Money

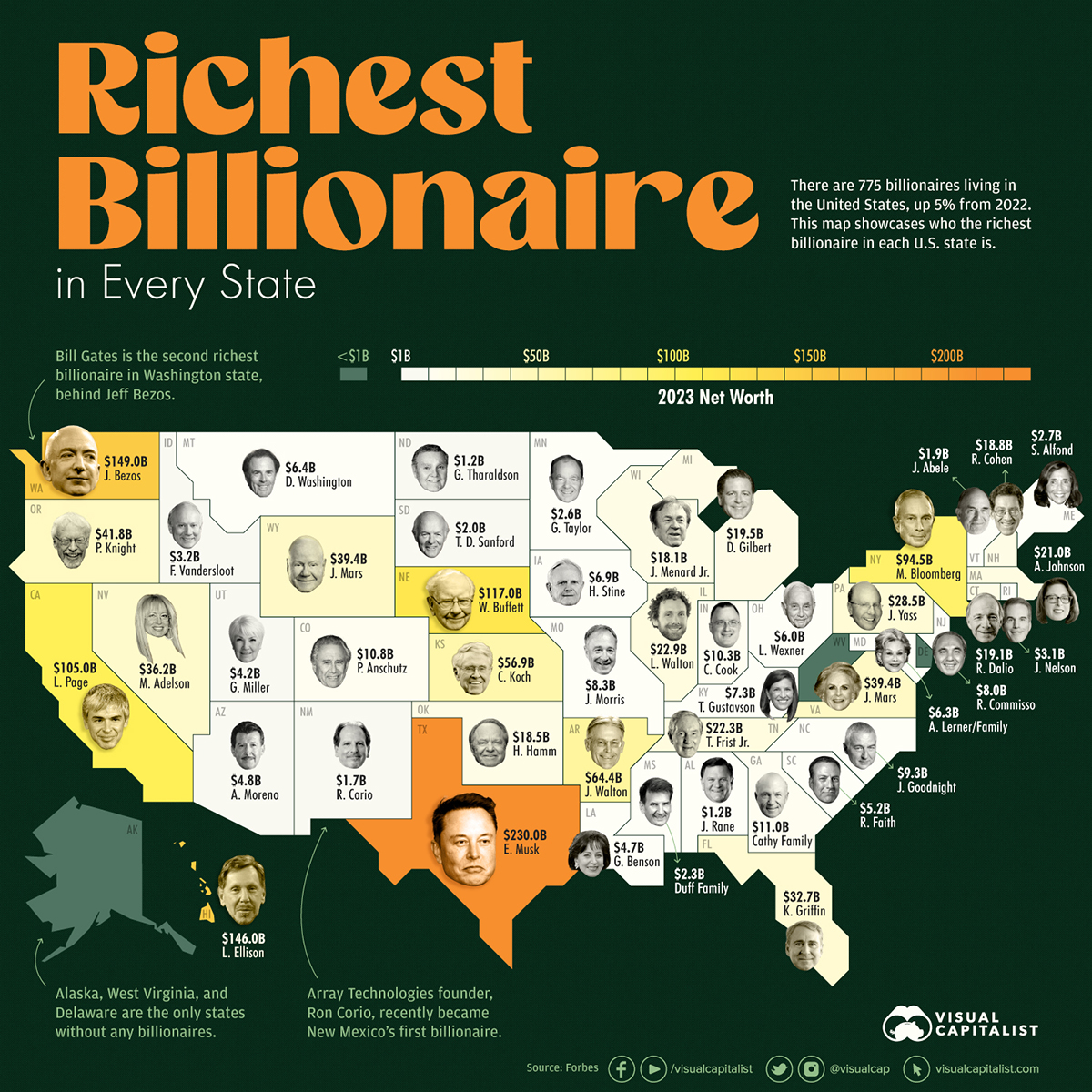

Mapped: The Richest Billionaires in U.S. States

Mapped: The Richest Billionaires in Every U.S. State

The number of billionaires in the U.S. increased 5% compared to last year, going from 720 super wealthy individuals to 775. The richest of the rich are concentrated in states like Texas, California, and New York, but there is almost one billionaire in every single state.

This map uses data from Forbes to showcase the wealthiest billionaire in each state.

The State-by-State Breakdown

According to Forbes, just four states are home to 61% of the country’s billionaires: California (179), New York (130), Florida (92), and Texas (73).

Here’s a closer look at the data on who takes the title of the richest in each state:

| Name | State | Residence | Net Worth (Est.) | Source of Wealth |

|---|---|---|---|---|

| Jimmy Rane | Alabama | Abbeville | $1.2 B | Lumber |

| Arturo Moreno | Arizona | Phoenix | $4.8 B | Billboards, Los Angeles Angels |

| Jim Walton | Arkansas | Bentonville | $64.4 B | Walmart |

| Larry Page | California | Palo Alto | $105.0 B | |

| Philip Anschutz | Colorado | Denver | $10.8 B | Energy, sports, entertainment |

| Ray Dalio | Connecticut | Greenwich | $19.1 B | Hedge funds |

| Ken Griffin | Florida | Miami | $32.7 B | Hedge funds |

| Dan Cathy, Bubba Cathy, and Trudy Cathy White | Georgia | Atlanta | $11.0 B | Chick-fil-A |

| Larry Ellison | Hawaii | Lanai | $146.0 B | Oracle |

| Frank VanderSloot | Idaho | Idaho Falls | $3.2 B | Nutrition, wellness products |

| Lukas Walton | Illinois | Chicago | $22.9 B | Walmart |

| Carl Cook | Indiana | Bloomington | $10.3 B | Medical devices |

| Harry Stine | Iowa | Adel | $6.9 B | Agriculture |

| Charles Koch | Kansas | Wichitia | $56.9 B | Koch Industries |

| Tamara Gustavson | Kentucky | Lexington | $7.3 B | Self storage |

| Gayle Benson | Louisiana | New Orleans | $4.7 B | New Orleans Saints |

| Susan Alfond | Maine | Scarborough | $2.7 B | Shoes |

| Annette Lerner & family | Maryland | Chevy Chase | $6.3 B | Real Estate |

| Abigail Johnson | Massachusetts | Milton | $21.0 B | Fidelity |

| Daniel Gilbert | Michigan | Franklin | $19.5 B | Quicken Loans |

| Glen Taylor | Minnesota | Mankato | $2.6 B | Printing |

| Thomas Duff & James Duff | Mississippi | Hattiesburg | $2.3 B | Tires, diversified |

| John Morris | Missouri | Springfield | $8.3 B | Sporting goods retail |

| Dennis Washington | Montana | Missoula | $6.4 B | Construction, mining |

| Warren Buffet | Nebraska | Omaha | $117.0 B | Berkshire Hathaway |

| Mirian Adelson & family | Nevada | Las Vegas | $36.2 B | Casinos |

| Rick Cohen & family | New Hampshire | Keene | $18.8 B | Warehouse automation |

| Rocco Commisso | New Jersey | Saddle River | $8.0 B | Telecom |

| Ron Corio | New Mexico | Albuquerque | $1.7 B | Solar |

| Michael Bloomberg | New York | New York City | $94.5 B | Bloomberg LP |

| James Goodnight | North Carolina | Cary | $9.3 B | Software |

| Gary Tharaldson | North Dakota | Fargo | $1.2 B | Hotels |

| Lex Wexner & family | Ohio | New Albany | $6.0 B | Retail |

| Harold Hamm & family | Oklahoma | Oklahoma City | $18.5 B | Oil & gas |

| Phil Knight & family | Oregon | Hillsboro | $41.8 B | Nike |

| Jeff Yass | Pennsylvania | Haverford | $28.5 B | Trading, investments |

| Jonathan Nelson | Rhode Island | Providence | $3.1 B | Private equity |

| Robert Faith | South Carolina | Charleston | $5.2 B | Real estate management |

| T. Denny Sanford | South Dakota | Sioux Falls | $2.0 B | Banking, credit cards |

| Thomas Frist Jr. & family | Tennessee | Nashville | $22.3 B | Hospitals |

| Elon Musk | Texas | Austin | $230.0 B | Tesla, SpaceX |

| Gail Miller | Utah | Salt Lake City | $4.2 B | Car dealerships |

| John Abele | Vermont | Shelburne | $1.9 B | Healthcare |

| Jacqueline Mars | Virginia | The Plains | $39.4 B | Candy, pet food |

| Jeff Bezos | Washington | Medina | $149.0 B | Amazon |

| John Menard Jr. | Wisconsin | Eau Claire | $18.1 B | Home improvement stores |

| John Mars | Wyoming | Jackson | $39.4 B | Candy, pet food |

Many billionaires in the U.S. are extremely well-known, such as California’s Larry Page, New York’s Michael Bloomberg, or Washington state’s Jeff Bezos.

Interestingly, Bill Gates doesn’t take the top spot as the richest billionaire in Washington because Bezos has a higher net worth—$149 billion vs. Gates’ $104 billion—although they do live in the exact same town of Medina, WA.

Nearly every state is home to at least one billionaire, some far wealthier than others, like Nebraska’s Warren Buffett ($117 billion), compared to Alabama’s Jimmy Rane ($1.2 billion). Some new states, which gained billionaires this year include Alabama, New Hampshire, and Vermont.

Billionaire Wealth

The number of billionaires globally is following a different trend than the one in the U.S., declining year-over-year, and seeing billionaire wealth overall decrease by $500 billion.

The U.S. is home to almost 30% of all the world’s billionaires and while a few like Sam Bankman-Fried and Kanye West lost their billionaire status this year, many continue to get richer. In addition to Ron Corio, New Mexico’s first ever billionaire, eight other individuals on the U.S. list gained billionaire status in the last four years.

Finance and investments, food and beverage, fashion and retail, and technology are the top sources of wealth for U.S. billionaires, with almost 50% of them gaining their fortunes from these specific industries.

Markets

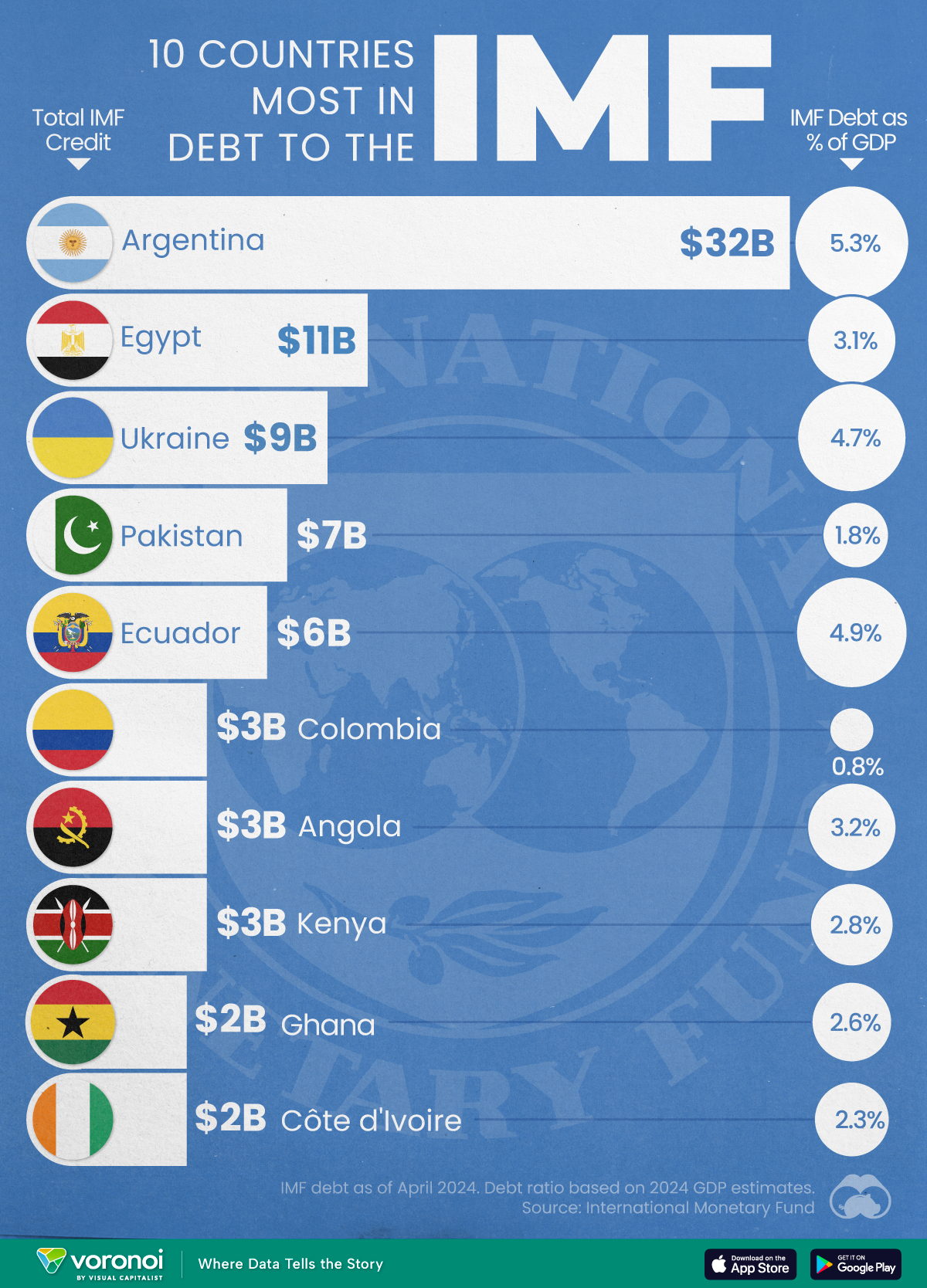

Top 10 Countries Most in Debt to the IMF

Argentina tops the ranking, with a debt equivalent to 5.3% of the country’s GDP.

Top 10 Countries Most in Debt to the IMF

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Established in 1944, the International Monetary Fund (IMF) supports countries’ economic growth by providing financial aid and guidance on policies to enhance stability, productivity, and job opportunities.

Countries seek loans from the IMF to address economic crises, stabilize their currencies, implement structural reforms, and alleviate balance of payments difficulties.

In this graphic, we visualize the 10 countries most indebted to the fund.

Methodology

We compiled this ranking using the International Monetary Fund’s data on Total IMF Credit Outstanding. We selected the latest debt data for each country, accurate as of April 29, 2024.

Argentina Tops the Rank

Argentina’s debt to the IMF is equivalent to 5.3% of the country’s GDP. In total, the country owns more than $32 billion.

| Country | IMF Credit Outstanding ($B) | GDP ($B, 2024) | IMF Debt as % of GDP |

|---|---|---|---|

| 🇦🇷 Argentina | 32 | 604.3 | 5.3 |

| 🇪🇬 Egypt | 11 | 347.6 | 3.1 |

| 🇺🇦 Ukraine | 9 | 188.9 | 4.7 |

| 🇵🇰 Pakistan | 7 | 374.7 | 1.8 |

| 🇪🇨 Ecuador | 6 | 121.6 | 4.9 |

| 🇨🇴 Colombia | 3 | 386.1 | 0.8 |

| 🇦🇴 Angola | 3 | 92.1 | 3.2 |

| 🇰🇪 Kenya | 3 | 104.0 | 2.8 |

| 🇬🇭 Ghana | 2 | 75.2 | 2.6 |

| 🇨🇮 Ivory Coast | 2 | 86.9 | 2.3 |

A G20 member and major grain exporter, the country’s history of debt trouble dates back to the late 1890s when it defaulted after contracting debts to modernize the capital, Buenos Aires. It has already been bailed out over 20 times in the last six decades by the IMF.

Five of the 10 most indebted countries are in Africa, while three are in South America.

The only European country on our list, Ukraine has relied on international support amidst the conflict with Russia. It is estimated that Russia’s full-scale invasion of the country caused the loss of a third of the country’s economy. The country owes $9 billion to the IMF.

In total, almost 100 countries owe money to the IMF, and the grand total of all of these debts is $111 billion. The above countries (top 10) account for about 69% of these debts.

-

Demographics6 days ago

Demographics6 days agoMapped: U.S. Immigrants by Region

-

United States2 weeks ago

United States2 weeks agoCharted: What Southeast Asia Thinks About China & the U.S.

-

United States2 weeks ago

United States2 weeks agoThe Evolution of U.S. Beer Logos

-

Healthcare2 weeks ago

Healthcare2 weeks agoWhat Causes Preventable Child Deaths?

-

Energy1 week ago

Energy1 week agoWho’s Building the Most Solar Energy?

-

Markets1 week ago

Markets1 week agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Technology1 week ago

Technology1 week agoMapped: The Number of AI Startups By Country

-

Healthcare1 week ago

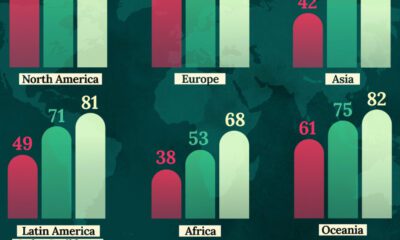

Healthcare1 week agoLife Expectancy by Region (1950-2050F)