GBP Lower As NIESR Flags Fresh Recession Risks

2024 Recession Risks Growing

After narrowly avoiding a recession so far this year, and with the likes of the IMF and the BOE no longer forecasting a recession in the UK this year, GBP bulls were dealt a fresh blow this morning. The National Institute of Social and Economic Research (NIESR) has warned in a new report today that the UK faces a more than 60% likelihood of recession next year as a result of BOE tightening. Additionally, the group warns that the UK is at risk of suffering five “lost” years of economic growth as a result of COVID, Brexit and the conflict between Russia and Ukraine.

Housing & Food Costs to Remain High

The group warned that housing and food costs were likely to stay elevated well into next year, creating significant headwinds for GDP. While NIESR warned that a UK recession might still materialise this year, its central scenario is for a downturn to take hold next year. Still, while the UK will likely avoid a technical recession this year it warned that it would feel like a recession given the strain imposed by the cost-of-living crisis.

BOE Tightening Impact

The group’s latest forecast takes a dimmer view on the economy than seen last time, due largely to ongoing BOE tightening. With rates having risen for a 14th consecutive month at the last meeting and with expectations of further tightening to come, NIESR has turned more bearish on the UK economy near-term.

Technical Views

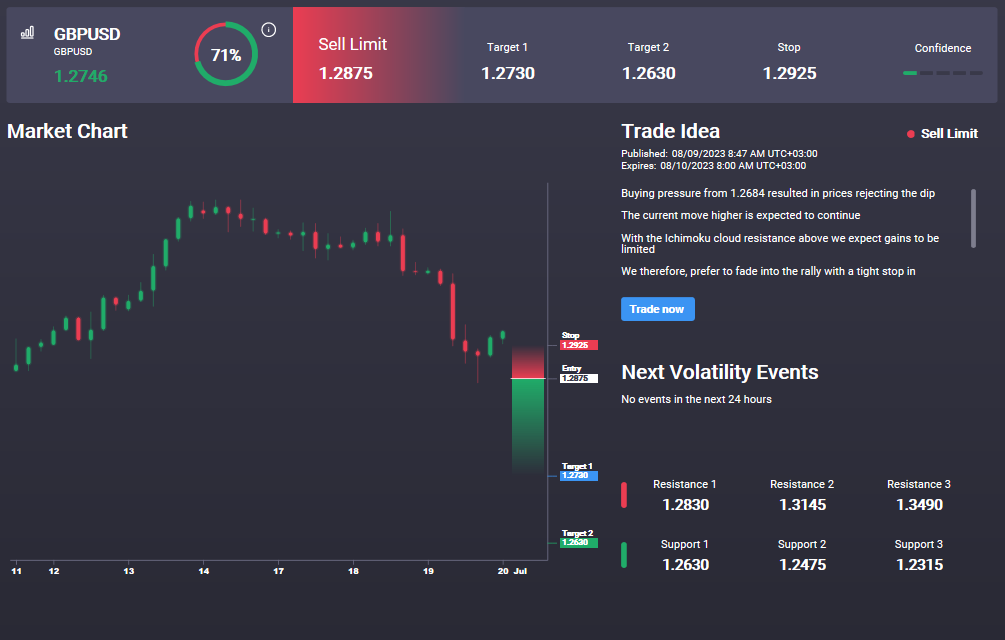

GBPUSD

The reversal lower in GBPUSD has seen the market breaking back below the 1.2992 level, which subsequently held as resistance when retested. Price has now broken below the bullish trend line also and is currently stalled at 1.2659 support. With momentum studies turned lower, bearish risks remain and a break of current support will open the way for a test of 1.2437 next. Notably, we also have an active sell signal for GBPUSD in the Signal Centre today. The signal is set below market at 1.2875 targeting 1.2730 initially.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.