Australian Dollar, AUD/USD, U.S. Stimulus, Sentiment – Talking Points

- Sentiment lifts Wall Street trading as stimulus talks progress

- Australian Dollar remains near multi-year highs following local PMIs

- Upcoming FOMC interest rate decision likely to dictate market mood

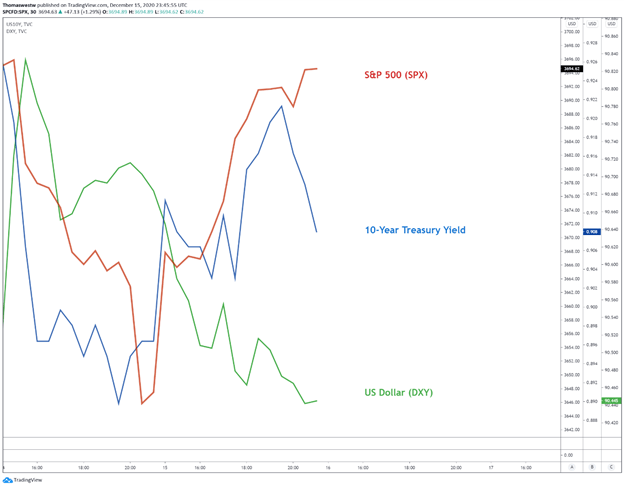

U.S. stocks advanced on Tuesday with the S&P 500 rising 1.35% while the 10-year Treasury yield climbed above 0.90% as sentiment improved on stimulus hopes. The US Dollar reflected the risk-on flow as progress between U.S. congressional leaders over sticking points following weeks of disagreement injected upbeat sentiment into markets.

Still, key obstacles remain on Capitol Hill, with Friday’s deadline when benefits protecting millions of unemployed Americans will lapse. The top ranking Senator Mitch McConnell said that there will be no holiday break for lawmakers if a Covid bill is not passed. Meanwhile, the United States continues to see Covid hospitalizations push higher, although markets appear to continue celebrating the recent progress in vaccine headlines and stimulus talks.

S&P 500, US Dollar, 10-Year Treasury Daily Chart

Chart created with TradingView

Wednesday’s Asia-pacific Outlook

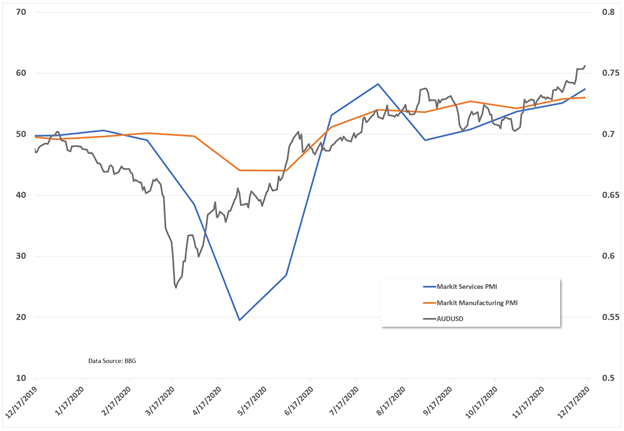

The Australian Dollar continues its march higher against the Greenback with AUD/USD at fresh multi-year highs. Local economic data from IHS Markit reflected strong economic activity for December with services and manufacturing PMI improving from the previous month. According to the DailyFX Economic Calendar, Services PMI rose to 57.4 from 55.1, and manufacturing PMI came across at 56.0, up from 55.8 in November.

Australian PMI Data versus AUD/USD

Later this week, Australia will report labor market data for November with the employment change figure forecasted to cross the wires at 50k, down from the previous month’s blowout 178.8k reading. The unemployment rate is anticipated to remain at 7%. The U.S. Federal Reserve (Fed) is also on tap to keep interest rates unchanged at 0.25% this week, but traders will be keying in on any language surrounding the Fed’s balance sheet and other quantitative measures, in particular, their forward guidance

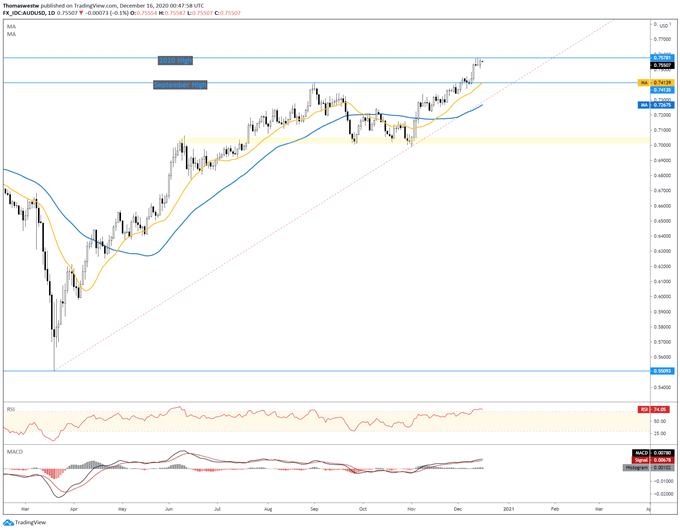

The US Dollar weakness prompted by stimulus headlines has underpinned AUD/USD strength this week, although current price action appears to be facing some resistance below the 0.76 handle. The technical structure appears supportive for further movement higher, but a near-term pullback may be likely seeing the current daily RSI turning lower and Tuesday’s daily close failing to eclipse Monday’s high.

AUD/USD Daily Chart

Chart created with TradingView

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter