Japanese Yen, USD/JPY, AUD/JPY, Technical Analysis, Retail Trader Positioning – Sentiment Weekly

- Retail traders have sold the Japanese Yen despite recent strength

- As a contrarian signal, this might bode ill for USD/JPY, AUD/JPY

- Fundamental analysis is provided in the webinar recording above

The Japanese Yen has been making a comeback over the past couple of weeks following a prolonged period of weakness this year. Retail traders have been noticing. Looking at IG Client Sentiment (IGCS), long exposure has been rising in USD/JPY and AUD/JPY. IGCS tends to function as a contrarian indicator. If this trend in positioning continues, perhaps the Yen might have more room to recover. However, do the fundamentals align with this scenario? For detailed coverage, check out the webinar recording above.

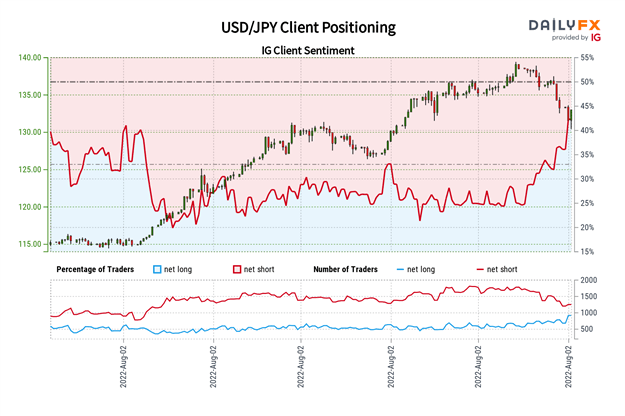

USD/JPY Sentiment Outlook - Bearish

The IGCS gauge shows that about 44% of retail traders are net-long USD/JPY. Since most traders are still biased lower, this hints prices may continue rising. However, upside exposure has climbed by 9.99% and 22.38% compared to yesterday and last week respectively. With that in mind, recent changes in exposure hint that recent losses in USD/JPY could extend in the sessions ahead.

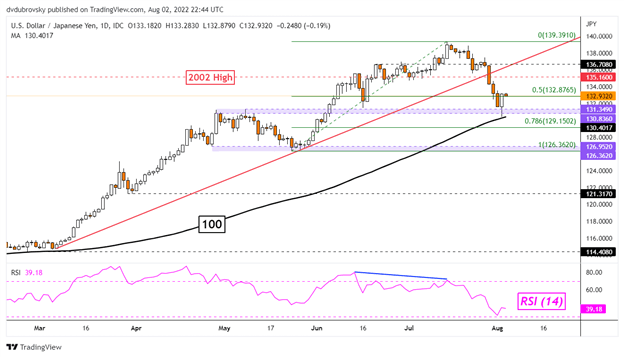

Daily Chart

USD/JPY has confirmed a breakout under the rising trendline from March, opening the door to extending losses. However, prices were unable to clear the 130.83 – 131.34 inflection zone. This is as the 100-day Simple Moving Average (SMA) held as support. In the event of further upside gains, this could spell a resumption of the broader uptrend. Otherwise, clearing support would likely open the door to continue the descent from late June towards May lows.

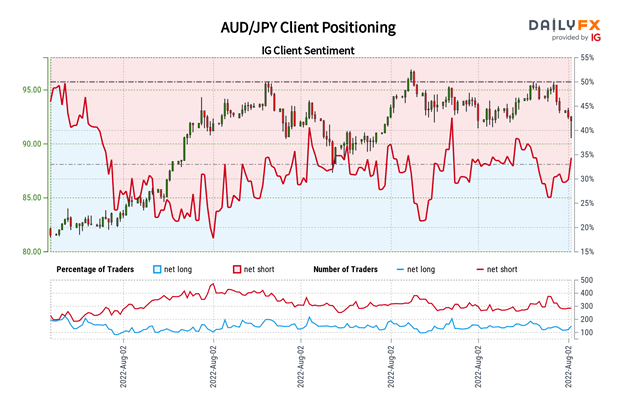

AUD/JPY Sentiment Outlook - Bearish

The IGCS gauge reveals that about 38% of retail traders are net-long AUD/JPY. The majority of them remain biased to the downside. This suggests prices may continue rising. However, downside exposure has decreased by 17.79% and 31.25% compared to yesterday and last week respectively. With that in mind, recent changes in sentiment are hinting that AUD/JPY may extend recent losses.

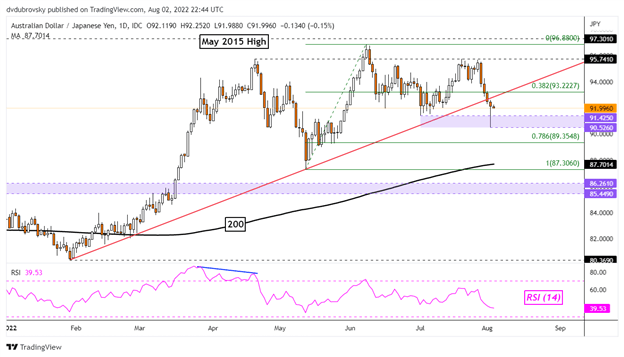

Daily Chart

AUD/JPY has broken under the trendline from February, but further downside confirmation has been somewhat lacking. A larger lower wick was created on Tuesday, reflecting buyers coming in as losses were trimmed. This has left behind a range of support between 90.52 and 91.42. Clearing this zone would open the door to extending losses towards the May low. Otherwise, a bounce would place the focus back on the trendline, which could hold as new resistance.

*IG Client Sentiment Charts and Positioning Data Used from August 2nd Report

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter