagship+. Regular stores often earn $40 million annually, while flagship+ stores typically earn more than $100 million.

By 2027, the company plans to build or remodel 53 stores globally, with the majority located in the U.S. and China.

-

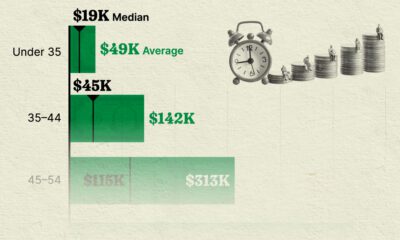

Money1 week ago

Money1 week agoVisualizing America’s Average Retirement Savings, by Age

-

Economy2 weeks ago

Economy2 weeks agoVisualizing the Tax Burden of Every U.S. State

-

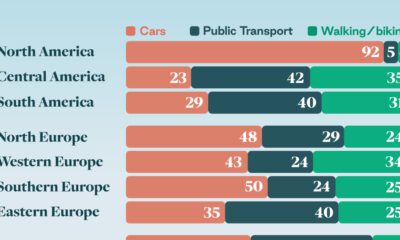

Automotive2 weeks ago

Automotive2 weeks agoHow People Get Around in America, Europe, and Asia

-

Economy2 weeks ago

Economy2 weeks agoMapped: Southeast Asia’s GDP Per Capita, by Country

-

Demographics2 weeks ago

Demographics2 weeks agoMapped: U.S. Immigrants by Region

-

Healthcare2 weeks ago

Healthcare2 weeks agoWhich Countries Have the Highest Infant Mortality Rates?

-

Misc2 weeks ago

Misc2 weeks agoCharted: How Americans Feel About Federal Government Agencies

-

Mining2 weeks ago

Mining2 weeks agoVisualizing Copper Production by Country in 2023