RBA in Focus

AUDUSD is holding just below the .6681 resistance level on Monday, as traders look ahead to the coming RBA rate decision tonight. While the bank is expected to keep rates on hold again this month, traders will be closely monitoring the statement for clues as to whether the bank is likely to tighten again this cycle or if the focus is shifting towards anticipating monetary easing.

RBA Saw Further Tightening in November

The minutes of the November meeting showed that members broadly agreed that there would likely be further increases in coming months, given the current path of inflation. With that in mind, the focus is likely to remain on the inflation outlook this meeting with the bank to signal further rate hikes should inflation prove sticky or show any fresh upside. However, if inflation continues to fall to target, this should keep RBA tightening expectations muted.

Market Impact

Ultimately, if the market gets a sense that there is still a real risk of further tightening this should help drive AUDUSD higher here, given the dovish Fed expectations which have taken hold over recent weeks. However, if the bank is seen downplaying the likelihood of further tightening, AUD is likely to weaken a little near-term ahead of Friday’s US jobs data which will be make or break for the pair.

Technical Views

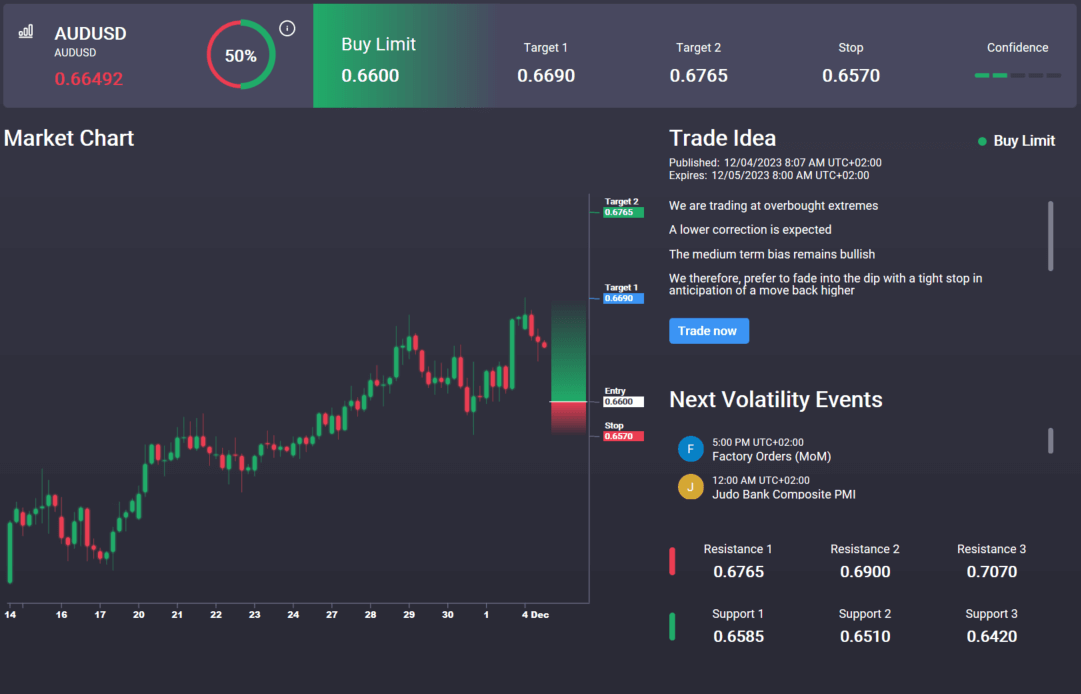

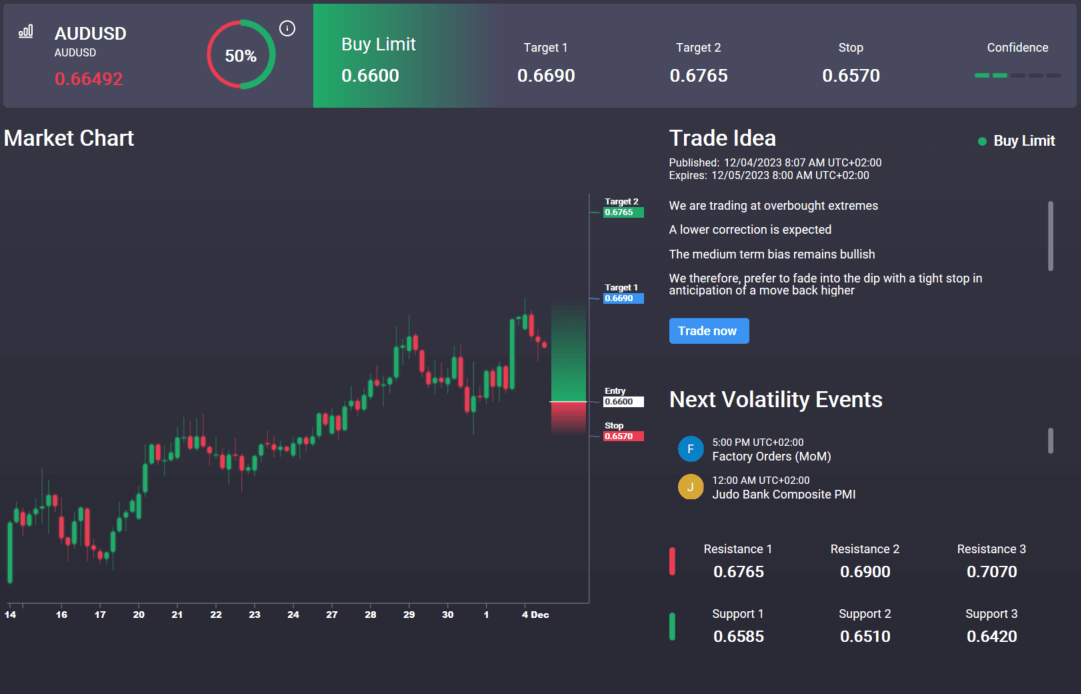

AUDUSD

The rally in AUDUSD has seen the pair attempting to breakout above the bear channel highs. However, for now, the move has stalled into the .6681 level resistance. With momentum studies bullish, the focus stays on further upside while .6520 holds below as support with .6857 the next target for bulls. Notably, in the Signal Centre today we have a bullish signal set below market at .6600 suggesting a preference to buy dips from current levels.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.