EURUSD Decline Runs into Barriers as EU Growth and Inflation Data Counter US Data Surprises

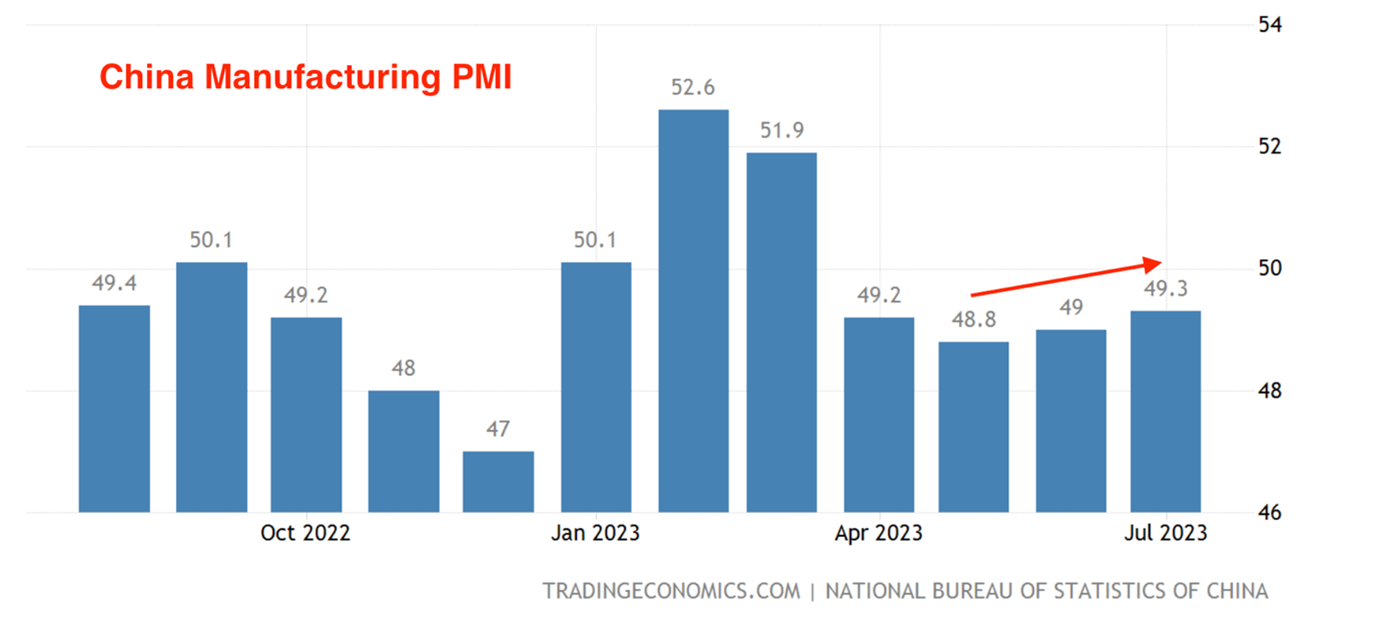

On Monday, the week kicked off with the report on China's industrial sector activity. The PMI index surprised on the upside, rising to 49.3 and beating consensus estimate of 49.2 points. The slowdown in activity has been gradually easing for the second consecutive month, alleviating concerns about China's economy and supporting the search for yield in asset markets. However, it's important to note that the index remains below 50 points, and talking about optimism may be premature:

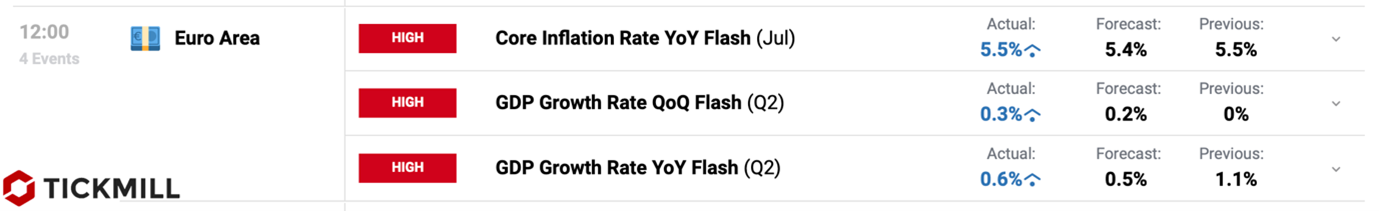

Asian and European stock markets began the week on a positive note, with Japanese and Korean indices closing with gains of over 1%, while European indices showed moderate growth. The dollar index flattened after the comeback of the US currency at the end of the previous week, following an unexpected rebound in economic activity in the US. To recall, the US quarterly growth in the second quarter exceeded expectations, and durable goods orders surged in July, leaving the markets with no choice but to price in a higher chance of another interest rate hike by the Federal Reserve (in September). However, on Monday, the dollar's rally, especially against the euro, hit roadblocks as European data also surprisingly showed improvement. Core inflation in the EU remained at the same level (5.5%) in July, surpassing the forecasted 5.4%, and the quarterly GDP growth in the second quarter exceeded expectations, reaching 0.3% instead of the anticipated 0.2%:

As the European Central Bank (ECB) signaled in the last meeting that strong incoming data could be grounds for another rate hike, the desire to sell the Euro today diminished after the released data, resulting in the price stabilizing near the 1.10 level.

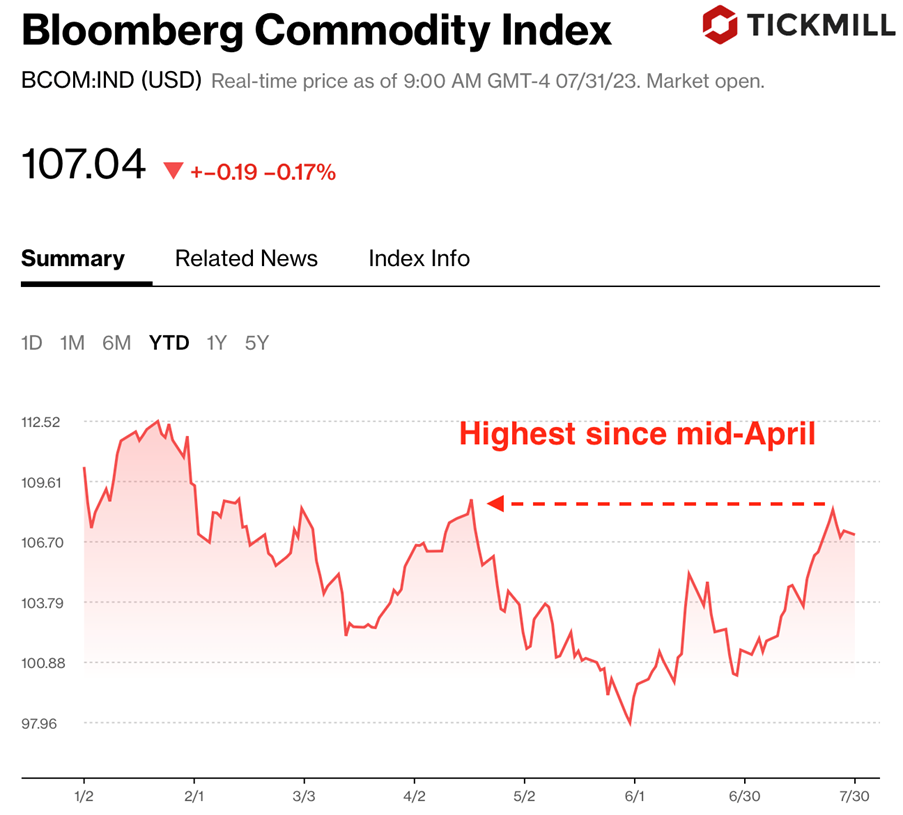

Commodity markets, particularly oil prices, continue to rise steadily. Prices increased by 15% in July, reflecting market optimism about the growth prospects of energy-consuming countries, despite the threats to growth posed by central banks' restrictive policies and the possibility of even tighter measures in the second half of the year. The Bloomberg Commodity Index reached its highest level in several months, with robust growth throughout July, similar to the trend seen in oil prices:

Critical for the ability of commodity markets to maintain gains will be the ISM report on US services on Thursday and the Non-Farm Payrolls (NFP) on Friday. If the data proves stronger than forecasted or at least meets expectations (with modest expectations of 200K new jobs for the NFP), in the context of easing inflation it will increase the chances of a "soft landing" for the US economy. Such a market regime (better growth expectations with moderating inflation) typically benefits commodity markets and developed market equities.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.