AUD/USD, AU Employment Talking Points

- Australian employment change comes in at -30,600 against a previous gain of 77,000

- The Australian unemployment rate falls to 5.5%, however labor force participation also dropped

- AUD/USD pushed lower Wednesday following a wave of risk-off sentiment across all asset classes

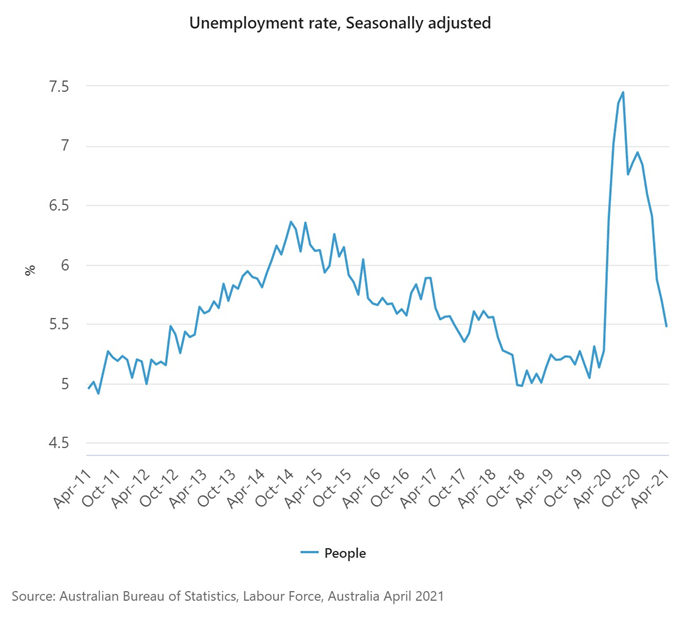

Australian employment data largely disappointed on Thursday as total employment decreased by 30,600 jobs, against an expected gain of 15,000 jobs for April. Despite the miss, the country’s unemployment rate dropped to 5.5%, down 0.2% from March. Perhaps a green shoot in the reading was the gain in full-time employment, which grew in April by 33,800. Of note, the end of the domestic “JobKeeper” subsidy program will present a headwind to further significant employment gains. Experts labeled the program as a key factor in the sharp decline in Australian unemployment over the last 6 months.

Australian Employment Trends

Data courtesy of Australian Bureau of Statistics

Despite the significant improvement in economic conditions in Australia, Reserve Bank of Australia (RBA) officials remain adamant that interest rate hikes will not take place until employment and inflation quotas are met. RBA officials will pay serious attention to the changes in the labor market, particularly the decrease in labor force participation. Participation dropped from 66.3% in March to 66.0% in April. In RBA minutes released this week, officials hinted at a willingness to alter bond buying, but committed to no rate hikes until 2024.

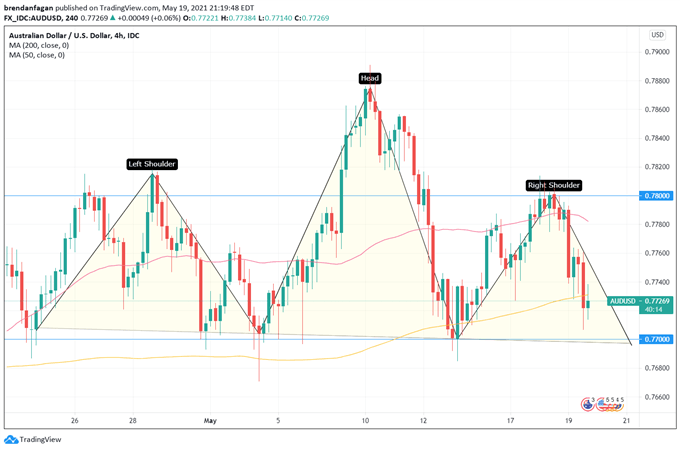

The Australian dollar came under pressure Wednesday as FOMC minutes mentioned tapering of asset purchases, specifically the fact that multiple FOMC participants believe taper talk should take place over the next few meetings. Markets reacted immediately, with the US dollar catching an immediate bid on the news. Any significant strength in the Greenback may be enough to see AUD/USD break below the neckline of a head and shoulders (H&S) pattern that has been forming since late April. Currently, the neckline stands around 0.7700. For more on this H&S pattern, please click here for insight from Rich Dvorak.

AUD/USD 4 Hour Chart

Chart created with TradingView

--- Written by Brendan Fagan, Intern for DailyFX

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter