-

Statement by Philip Lowe, Governor: Monetary Policy Decision

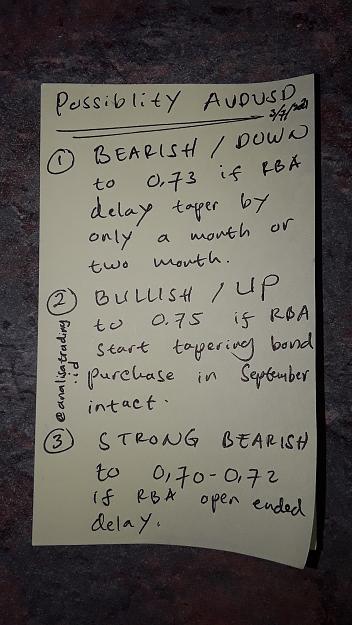

At its meeting today, the Board decided to: *Maintain the cash rate target at 10 basis points and the interest rate on Exchange Settlement balances of zero per cent *Maintain the target of 10 basis points for the April 2024 Australian Government bond *Continue to purchase government securities at the rate of $5 billion a week until early September and then $4 billion a week until at least mid November. The economic recovery in Australia has been stronger than was earlier expected. The recent outbreaks of the virus are, however, interrupting the recovery and GDP is expected to decline in the September quarter. The ... (full story)

-

RBA: Condition for rate rise will not be met before 2024, sees Australia growing 'little over' 4% in 2022 -BBG

— DailyFX Team Live (@DailyFXTeam) August 3, 2021

-

RBA SEES AUSTRALIA'S ECONOMIC OUTLOOK AS UNCLEAR IN THE NEXT MONTHS.

— Breaking Market News (@financialjuice) August 3, 2021

-

RBA SAYS MEETING RATE HIKE CONDITION WILL REQUIRE LABOUR MARKET TO BE TIGHT ENOUGH TO GENERATE WAGES GROWTH THAT IS MATERIALLY HIGHER THAN IT IS CURRENTLY #News #Forex #RBA

— Capital Hungry (@Capital_Hungry) August 3, 2021

- Comments

- Comment

- Subscribe

- Comment #1

- Quote

- Aug 3, 2021 12:36am Aug 3, 2021 12:36am

-

RedCable

RedCable - | Joined May 2020 | Status: Member | 33 Comments

- Comment #2

- Quote

- Aug 3, 2021 12:40am Aug 3, 2021 12:40am

- Guest

- | IP XXX.XXX.8.207

- Comment #3

- Quote

- Aug 3, 2021 12:46am Aug 3, 2021 12:46am

- Guest

- | IP XXX.XXX.169.46

- Comment #4

- Quote

- Aug 3, 2021 12:50am Aug 3, 2021 12:50am

-

Prof.Trader

Prof.Trader - | Commercial Member | Joined Jan 2018 | 718 Comments

- Comment #5

- Quote

- Aug 3, 2021 12:55am Aug 3, 2021 12:55am

-

k3nshinz3139

k3nshinz3139 - Joined Oct 2012 | Status: Chart can tell you everything! | 642 Comments

- Comment #6

- Quote

- Aug 3, 2021 12:57am Aug 3, 2021 12:57am

- jordanvic

- | Joined Jul 2020 | Status: Bro | 908 Comments

- Comment #7

- Quote

- Aug 3, 2021 1:06am Aug 3, 2021 1:06am

- nrobinson

- | Joined Feb 2020 | Status: Junior Member | 1 Comment

- Comment #8

- Quote

- Aug 3, 2021 1:16am Aug 3, 2021 1:16am

- arcwinz

- | Joined Oct 2017 | Status: Member | 25 Comments

- Comment #9

- Quote

- Aug 3, 2021 2:24am Aug 3, 2021 2:24am

- umbrella man

- | Joined Aug 2009 | Status: Member | 544 Comments

- Comment #10

- Quote

- Aug 3, 2021 3:11am Aug 3, 2021 3:11am

- Guest

- | IP XXX.XXX.245.46

- Comment #11

- Quote

- Aug 3, 2021 3:20am Aug 3, 2021 3:20am

- eozdural

- | Joined Jun 2015 | Status: Member | 197 Comments

- Comment #12

- Quote

- Aug 3, 2021 4:03am Aug 3, 2021 4:03am

-

HengkiTjen

HengkiTjen - Joined May 2018 | Status: Member | 38 Comments

- Comment #13

- Quote

- Aug 3, 2021 4:07am Aug 3, 2021 4:07am

- Guest

- | IP XXX.XXX.7.57

- Comment #14

- Quote

- Aug 3, 2021 4:56am Aug 3, 2021 4:56am

- Sean1224

- | Joined Nov 2020 | Status: Member | 81 Comments

- Comment #15

- Quote

- Aug 3, 2021 7:59am Aug 3, 2021 7:59am

- Bakker

- Joined Jun 2011 | Status: Member | 3247 Comments