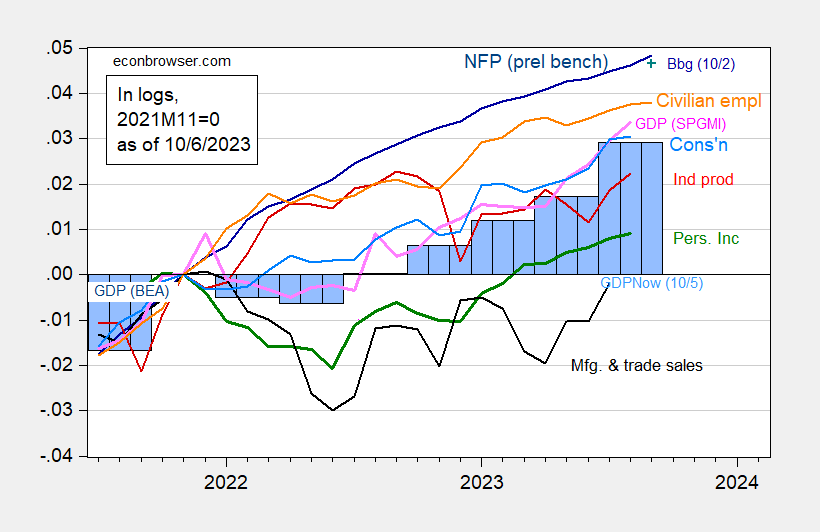

With September employment reported today (336K vs. 170K Bloomberg consensus), we have the following picture of the economy.

Figure 1: Nonfarm Payroll employment incorporating preliminary benchmark (dark blue), implied September NFP incorporating Bloomberg 10/2 consensus (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2017$ (green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, BLS preliminary benchmark, Federal Reserve, BEA 2023Q2 second release via FRED, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (10/2/2023 release), Atlanta Fed (10/5/2023 release), and author’s calculations.

Figure 1 shows nonfarm payroll employment incorporating the preliminary benchmark which revised downward March 2023 employment by 306,000. Figure 2 shows the official series (tan) compared to alternative measures of nonfarm payroll employment.

Figure 2: Nonfarm payroll employment (tan), NFP employment incorporating preliminary benchmark calculated by author (bold blue), Philadelphia Fed early benchmark (green), household employment adjusted to conform to NFP concept (light blue), and QCEW covered employment adjusted by Census X-13 by author (red), all in thousands, seasonally adjusted. Source: BLS via FRED, Philadelphia Fed, BLS, BLS-QCEW, and author’s calculations.

The household series adjusted to NFP concept looks a little softer than the CES series. However, this is a reflection in part of the softer reading from the CPS survey (see Figure 1, orange line).

Still no recession apparent as of 2023M09, although these data are going to be revised, so no assurances.

Kevin Drum covers how the press treated this as bad news:

https://jabberwocking.com/economic-reporting-is-not-biased-against-liberals/

Well forget what Kevin concluded and just look at those headlines. Interest rates may rise? Oh no! Stock prices may suffer? The end of the world as we know.t.

No the press cannot bring itself to admit the job market remains strong. And BTW full employment is a Communist plot.

Comments to the prior post referenced the relative steepening (reduced flattening) of the 2s/10s spread. Something to do with recession odds.

Note that the curve was in transition from inversion to steepening before recession began:

https://fred.stlouisfed.org/graph/?g=19ODF

So, if the curve is working as it historically has as a predictor of recession, the current signal is that recession is near at hand.

Ducky wonders: “Something to do with recession odds.”

Ducky making things up again, putting words in people’s mouths (as is his won’t.) recession odds were not mentioned.

Pot calling kettle black.

This is his entire comment:

;Macroduck

October 6, 2023 at 10:03 am

Again, no. Is this your new favorite misunderstanding? I don’t think you need a new one. You have so many already.

I take your new mistake to mean “Well I wanted the U.S. to have a recession, but if I can’t have that, I’ll find something else to suggest there’s some kind of problem.”;

Sounds right to me. But leave to little Jonny boy to misrepresent this too!

This is so cute! Johnny trying so hard to be a big boy, using fancy words and getting them wrong!

Not “won’t”, Johnny.

Also, not my ‘wont’. This is just another case of you, having been caught in some dishonest behavior or some error, attributing dishonesty or error to others. Johnny does this all the time.

You have accused pgl, a crusader against corporate transfer pricing, of supporting corporporate interests. You claimed that I am affiliated with financial firms on no evidence (nice weasel word, “affiliated”) and that I’m affluent, on no evidence. You have repeatedly claimed to have knowledge in economics which you don’t have, and then claim the real economists are ignorant of economics.

Johnny, allow me to counsel you – and keep in mind, this is not new territory. Johnny, you aren’t serving your masters well. I know that the book of tricks you’ve trained on tells you to raise doubts about people who challenge your assertions, but being silly about it can’t be all that useful. You aren’t well versed in economics and it shows. You aren’t well versed in international relations and it shows. You are paid to spread propaganda and don’t seem to be much better at that than at economics. You’re giving your masters poor value for money, Johnny. Shape up.

“You are paid to spread propaganda”

He spreads it but pray tell who would waste their money paying this clown?

https://www.msn.com/en-us/money/markets/larry-kudlow-here-s-a-warning-on-the-economy/ar-AA1hOweZ?ocid=msedgdhp&pc=U531&cvid=e0b057d6eca2443cb91ec12ea9ba3bff&ei=5

I predicted it – Kudlow claims employment growth was weak last month. Household survey, the Princeton Steve multiple job holders trick, and all the rightwing tricks combined. Kudlow even says Biden is the one who is lying. No Larry – that would be you that is lying.

I hope the employment numbers are correct. I hope my eyes are lying, about my girl in the bed I see right now, with another guy…… ALL those homeless people, and “surplus jobs”. The homeless love starving and wandering the streets. Economists told me so. It was in a graph. I don’t want to get to “anecdotal” IN FRONT OF MY OWN EYES kind of cheap rate thinking here. Summers and Lucas family forgive me