- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & Analysis

- Forex

- FX Analysis – Falling Yields Pressure USD, the Key Levels to Watch.

- Home

- News & Analysis

- Forex

- FX Analysis – Falling Yields Pressure USD, the Key Levels to Watch.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – Falling Yields Pressure USD, the Key Levels to Watch.

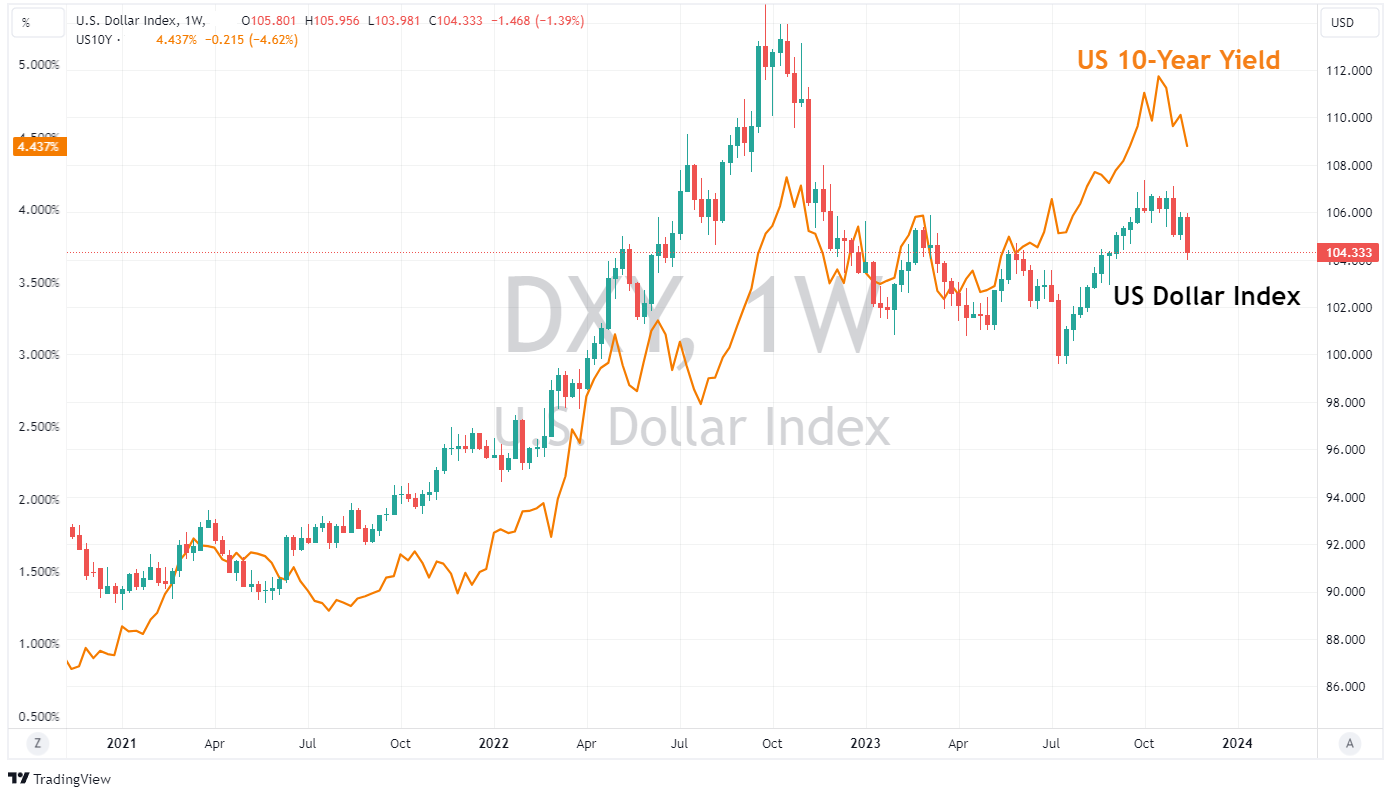

17 November 2023 By Lachlan MeakinRecent US figures have seen a rout in treasury yields with the flagship 10-year now yielding 4.435% after starting November at 16-year highs north of 5% and in a seemingly unstoppable uptrend. A cooler CPI and PPI showing inflation is decelerating at a faster pace than the market anticipated, along with weaker employment and industrial production figures have traders re-adjusting for a less hawkish Fed and bringing their timing forward for the pricing in of rate cuts.

Why this is important to serious FX traders is because rates and FX have a high correlation, even more in the post pandemic period of cuts, hikes and peak rates and maybe cuts again, big FX traders look for yield and that can be used as important information for smaller players to position themselves to take advantage of that. An example of this relationship can be seen on the weekly chart of the US Dollar index below.

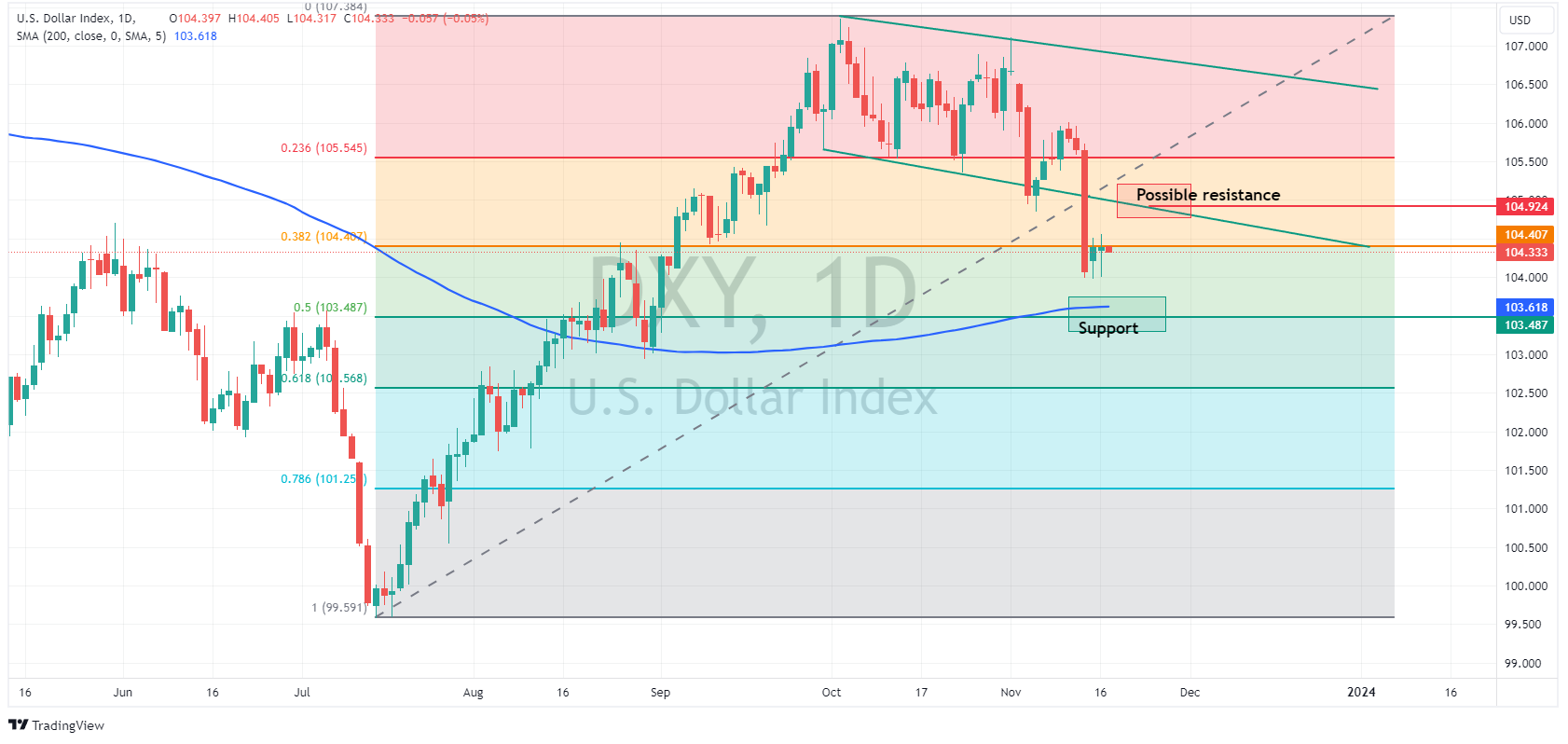

The US dollar Index has fallen 2.5% so far in November, a move first started with the big miss in NFP which saw support at the 23.6 Fib level broken, then accelerating this week on a Cooler CPI which saw it take out the 38.2 Fib level support which the price is currently hovering around at 104.41.

This along with the situation in yields will be the level to watch in the short term, if yield and dollar bulls take charge a break and support hold could see USDollar first test the lower trend line resistance, with the next stop from a technical point of view being the 23.6 Fib level resistance at 105.545. To the downside if yields continue their fall the next technical support will be the 50% fib level, paired with the 200-day moving average.

Next week there are a few important data points with FOMC minutes, consumer sentiment and manufacturing figures all scheduled. For FX traders they will be worth watching for any further clues as to yields and where traders think they will go as they work to front run the Fed.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The Week Ahead – Charts to watch , AUDUSD, Dow, Gold

Last week price action hammered home the narrative that markets are still dancing to the tune of the Fed, with a broad rally in equities and a fall in yields and the USD being kickstarted by a cooler than expected US CPI figure and accelerating on further weak US economic data. We are looking for a quieter week ahead after the recent big swings,...

November 20, 2023Read More >Previous Article

Walmart earnings results announced

The world’s largest supermarket chain Walmart Inc. (NYSE: WMT) released third quarter earnings results before the market opened in the US on Thursda...

November 17, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.

- Trading