Key events in developed market next week

The highlight next week will be the FOMC meeting. We are sticking to our forecast of a 75bp hike. In the eurozone, both 2Q GDP and inflation data will be released

US: July FOMC meeting and 2Q GDP in focus

It is an important week in the US with the July FOMC meeting and 2Q GDP the highlights. For the former, expectations are firmly centred on a 75bp interest rate increase as the Federal Reserve desperately tries to get a grip on rampant inflation.

Many in the market had been talking up the possibility of a 100bp move following the June 9.1% US inflation print and the Bank of Canada’s decision to hike by 100bp. However, a softer batch of recent activity data and indications from the two most hawkish members on the committee (St Louis Fed President James Bullard and Board of Governors' member Chris Waller) that they were not strongly convinced to the need for a 100bp move has seen the likelihood recede. If those two aren’t going to vote for it then we can’t see anyone else voting for it either.

That said, there may be one or two dissenters who favour a smaller 50bp hike given evidence that the economy is losing momentum and both market and consumer inflation expectations are softening. We are forecasting smaller 50bp hikes in September and November with a final 25bp hike in December which would take the target for the fed funds rate to 3.5-3.75%.

In terms of the GDP report, the US economy contracted 1.6% in the first quarter of 2022 due primarily to a massive trade deficit as strong domestic demand sucked in imports, but Covid constraints and port disruption elsewhere limited export growth. Unfortunately, the latest revisions also show consumer spending was not as strong as we were initially led to believe, while monthly data suggests that momentum weakened further in the second quarter as confidence faltered due to the rising cost of living and the threat of higher interest rates. With inventories being run down once again, we can’t rule out the possibility that our tepid 0.4% quarter-on-quarter annualised second-quarter growth forecast is too optimistic and we see a second consecutive negative GDP print.

This would meet the technical definition of recession, but this is unlikely to sway the Federal Reserve from tightening policy. Fed officials have made it abundantly clear that they are prepared to sacrifice near-term growth to achieve the inflation target over the medium term.

Moreover, we doubt that the National Bureau of Economic Research’s Business Cycle Dating Committee would list this as an official recession given the economy is still experiencing rising consumer and business spending and falling unemployment. However, we suspect this will only be a temporary reprieve with a strong chance of broad-based economic weakness in late 2022/early 2023.

Other US data include the Fed’s favoured measure of inflation – the core personal consumer expenditure deflator. This is set to show the annual rate ticking modestly higher. We will also get durable goods orders where strong Boeing aircraft orders will help to offset weakness elsewhere. Also, look out for another batch of soft housing numbers and weakening regional manufacturing surveys.

Eurozone: Peak inflation is not yet reached, and 2Q GDP is expected to see a small increase

While it’s getting pretty quiet in the eurozone with a lot of people going on vacation for their summer breaks, the economy continues to be interesting. Friday will see GDP and inflation data released which will be eagerly awaited. Expectations are that peak inflation has not been reached yet with another tick-up in July on the cards. For 2Q GDP data, expectations are for a small increase in activity. The economy is profiting from a reopening effect for services, but weak manufacturing and a possible inventory correction will dampen the 2Q data.

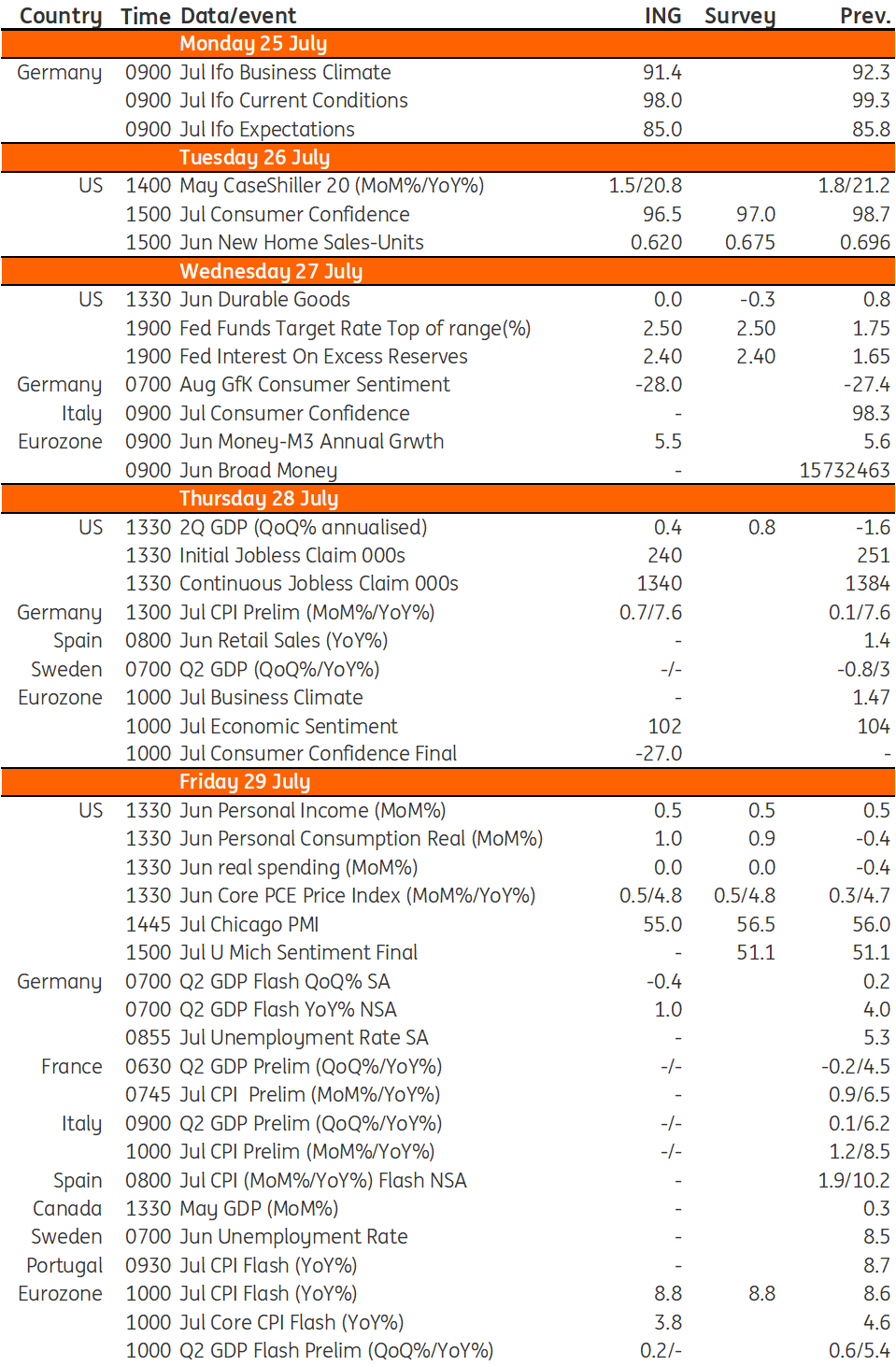

Developed Markets Economic Calendar

Download

Download article22 July 2022

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more