Everyone trading on the exchange must know and understand what a swap is. In my rather long professional career, I have come across many situations where people lost entire deposits simply because they didn’t know how swaps worked.

In other words, if you understand well what swap is and how it works, you can protect yourself from unnecessary losses and even use swaps for additional profit. This concept is as important as leverage.

The article covers the following subjects:

What are swaps and how are they calculated?

Now let's figure out what fx swap is.

Foreign exchange swap is the difference in the interest rates of the banks issuing the two currencies, which is credited to or charged from the account when the trading position is kept overnight.

The central banks of each country determine the key interest rate. This is the rate at which the central bank lends to other banks. This rate may change throughout the year. But its starting value is determined at the first meeting of the central bank of the year.

On the foreign exchange market currency pairs are traded. Two different currencies are involved in the transaction, and each of them has its own interest rate.

The currency pair contains the base and the quote currency. The former is the currency we buy and the latter is the currency we buy it with.

The base currency is also called the deposit currency. This is our currency and the exchange uses it on a daily basis. Therefore it must pay us a certain percentage for it.

The quote currency is also called the counter currency. It belongs to the bank and we borrow it from the bank. Therefore we pay interest to the bank for the use of its currency, like with a consumer loan.

A negative swap is when you pay it or a positive when it is paid to you.

If there is a negative swap (with a minus sign), its crediting to your trading account will end when you withdraw the funds (points). If the difference in the interest rates gives a positive swap, the money will not be withdrawn from your trading account, but rather a certain number of points will be credited.

Thus, if the client has an open position at the close of the New York trading session, a swap operation with currencies is enforced. This means the position is simultaneously closed and opened for the new day. But on the client's trading account there is no actual closing and opening. Rather the credited or charged interest is simply displayed.

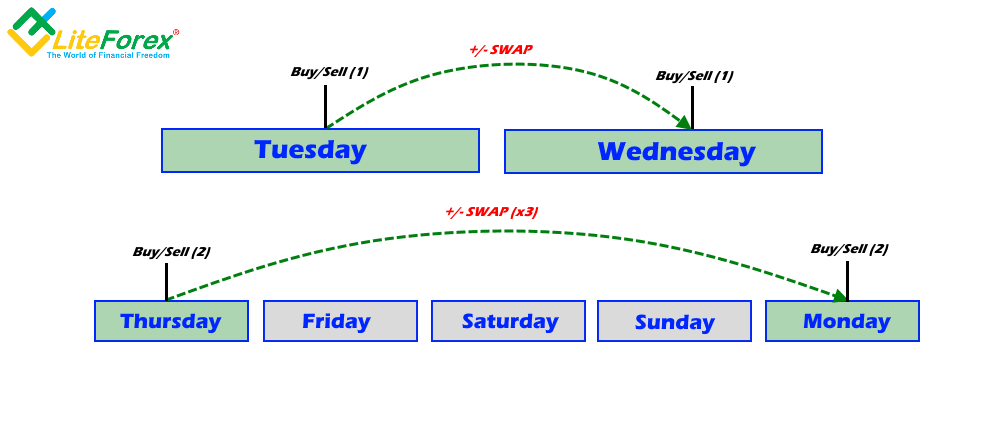

However, there is a day when this operation is tripled. This is called a triple swap day. For currency pairs on the forex market, this is Wednesday to Thursday night. This is because settlements on the exchange for a position open on Wednesday are made on Friday. Therefore, the calculations for the position carried over from Wednesday to Thursday are done for the next day. And the next business day after Friday is Monday. This adds up to 3 days and the weekend swaps charge triple.

Swap as a trading strategy is different for each instrument. It wouldn’t be convenient to constantly calculate them, so brokers provide special swap tables. My broker has a swap table you can use here.

How to calculate swap in Forex?

In order to understand when we pay swap and when it is paid to us, let's talk about how is swap rate calculated in Forex trading when buying or selling:

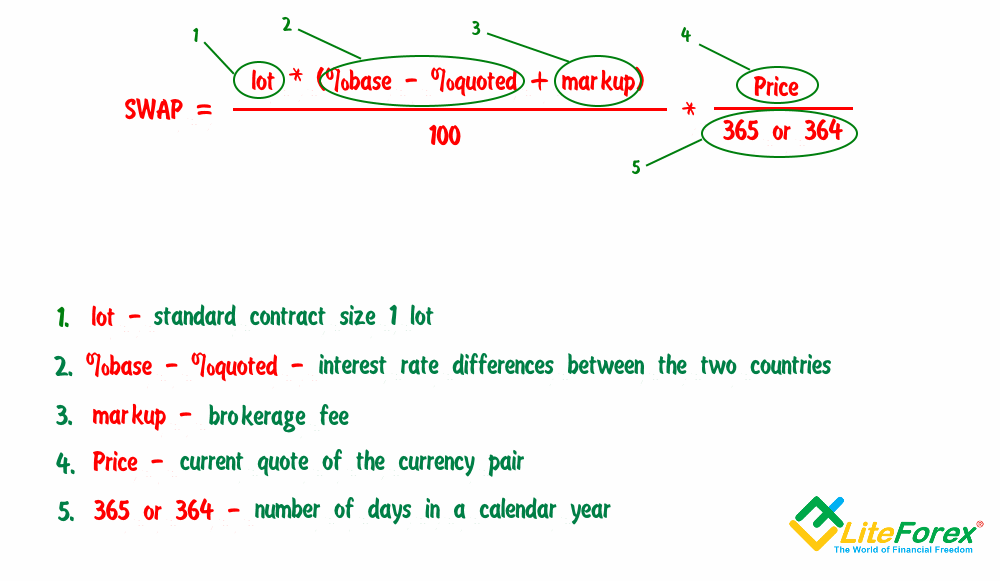

There is a simple formula, as shown above. The most important parameter of this formula is the rates of the central banks, or rather the difference in the interest rates of the base and quote currencies.

For example, let’s compare rates for one currency pair, the EURUSD for example. The ECB rate is now at 0% (loans are effectively free), and the Fed rate is set at 0.25%.

So if we buy a currency pair, we must subtract the quote currency rate from the base currency rate: 0 - 0.25 = -0.25. This means when buying this pair, the difference in rates is negative, and therefore the swap rate will be negative.

But when selling a pair, on the contrary, we need to subtract the base currency from the quote currency: 0.25 - 0 = 0.25. The swap rate will be positive.

This operation only gives us the positive or negative sign of the swap rate (which means either you pay or get paid). If we want to calculate the swap value itself, we need to substitute all the values into the formula.

Today almost no one uses the formula to calculate the swap rate anymore. Traders either look it up in tables or find it using an fx swap calculator.

Every reliable broker has such a calculator on their website. I gave you an example of my broker's calculator above.

FX Swaps and Cross Currency Swaps

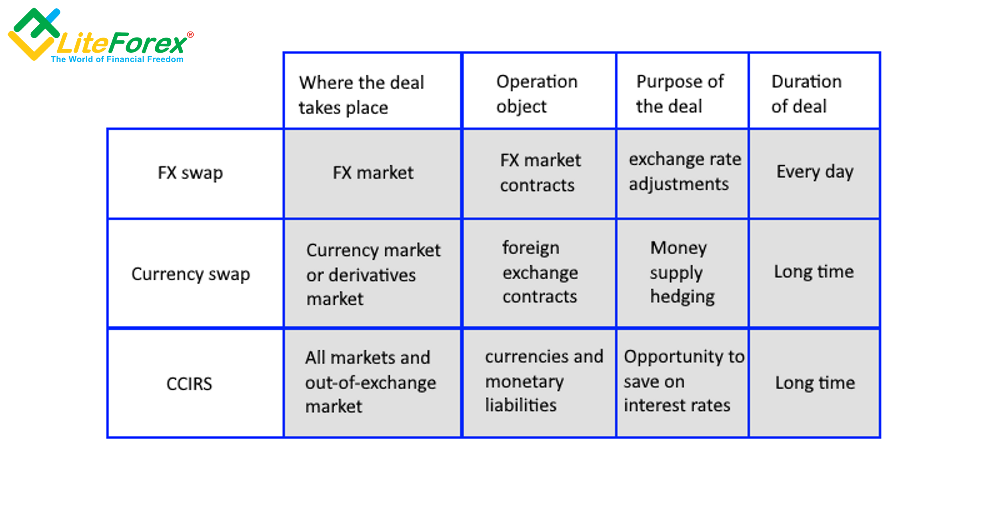

As I said above, there are several types of swaps. Now let's take a look at the difference between the three main types of swaps.

Forex swap

Fx swap rates are the financial instrument that represents the difference between the paying interest rates of the banks of the two currencies in a pair, which is credited or charged when an open position is carried overnight.

Cross currency swap

This is the official definition. Now let me explain it in simple terms:

A cross swap on Forex trading is a situation that occurs when two companies participating in trades on the foreign market enter into an agreement with each other. Within this agreement, they sell each other the same amount in different currencies based on their current rate immediately after the swap operation itself and not at a higher interest rate compared to the changes of the market. After a predetermined period, which they have set under the forward contract, they sell these amounts back to each other in accordance with their rate under the forward contract.

Currency interest rate swap on Forex

A currency interest rate on the Forex swap is a simple interest rate swap that is carried out with different currencies.

Despite the fact that this operation is typical for large financial institutions, it also occurs in everyday life.

For example, you have a loan in foreign currency. The only option for you is to take out a new loan to cover the old one. But taking a new loan in foreign currency is a bad option as the stakes are high. But in local currency they are acceptable. At the same time, you happen to have a friend overseas with similar problems. So you take out a loan in your local currency, and he takes out one in his local currency, which is foreign for you. And then you simply exchange these amounts. As a result, you pay interest on his loan, and he does on yours. Everyone wins and you both saved on the interest rate without any risk involved.

To help you understand the difference between the different types of currency swaps, I have made a comparison table:

How a Currency Swap Works - FX Swap Examples

Now let's take a closer look at how foreign exchange swap works.

I have already mentioned this above. At its core, Fx swap rates are the difference in the interest rates of the central banks of the two countries whose currencies are represented in the pair.

Above, I gave you the formula to calculate the base swap rate. The main parameters of this formula are basically unchanged during the year. And for some currencies, even for several years.

The main parameters are the values of interest swap rates. Except for the current year 2020, changes in interest rates are not frequent. This happens once a year at best.

The variable parameters are the markup and the quote of the currency pair. These parameters can change even more often than once a day. Therefore, if we want to know the exact value of the swap, we need to constantly recalculate the value using a formula or a special calculator.

In addition to being positive and negative, swap rates can also be long and short positions open. In other words, a buy swap and a sell swap.

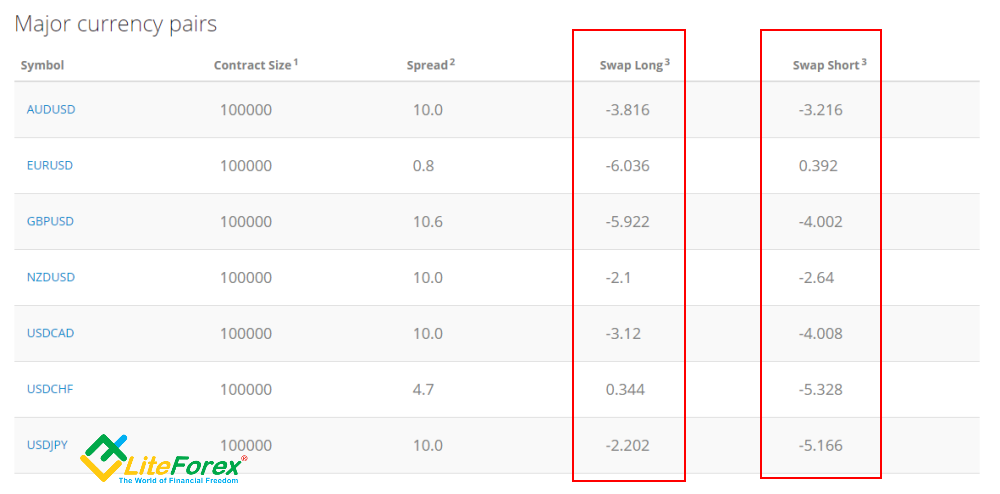

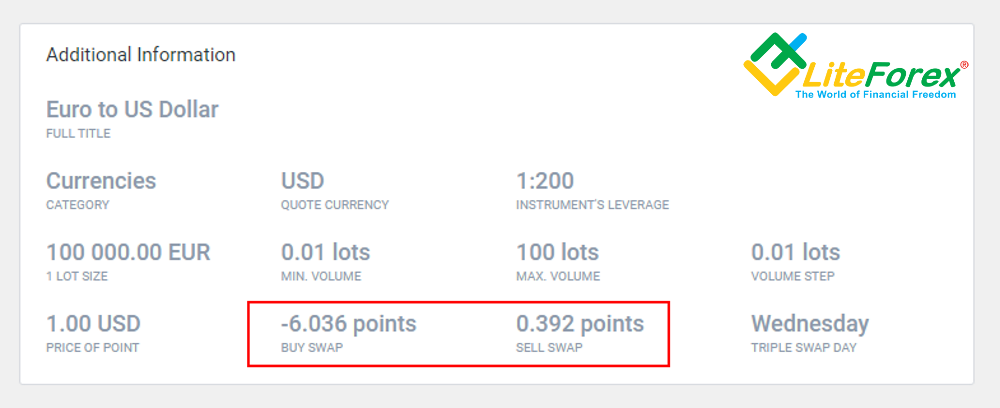

In my broker's swap table, it looks like this:

These values in the red columns indicate the swap value in points per one full lot, which will be credited to or charged from the trader's account if you have your positions open. In other words, if we have an open position to sell the AUDUSD pair, when we carry it overnight a swap short is applied to our position, which is equal to -3.216 points. If we have an open position to buy this pair, Swap Long will be applied, and it will be equal to -3.816 points.

The largest swap value is usually associated with exotic currency pairs such as USDRUB.

If you need to know the swap just before opening the position, you can use the contract specification table:

The situation with swap rates will be slightly different for the euro/dollar pair. The buy swap pip value will be -6.036. In other words, an amount equal to this value per lot will be charged from your account. But the sell swap is equal to 0.392 points. A positive sign means that this value will be credited to your account. So you can actually earn money on a swap.

I have already explained why swap rates can be positive and negative. It's all about the difference in interest swap rates. If the interest rates of the central banks of currencies differ greatly, then the swap sign will be different when buying and selling.

Calculating the swap fees on a short position

Now let's take a closer look at how the total swap value is calculated on Forex trading for a sell trade in the EURUSD currency pair.

- SWAP (short positions) = (Lot * (quote currency rate - base currency rate - markup) / 100) * current quote / number of days in a year.

However, it should be noted that the value will not be entirely accurate since we do not know the exact markup value.

If the positions open at 1 lot with the current quote at 1.19626 and markup at, for example, 0.20%, the swap size will be:

- SWAP (short positions) = (100 000 *(0.25 - (0.0 - 0.20)/100) * 1.19626/365 = 0.163 EUR with an incorrect markup value.

If you perform this operation using a calculator on the broker's website, you get 0.376 USD, so the difference is only in the markup value.

Swap on a long position

Now let's look at how the total swap value is calculated for a buy when you trade Forex using the EURUSD pair.

- SWAP (long positions) = (Lot * (base currency rate - quote currency rate - markup) / 100) * current quote / number of days in a year.

However, it should be noted that the value will not be entirely accurate since we do not know the exact markup value.

If we open a position of 1 lot with the current quote at 1.19626 and markup at, for example, 0.20%, the swap size will be:

- SWAP (long positions) = (100,000 * (0.0 - (0.25 + 0.20) / 100) * 1.19626 / 365 = -1.474 EUR with an incorrect markup value.

If you perform this operation using a calculator on the broker's website, you get -6.036 USD, so the value of the broker's markup for a short trade is significantly different.

Can I make money from swap in Forex trading?

After traders learn that they can actually earn on swap in Forex trading, they start to look for pairs with positive swap in order to avoid high risk choices such as trading with CFDs. And there are enough of them, but with one caveat. There are no pairs where all swap rates are positive, but there are pairs where the swap is positive depending on the type of operation.

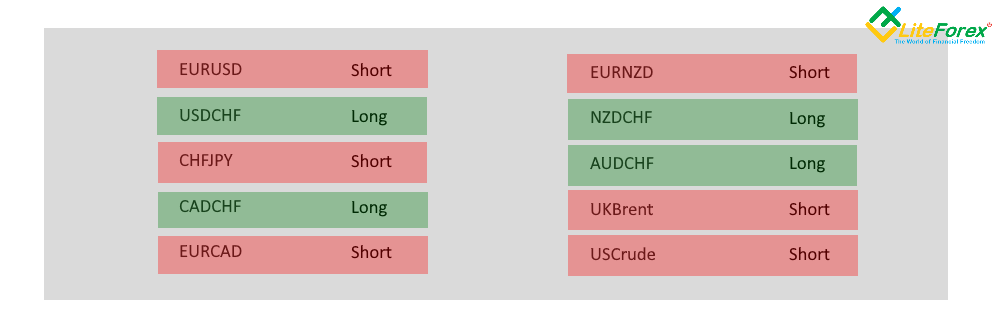

Below, I have listed the pairs with positive Forex swap. Under certain conditions, we can earn on swaps trading these pairs.

At the moment, this is the entire list of instruments with positive forex swaps that my broker provides. However, their number may vary depending on market conditions. For example, if one of the central banks changes its underlying interest rate or your broker changes the markup value.

In general, if you know that a country has a negative net interest rate, this is the sign that positive Forex swap rates may appear in currency pairs containing the currency of this country. However, traders should remember that a small positive swap in Forex trading will be easily eaten up by a spread and can lead to a high risk of losing money rapidly.

But even if such situations are rare, there are some very simple Forex trading strategies to earn on interest and Forex swap rates differences.

Carry Trade

The most popular trading strategy for making money on swap rates is, of course, the carry trade.

The principle of the strategy is to find the largest difference in interest swap rates of different countries. After that, we group the currency pairs that include the currencies of these countries and find a pair where the swap in one direction is greater than in the others.

After a quick look, I have highlighted the CADCHF pair. Forex buy swap on it is 0.528 points. Therefore, if we buy this currency pair, we will be making money on a positive swap. Since the position must be held for a long time to make a profit, we need to analyze the global chart for growth prospects. This particular pair has a growth potential. Now all that remains is to buy and wait, making a profit from the growth of the rate and a positive swap. However, the strategy requires that we keep the position open for quite a long time.

Swap and Fly

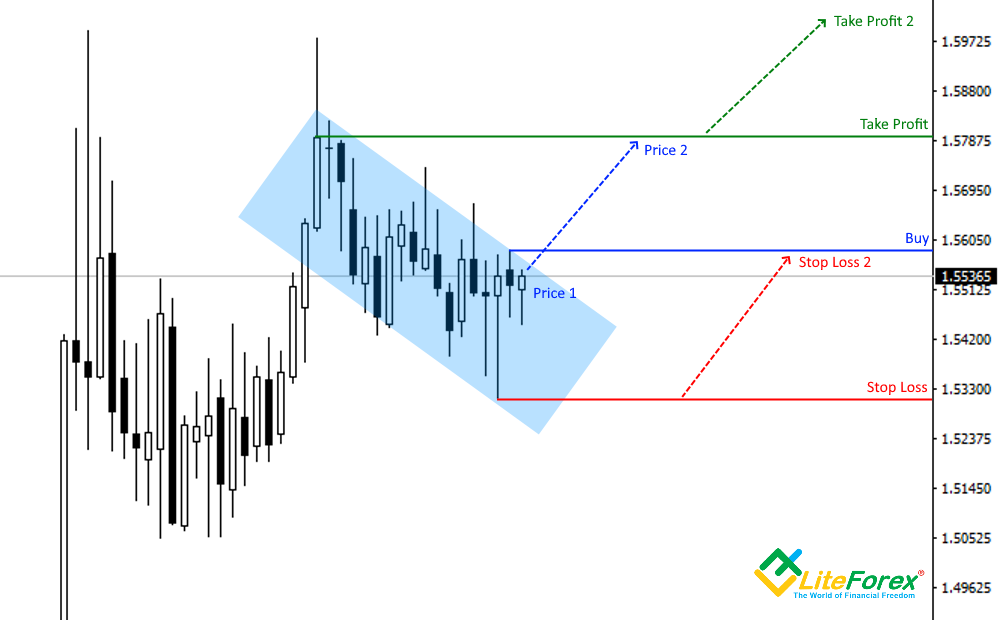

There is another strategy that resembles the previous one — Swap and Fly. The strategy appeared after most forex brokers began to provide the trailing stop option.

We choose an instrument similarly to the first strategy. After we’ve found the pair, we need to find a pattern that’s highly likely to be realized. Candlestick patterns are used more often, but geometric patterns will also work. In our case, this is a flag pattern, after which we expect growth. It’s important not to use mathematical indicators.

After that, order levels are placed with standard rules, which makes the ratio approximately 1:1. After the price starts to grow and goes above the entry point, you need to move Stop Loss to breakeven, I.e. at the level that a position opens. And that's it. Then you just keep the position until the stop loss is triggered. Of course, you can use a trailing stop and also increase your profit by the rate difference. But this is not the essence of the strategy.

The essence of the strategy is to make money on a positive swap. In our case, it is equal to 0.834 points for a buy position. For a 1 lot trade, it’s about 80 cents. If we can maintain the position for a month, when closed by stop loss there will be no exchange rate difference, but the swap will bring us 21 * 0.8 = 16.8 dollars.

Currency futures strategy

There is another good strategy. I sometimes use it myself. The essence of the strategy is to create an ordinary locked position but with different types of contracts. You know that besides currency pairs, there are also futures, options, trading CFDs, and many other contracts. So, futures are essentially no different from a currency pair. Their most important difference is the absence of a swap. Did you already guess what I'm getting at?

Exactly. I create a locked structure by buying a currency pair with a positive buy swap when trading Forex on market and at the same time selling futures for the same pair on another exchange. The currency pair and futures quotes are usually the same, as are the fluctuations. Therefore, wherever the price goes, I will always have 0 because one side is bought and the other is sold.

The profit will be formed from the positive swap when you trade Forex. Of course, there are nuances, such as the size of the spread and the commission. But you can always account for them in the strategy and compensate either by the duration of the position or by a short-term play on price fluctuations and their future performance.

If you want to know more strategies, learn more about trading CFDs for making money on swaps without a higt risk of losing money rapidly, I recommend that you get specialized training from your broker.

What is swap fee in Forex — islamic accounts

Forex brokers also have special swap-free accounts. They are also called Islamic accounts. An Islamic account is a trading account that does not have any swap charge or fees in the form of an interest rate. According to the laws of Islam, Muslims are prohibited from receiving or giving interest on any kind of activity. So Islamic accounts were created in order for Muslims to be able to use the services of the Forex brokers.

Despite the fact that this type of account was created for Muslims, anyone can open it now. In order to open an Islamic account for yourself, you need to submit an application to your broker.

However, we all understand that brokers are not charity organizations. And if the account is swap-free, the broker will get their money in other ways. Usually this means larger spreads or a fixed commission per trade.

Start trading right now

Conclusion

The topic of swap is quite important on the exchange. Many large investors make money not on the difference in exchange rates, but rather on the difference in net interest rates. When you trade Forex in the financial markets, most traders view forex swaps as another type of commission that brokers use to get rich. But if you understand how swap works, you can turn it from an enemy into a reliable ally that will bring you profit regardless of exchange rate fluctuations. Thus, using swap trading first on a demo account with a nominal position will help you understand how this efficient tool works with no need to risk money on complex instruments like trading cfds, or even avoid the high swap charges.

Forex Swap FAQs

In simple words, swap is a special operation that carries an open position in trading financial instruments overnight, for which the difference in interest rates is credited or charged. Note that Forex trading is one of the complex instruments that come with high risk, and thus requires much knowledge and skills to prevent potential losses.

The Rollover interest rate can be thought of as the forex trading swap rate. So a simple formula for calculating rollover will look like this:

The trade amount in the trade currency * (base currency % rate - quoted currency % rate) divided by the number of days in a year * the current currency pair quote.

Carry traders use this mechanism for working with high interest rates. It creates a market position for a currency pair, in which the direction of the position will ensure the crediting of a positive swap to the trader's trading account and can boost their initial investment.

This is a special combined exchange trade that starts tomorrow and ends the trading day after tomorrow and there is no actual movement of funds. In other words, this is a swap operation. At the close of the main trading session, the current position is closed and the same position is simultaneously opened, but with the calculations for the next trading day. The day the position is settled is called the value date.

Triple swap is the situation when a position is carried overnight from Wednesday to Thursday. So the calculations for the Wednesday position take place on Friday, which means that the transfer to Thursday is calculated on the next business trading day after Friday, which is Monday. The calculation includes three days at once, for which a triple swap charge is added.

The Swap point when you trade Forex is the value of the commission calculated in advance by the broker for the transfer of a position overnight. This is called a swap and is indicated in points. All Forex swaps are usually indicated in points.

The key difference between a Forex swap and a forward contract is that a swap trade is essentially an exchange transaction, while a forward contract is a non-standardized OTC contract. In other words, the swap can change every day, and the forward rate remains the same until the end of the contract.

The main difference between a currency and a Forex swap is that a currency trading swap is not used for profit. A currency swap transaction is concluded with the aim of offsetting the costs of the original transaction with a subsequent one. In other words, the goal is to hedge the currency trading risk involved.

This is a commission that is charged or debited to the trader's retail accounts for transferring a trade overnight from Wednesday to Thursday. This swap charges a commission triple the amount taking into account the upcoming days and is known as the weekend swaps.

Positive swap is a situation that occurs when the high interest rate of the central bank issuing the base currency exceeds the interest rate of the central bank issuing the quoted currency. A positive swap is credited to the trader's trading account every day while such a trade is open.

Forex swap is charged every day. This occurs immediately after the close of the New York trading session. As a rule, it is 24:00 according to the time of the broker's trading terminal.

You can make money on swaps either by trading currency pairs for which the swap is positive, or by using one of the special trading strategies. For example: Carry Trade or Swap and Fly.

In the Metatrader terminal, swap is displayed in the specifications of a trading contract. To find it, right-click on the currency pair in the data window and select the menu item Contract Specifications.

Forex swap is more dependent on the difference in interest rates. A trader cannot reduce it on their own. However, you can make trades that are not carried overnight. In this case, the swap will not be charged at all.

Long positions swap is a commission that will either be credited to or charged from the trader's trading account in the event that an open buy trade is carried overnight. In other words, this is a swap for a Buy trade.

The swap amount has already been calculated by the broker and is displayed in the contract specifications. You can also find the swap in the table of trading financial instruments on your broker's website or calculate it using a special trader's calculator on the broker's website.

blog

Promo code

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.