With September IHS-Markit (Macroeconomic Advisers) monthly GDP, we have the following picture of some key indicators followed by the NBER Business Cycle Dating Committee.

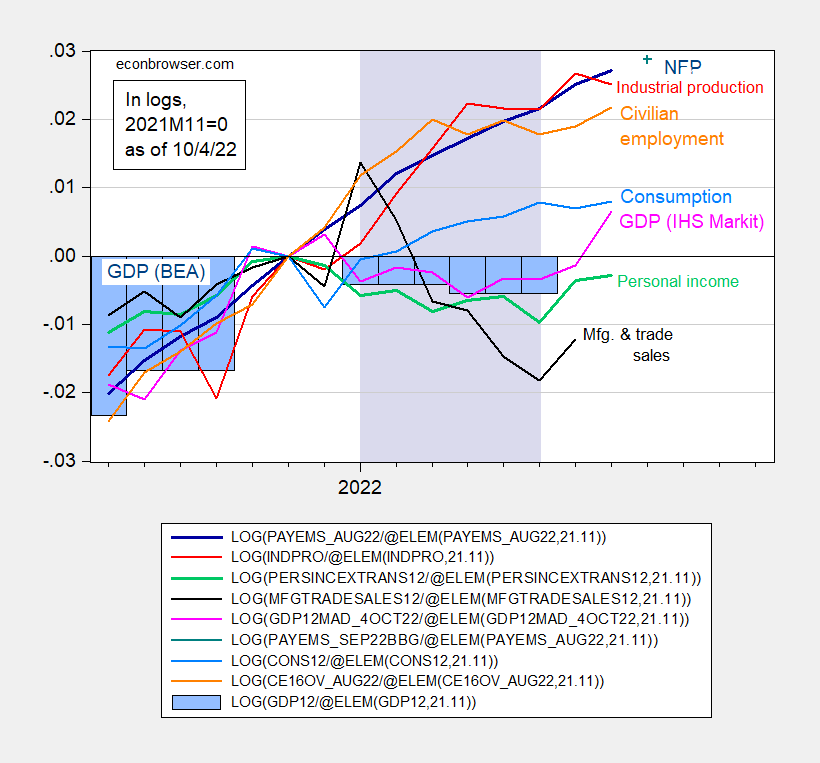

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus as of 10/4 for NFP (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), official GDP (blue bars), all log normalized to 2021M11=0. Lilac shading denotes dates associated with a hypothetical recession in H1. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (10/4/2022 release), and author’s calculations.

Note that monthly GDP moved up sharply in September. From IHS-Markit:

Monthly GDP rose 0.8% in August following a 0.2% increase in July. The latter was revised lower by 0.2 percentage point. The increase in August was accounted for by large increases in nonfarm inventory investment and net exports. Final sales to domestic purchasers were

essentially flat in August. The sharp gain in inventory investment in August is likely to be reversed in September, as inventories (outside of motor vehicles and parts), by our estimation, were already somewhat overbuilt heading into August GDP and other indicators seem to be at variance; however, if we look at GDO, they seem more consistent.

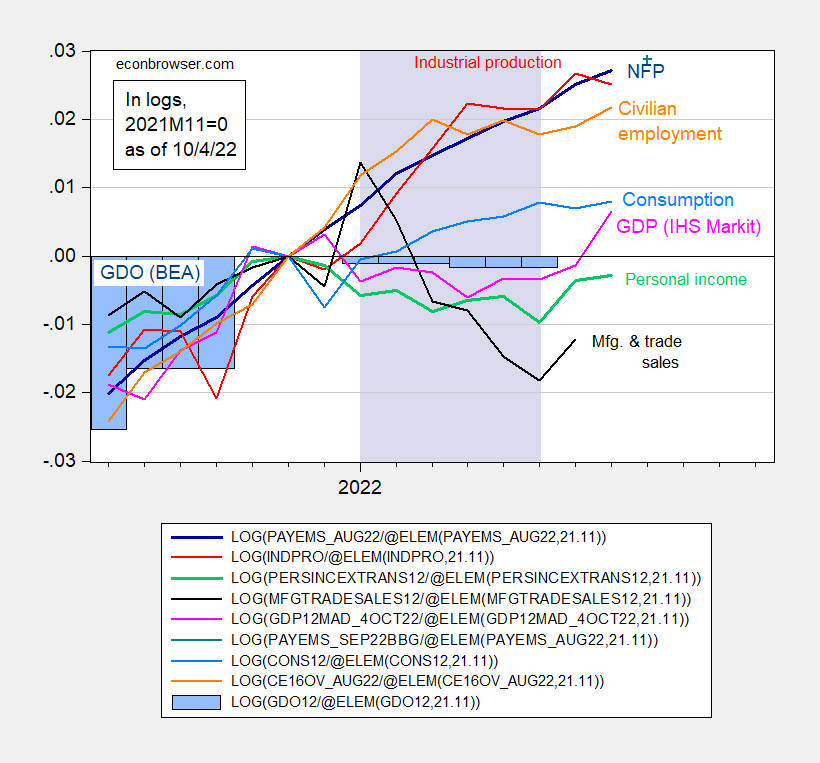

Figure 2: Nonfarm payroll employment (dark blue), Bloomberg consensus of 10/14 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), Gross Domestic Output, GDO (blue bars), all log normalized to 2021M11=0. Lilac shading denotes dates associated with a hypothetical recession in H1. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (10/4/2022 release), and author’s calculations.

For more discussion of GDP vs. GDO and other related measures, see this post from the beginning of the month, and discussion of GDP annual revision, here.

With consumption, employment and production measures rising throughout H1, and GDO trending sideways, it does not seem likely that H1 will be declared a recession, defined as a broad based and persistent decline in economic activity.

IHS-Markit (Macroeconomic Advisers) is part of S&P Global. The RECESSION CHEERLEADERS will likely ignore that this fine group of economists have just said.

https://www.nytimes.com/2022/09/29/climate/hurricane-ian-flood-insurance.html

September 29, 2022

Hurricane Ian’s Toll Is Severe. Lack of Insurance Will Make It Worse.

By Christopher Flavelle

Most of the Florida homes in the path of Hurricane Ian lack flood insurance, posing a major challenge to rebuilding efforts, new data show.

In the counties whose residents were told to evacuate, just 18.5 percent of homes have coverage through the National Flood Insurance Program, according to Milliman, an actuarial firm that works with the program.

Within those counties, homes inside the government-designated floodplain, the area most exposed to flooding, 47.3 percent of homes have flood insurance, Milliman found. In areas outside the floodplain — many of which are still likely to have been damaged by rain or storm surge from Ian — only an estimated 9.4 percent of homes have flood coverage….

https://www.nytimes.com/2022/10/04/us/florida-hurricane-housing-crisis.html

October 4, 2022

‘Where Am I Going to Go?’ Floridians Hit by a Hurricane and a Housing Crunch.

Losses from the storm are just coming into focus. But what is clear is that recovery will be hardest on people already struggling to make ends meet.

By Frances Robles, Audra D. S. Burch, Richard Fausset and Michael Majchrowicz

FORT MYERS, Fla. — Days after Hurricane Ian buffeted the state with a trifecta of wind, rain and storm surge, many Floridians are emerging from the wreckage uncertain of their next chapter — and fearing they may become homeless.

The extent of the damage and the number of people who lost their lives or homes is only beginning to come into focus. Much clearer is the storm’s likely broad and lasting impact on the recovery of those least able to afford it.

“I don’t have enough money to replace my car and my house. I got enough money to replace one or the other,” said Llewellyn Davenport, 50. The storm surge swallowed his car, and engulfed the 28-foot-trailer he lived in near Fort Myers.

Now Mr. Davenport, a sanitation worker, must make a tough decision: get another home or another car. “My entire life changed in a matter of hours.”

After the storm, many Floridians, limited by low or fixed incomes, face finding a decent place to live in a state that is mired in an affordable housing crunch. The state’s enduring popularity, inflation and soaring rental costs have made it one of the least affordable places to live in the nation.

Already, an estimated 2.24 million households in Florida with incomes below $50,000 pay more than 30 percent of their income in rent or mortgage — more than a quarter of the total households, according to the University of Florida’s Shimberg Center for Housing Studies….

Oh yes, America BAD, etc. Roger that.

By the way, ltr, you seem to have missed *this* New York Times article about China (actually, all of them):

OPINION

GUEST ESSAY

Why China’s Crimes in Xinjiang Cannot Go Unpunished

Sept. 30, 2022

https://www.nytimes.com/2022/09/30/opinion/international-world/china-human-rights-xinjiang-un.html?searchResultPosition=1

By Nicholas Bequelin

Mr. Bequelin is an expert on China’s human rights situation.

For years, China denied committing human rights violations in Xinjiang, denounced its accusers and tried to block a United Nations investigation. Now we know why.

The U.N.’s long-delayed findings by the United Nations, released late last month, confirmed the most chilling allegations by ethnic Uyghurs: systematic mass internment, disappearances, torture, cultural and religious erasure and political indoctrination of Uyghurs and other Turkic minorities.

The U.N.’s human rights office, which compiled the report, said these allegations may amount to crimes against humanity, the most severe violations, along with genocide and war crimes, under international law. Despite China’s long record of documented human rights abuses, this was the first time it faced such grave accusations from the United Nations.

The international community, working through the U.N., must respond with meaningful steps to end the abuses, free prisoners and hold Beijing to account.

The stakes extend far beyond Xinjiang’s borders.

Strong action is essential to draw a line in the sand against an orchestrated campaign waged for years by China to gut the U.N.’s ability to protect human rights. This goes well beyond China’s frequent use of its Security Council veto to shield abusers like Myanmar and Syria. Chinese efforts include a behind-the-scenes war of attrition to undermine mechanisms like the Office of the United Nations High Commissioner for Human Rights and the 47-nation Human Rights Council, which is tasked with addressing violations.

China’s offensive takes many forms, ranging from its attempt to defund the human rights component of U.N. peacekeeping operations in 2018 to intimidating civil society groups, blocking their U.N. accreditations and manipulating the Human Rights Council.

The Chinese Communist Party’s ultimate goal is to cripple the international community’s ability to censure countries for human rights violations. The party’s constitution candidly defines its rule as a “dictatorship,” and it sees human rights — and global scrutiny — as threatening its ability to crush challenges to its monopoly on domestic power and potentially impeding Beijing’s programs to build overseas influence like its Belt and Road Initiative.

China’s leverage is growing. The rise of authoritarianism around the world provides a widening base of support from like-minded regimes. Global dependence on Chinese trade, investment and financial assistance allows China to strong-arm other countries into silence. Chinese nationals lead or occupy high positions in several U.N. agencies, and Beijing exercises growing control over other appointments and financial affairs. Its readiness to interfere with vital U.N. work was made clear in its obstruction of World Health Organization efforts to determine the source of the coronavirus.

Xinjiang shows how effective this strategy can be.

Reports emerged in 2017 that China was incarcerating up to a million Uyghurs and other minorities in re-education camps. (Uyghurs, who are predominantly Muslim, have made up the bulk of Xinjiang’s population for centuries and have long chafed under Beijing’s control.) China eventually acknowledged that the camps existed, saying they were part of Islamic deradicalization efforts.

Horrifying allegations poured out: children separated from parents, Uyghurs punished when relatives spoke out overseas, women forcibly sterilized or sexually abused and what the U.N. report called an “unusual and stark” decline in Uyghur birthrates. In leaked documents on the Xinjiang crackdown, President Xi Jinping called in 2014 for “absolutely no mercy.”

Denying abuses, China sought to prevent global action. The U.N. human rights chief Michelle Bachelet repeatedly postponed publishing the investigation and during a visit to Xinjiang in May recited Chinese talking points. Her office released its report just minutes before her four-year term ended at midnight on Aug. 31, allowing her to avoid addressing its findings, and broke with precedent by refraining from recommending further international action.

The foot dragging hasn’t stopped there.

…

https://www.nytimes.com/2022/10/04/opinion/interest-rates-inflation.html

October 4, 2022

Is the era of low interest rates over?

By Paul Krugman

From a financial point of view, 2022 has, above all, been the year of rising interest rates. True, the Federal Reserve didn’t begin raising the short-term interest rates it controls until March, and its counterparts abroad acted even later. But long-term interest rates, which are what matter most for the real economy, have been rising since the beginning of the year in anticipation of central bank moves:

https://static01.nyt.com/images/2022/10/04/opinion/krugman041022_1/krugman041022_1-articleLarge.png

Taking a hike.

These rising rates correspond, by definition, to a fall in bond prices, but they have also helped drive down the prices of many other assets, from stocks to cryptocurrencies to, according to early indications, housing.

So what will the Fed do next? How high will rates go? Well, there’s a whole industry of financial analysts dedicated to answering those questions, and I don’t think I have anything useful to add. What I want to talk about instead is what is likely to happen to interest rates in the longer run.

Many commentators have asserted that the era of low interest rates is over. They insist that we’re never going back to the historically low rates that prevailed in late 2019 and early 2020, just before the pandemic — rates that were actually negative in many countries.

But I don’t see that happening. There were fundamental reasons interest rates were so low three years ago. Those fundamentals haven’t changed; if anything, they’ve gotten stronger. So it’s hard to understand why, once the dust from the fight against inflation has settled, we won’t go back to a very-low-rate world.

Some background: The low interest rates that prevailed just before the pandemic were the end point of a three-decade downward trend.

https://static01.nyt.com/images/2022/10/04/opinion/krugman041022_2/krugman041022_2-articleLarge.png

Check out our low, low rates….

Just one add-on. With the strong economy Obama left Trump, interest rates had started rising. Of course Trump threw a hissy fit and then let Covid19 run wild. MAGA!

I don’t agree. The Fed raising rates has less effect than in the past because the Fed rate hits far less of the economy than it did in 1980. Real Estate is more diversified, far smaller part of the economy and Corporate bond markets as seen, simply aren’t directly effected by it.

Raising rates in a structural strong dollar will just make it stronger. Where are people leaving bonds putting money into??? High risk corporate yields. Probably triggering a spending boom. Lets just say corporations have gone from where debt wiggled a bit tighter to loose as hell in 6 months. Getting financing for a corporate project is incredibly easy right now. IMO, too easy. It just smells like suppressing consumer demand only for corporate demand to replace it leading to a surge in spending ala the 90’s. Recession in the long run it will have. But enjoy the party.

So there’s no arbitrage? Funding costs are siloed between sectors? This is news to me.

“Recession in the long run it will have.”

Are you Yoda?

OK, silly arguments aside, the Fed’s actions are very clearly strongly affecting the real economy *right now*, and the strength of the effects are important:

Paul Krugman Twitter thread #1, on how fast the employment numbers are changing (backing up MD’s suggestions that the Fed may need to cool it for a bit):

https://twitter.com/paulkrugman/status/1577643699324043266

Paul Krugman Twitter thread #2, on what the high responsiveness of the job market in the past two months means for the possibility of a soft landing (higher, not lower!):

https://twitter.com/paulkrugman/status/1577389853255372800

(I posted this below in response to pgl)

Bottom line: Fed actions are having the desired effect *faster* than some would have anticipated. And this means that the Fed has finer control over the economy than we may have thought, and that may mean a soft landing is more likely (because backing away may be powerful, too). The apparent NAIRU is falling fast.

Caveats for my wishful thinking of course.

“Bottom line: Fed actions are having the desired effect *faster* than some would have anticipated.”

this is why i asked the question a couple of weeks ago regarding if the fed had ever made a rate change in between regularly scheduled meetings. we are going to get over a months worth of data before the next meeting (no october meeting), and midcourse correction may be needed. i believe the last 75 bp increase was too much. they should have gone back to 50 bp. would have had a better chance at a soft landing.

You have a point, but if the Fed has finer control over the economy than expected (assuming that’s true), it’s easier for them to walk back a hike that was too large.

Just lazily echoing your question here (without checking!): has the Fed not done emergency rate changes in the past? I seem to recall that happening on the downward direction in the recent past.

Has Kevin Drum been reading the barking from CoRev?

https://jabberwocking.com/70-of-republicans-blame-inflation-on-joe-biden/

I wonder what Republicans really think about this? If they’re serious about the cause not being spending bills passed by Congress (stimulus, CHIPS Act, infrastructure, the Inflation Reduction Act), what exactly is left to blame on “Biden administration policies”? It is a mystery.

Considering inflation only rose .5% the last 2 months……………whoops. Wait until OER comes off………..deflation here we come.

100% negative partisanship. That’s the beginning and the end of Republican ideas (besides tax cuts for the rich). Democrats BAD, Joe Biden is lead Democrat, therefore Joe Biden BAD.

Though I suppose that’s not quite right. The GOP has gotten some new ideas recently: either we won or they cheated, trans people using bathrooms is a threat to children, Donald Trump can declassify stuff with his mind. There, that’s three just off the top of my head.

Another real dumb motion from Team Trump on the Maro Lago search issue:

https://www.msn.com/en-us/news/politics/trump-asks-supreme-court-to-intervene-in-mar-a-lago-dispute/ar-AA12Bpo9

Lawyers for former President Donald Trump asked the U.S. Supreme Court on Tuesday to step into the legal fight over the classified documents seized during an FBI search of his Florida estate. The Trump team asked the court to overturn a lower court ruling and permit an independent arbiter, or special master, to review the roughly 100 documents with classified markings that were taken in the Aug. 8 search. A three-judge panel last month limited the special master’s review to the much larger tranche of non-classified documents.

The reasoning behind this motion is beyond dumb which makes me think the Supremes will not even entertain it. But maybe they should on the condition that famed legal scholar Rick Stryker gets to argue his first case before the Supremes. Yea – Team Trump will assuredly lose but come on – the Supremes need a good laugh and the sheer idiocy of Rick Stryker will have all nine rolling on the floor!

Off topic, weapons race in Ukraine –

I don’t know if it’s really news, but lots of reports have appeared in the past 24 hours about arming Ukraine. Reports indicate four more HIMARs are on the way, along with more land-based anti-ship Harpoons (range 170-190 miles) and South Korean shoulder-fired MANPAD anti-aircraft missiles. There are also apparently some new 4-launcher, small-vehicle guided missile systems showing up in the countryside. Lockheed has announced it is ramping up Javelin anti-tank production in anticipation of increased demand from Ukraine.

So far, still no longer-range, multi-warhead ATACMS, but Ukraine hasn’t given up negotiating for them. I wonder whether ATACMS would be useful in response to deployment of low-yield nukes near Ukraine. There is a point past which “don’t antagonize Putin” is just not realistic.

Anyhow, while Ukraine’s tank-and-troops drive is working well to retake territory, there is a continuing focus on small-squad weaponry, a focus which has worked well all along. The delivery of more Harpoons looks like a potentially expensive proposition for Russia, after what happened to the Vasily Bekh.

So, however much pressure there is on Russian forces in Ukraine, there may be more soon. So of course, Russia has let out that a low-yield nuke test near its border with Ukraine may be in the works.

Ukraine want ATACMS to be able to hit anywhere in Crimea. However, at this stage that would be the kind of overreach that could potentially provoke nukes. Kicking Russia out of Ukraine has to be a slow step-by-step process that retains Putin’s delusion that he can win this thing if only…. I am sure that the ATACMS are part of the planned escalation if Russia detonate a nuke. Russia likely have been told exactly what we will give Ukraine if nukes are detonated. It is a delicate balance but we are currently in a very strong position, if we can just go slow enough and retain Putin in thinking that there is a way for him to win this. This has been a very difficult balancing act especially because Russia has constantly surprised with its incompetence at all tasks and all the time.

With Ukraine having taken Davidyv Brid there is a small, but real, possibility that they could cut down to north of Nova Kakhovka and split the Russian Kherson force on the west side of the Dnipro river in two before winter. There may be Russian commanders on the ground currently orchestrating an orderly retreat from the west of the Dnipro river to avoid such a disaster. It looks like Lyman may have been such as case of Russian commanders on the ground doing what had to be done (to save men and equipment), regardless of what unrealistic idiocies were being howled and barked from mill bloggers, Putin and other arm chair generals in Moscow. When you run out of ammo you either start running away or you raise a white flag.

“before winter”? Heck, at their current rate, now controlling the northern third of Kherson oblast, they will be at the city of Kherson by the end of this week.

“It is a delicate balance but we are currently in a very strong position, if we can just go slow enough and retain Putin in thinking that there is a way for him to win this.”

I’m not sure about convincing Putin he can win. But there’s another thing, which is that progress in the South is coming so fast that Ukraine may not need ATACMS to reach Crimea soon enough (putting aside sabotage, which has been successful in the past). So slow and steady will do it without risking too many Ukrainians, and (as you say) the threat of delivery of ATACMS and other advanced weapons can be used to dissuade the Kremlin from dumb nuclear escalation.

It isn’t a small possibility. It looks inevitable at this point. They seem to be moving at an astounding speed if the maps can be believed. It sounds like Ukraine is headed to Mariupol pretty soon as well, cutting the Russian occupation into multiple pieces.

Back to the economy. I don’t believe we will have a recession just yet, in spite of the shocks to the economy. There are energy price shocks, the rise in interest rates, and finally Ian’s effect. Housing prices are falling around here. Finally. The stock market is down, and all that. Inflation is up to more than it has been for quite a while. I still don’t think we are going to have a recession because employment is still growing sufficiently to absorb new workers so far as I can tell.

Silly me. Most of these headlines, though not all, result from the new $600 million U.S. arms package for Ukraine.

It’s OK. Once I got stuck in my own jacket. True story.

https://fred.stlouisfed.org/series/JTSJOL

Job Openings back to where they were in the summer of 2021. Now the RECESSION CHEERLEADERS will scream about how much they fell but the level is still pretty high. But I will say to the FED – OK you took the pressure off the tight labor markets so stop it with the interest rate increases.

Bark, bark, now that the excess jobs issue is gone, what straw in your desperation will you grab next? BTW, I hope you noticed the direction of that ole gas price straw is taking? Is increasing inflation next? Or is the current/looming recession about to join the mix of Biden’s economic successes. Y’ano, just like his list of other successful policies, CHIPS Act, infrastructure, the Inflation Reduction Act.

Europe is about to join the “Drill baby drill” community with increased fracking.

now that the excess jobs issue is gone

God – what a moron you really are. Job Openings are still around 10 million where the number of unemployed is only 6 million. I guess you never heard of the Beveridge Curve or any other concept in labor economics.

Look CoRev – you flunked environmental economics badly but damn do you suck at labor economics.

Well, the rate of change is pretty high. All the jobs numbers are changing pretty fast. Doesn’t mean a hard landing is guaranteed, but does increase the apparent risk of an employment recession next year.

Bill McBride (Calculated Risk) on this:

https://www.calculatedriskblog.com/2022/10/bls-job-openings-decreased-to-101.html

Paul Krugman Twitter thread #1, on how fast the employment numbers are changing (backing up MD’s suggestions that the Fed may need to cool it for a bit):

https://twitter.com/paulkrugman/status/1577643699324043266

Paul Krugman Twitter thread #2, on what the high responsiveness of the job market in the past two months means for the possibility of a soft landing (higher, not lower!):

https://twitter.com/paulkrugman/status/1577389853255372800

It is good to know Krugman understands the Beveridge Curve and McBride provides the labor market details. Of course CoRev has no clue what any of this means. Yea – CoRev is incredibly stupid and unwilling to learn.

If things go sideways, a recession next year is possible. I don’t think it will hit until next year if we even have a recession. Trust the magic dowsing stick. That’s what it says.