Australian Dollar, AUD/USD, US Dollar, RBA, CPI, RBNZ, AUD/NZD – Talking Points

- The Australian Dollar ran higher after CPI figures beat estimates

- Both the headline and trimmed measures were above forecasts

- The RBA might have a problem on their hands. Will AUD/USD continue higher?

The Australian Dollar made a 5-moNth high in the aftermath of headline CPI of 7.8% beating forecasts of 7.6% year-on-year to the end of December and against 7.3% previously. This is the highest it has been since the early 1990's.

The December quarter-on-quarter headline CPI was 1.9% rather than the 1.6% anticipated and 1.8% prior.

The RBA’s preferred measure of trimmed-mean CPI was 6.9% year-on-year to the end of 2022 instead of estimates of 6.5% and 6.1% previously.

The trimmed mean quarter-on-quarter CPI read of 1.7% was above the 1.5% forecast and there was a revision to the prior quarter, up to 1.9%.

Interest rate futures markets nudged up the odds of a 25 basis-point hike by the RBA at their monetary policy meeting on the 7th of February. Later this week PPI data will also be released.

HOW TO TRADE AUDUSD

AUD/USD might find near-term support on the back of building price pressures. The RBA has previously said that they think CPI will get to 8% later this year before easing into next year.

Today’s data is pressing close to that estimate and if inflation becomes entrenched, the central bank might be in a tricky situation. Local press has made much of the so-called ‘mortgage cliff’.

That is in reference to borrowers that took out fixed-rate loans when the cash rate was at 0.10% 2-years or so ago. Many of these loans will start to roll over later this year. The current cash rate of 3.10% could stretch some household balance sheets and more hikes might further stress them.

Earlier in the day New Zealand CPI came in steady at 7.2% year-on-year to the end of December, the same as previously, but above the 7.1% forecast. Similarly, the quarter-on-quarter read was 1.4% rather than the 1.3% forecast but a deceleration from the prior print of 2.2%.

The overnight index swap (OIS) market is pricing a 50 bp hike by the Reserve Bank of New Zealand at their meeting on the 22nd of February.

NZD/USD initially spiked on the news but has since slid below where it was prior to the data. AUD/NZD is back above 1.0850 after having made a 12-month low of 1.0468 last month.

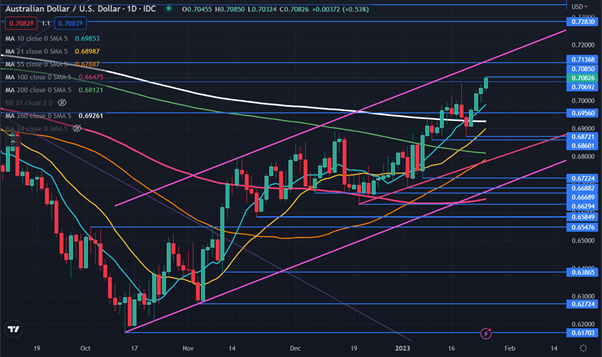

AUD/USD TECHNICAL ANALYSIS

AUD/USD made a 5-month high today at 0.7092 and remains in an ascending trend channel.

The price is above all short, medium and long-term daily simple moving averages (SMA).

The gradients on the 10-, 21-, 55- and 100-day SMAs are positive but the 200- and 260-day SMAs are yet to tick up. This may suggest that bullish short and medium-term momentum is evolving but long-term momentum is yet to completely acknowledge this.

Support may lie at the recent lows of 0.6872 and 0.6860 or further down at the ascending trend line, which currently dissects with the 55-day SMA at 0.6788.

On the topside, resistance might be at the prior peaks of 0.7137 and 0.7283.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter