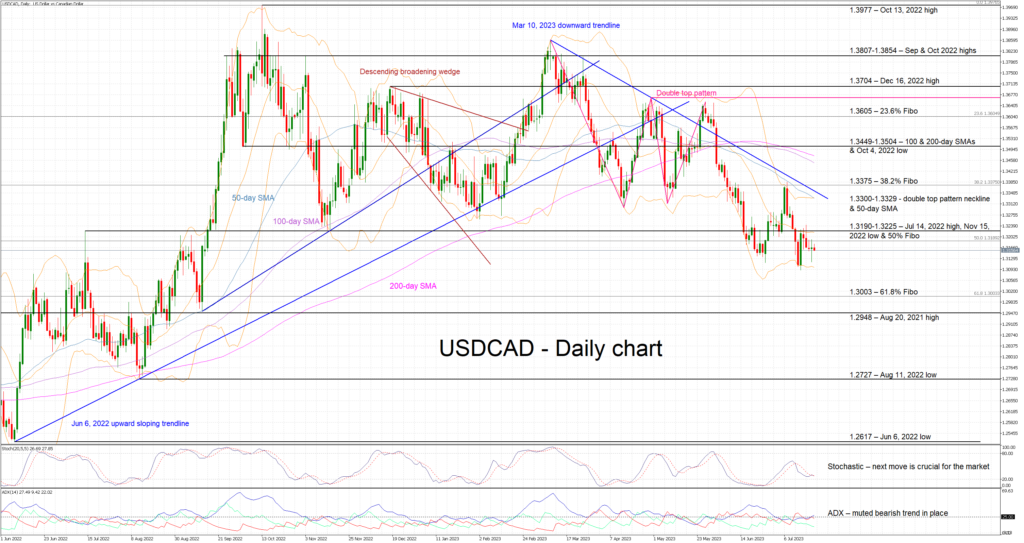

Technical Analysis – USDCAD downward trend continues; a new 2023 low is on the cards

With the Average Directional Movement Index (ADX) confirming the presence of a muted bearish trend in the market, the focus is on the stochastic oscillator. It is edging lower, battling with its moving average (MA). A successful move above the MA would unsettle the bears’ plan, while a drop lower would clearly be seen as a bearish signal.

Should the bears feel inspired by the overall technical picture, they would try to record a new 2023 low and then target the 61.8% Fibonacci retracement of the April 5, 2022 – October 13, 2022 uptrend at 1.3003. If successful, they could then have a go at the August 20, 2021 high at 1.2948 and possibly be given the chance to record the lowest print since August 2022.

On the other hand, the bulls are anxiously trying to push USDCAD above the busy 1.3190-1.3225 range populated by the July 14, 2022 high, the November 15, 2022 low and the 50% Fibonacci retracement respectively. They could then have the chance of testing the resistance set by both the March 10, 2023 downward sloping trendline and key 1.3300-1.3329 range.

To sum up, USDCAD bears feel in control of the market and ready to record a new 2023 low if the stochastic oscillator provides the appropriate signal.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.