USDJPY Testing Highs

USDJPY is pushing higher today ahead of keenly awaited comments from Fed chairman Powell. Giving the introductory speech yesterday at a Research and Statistics conference, traders were left empty handed with no mention of the economy or monetary policy. Today, however, the market is braced for more topical commentary from Powell with the Fed chief’s outlook on Fed monetary policy the key focus.

Powell on Watch

It's been a tricky time for USD in recent weeks. The drop in October employment data made a strong case against further tightening before year end, leading USD lower. However, subsequent hawkish remarks from some Fed members have kept bulls’ USD dream alive. Traders will now be keen to hear how Powell feels about the prospect of further tightening, particularly against the recent drop in US yields, which creates more scope for the bank to hike again.

BOJ To Maintain Easing

If Powell’s comments today are seen as hawkish, USDJPY is a good candidate for longs. Speaking earlier today, BOJ governor Ueda warned that the bank would maintain its policy of negative rates and yield curve control until inflation is sustainably at the bank’s 2% target, keeping pressure on JPY for now.

Technical Views

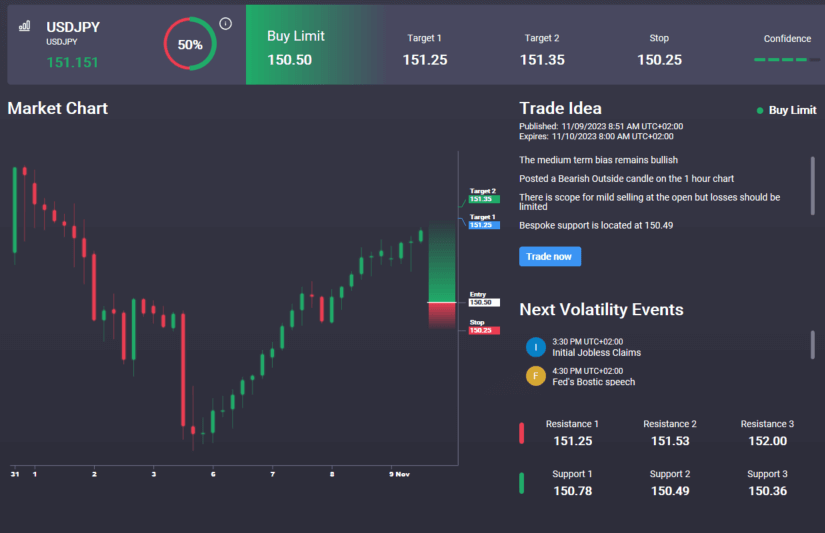

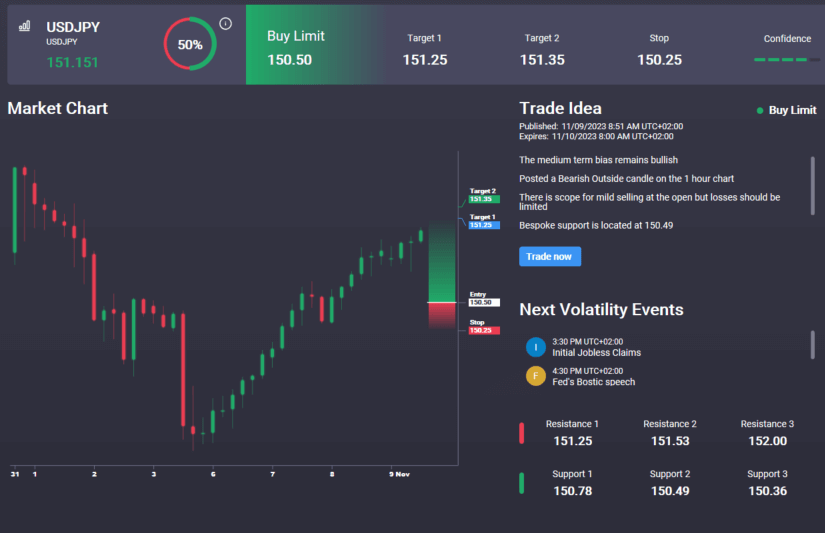

USDJPY

The rally in USDJPY has stalled for now into the 151.81 2022 highs. However, with dips finding solid demand the focus remains on further upside and an eventual breakout towards the October ,87 highs around 153.63. To the downside, if we correct lower, 148.98 is the next support ahead of 145 which is the main support to note. Notably, we have a buy signal in the Signal Centre today set below market at 150.50 suggesting a preference to buy dips from current levels.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.